HPE beats Q2 expectations

Hewlett-Packard published its second quarter financial results on Tuesday, beating market expectations and raising its fiscal 2018 outlook.

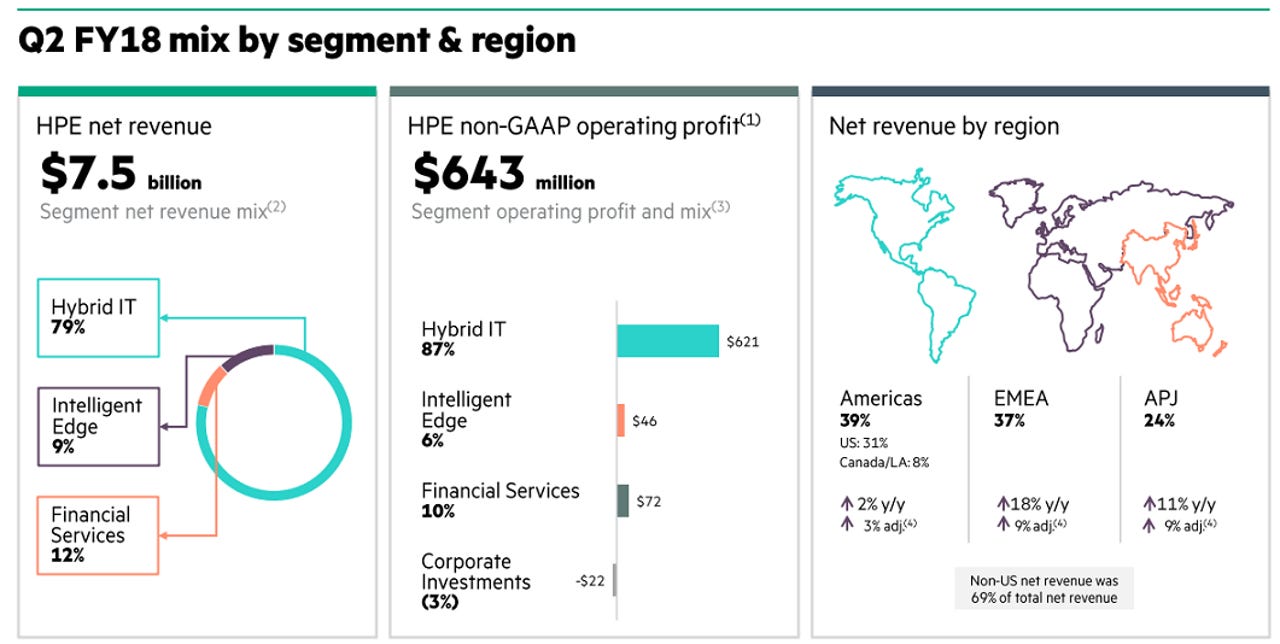

The company reported non-GAAP diluted net earnings per share of 34 cents on revenue of $7.5 billion.

Wall Street was looking for earnings of 31 cents per share on revenue on $7.38 billion.

"We delivered revenue growth in all business segments, expanded overall profitability, completed important milestones in our HPE Next initiative and continued to invest in innovation," CEO Antonio Neri said in a statement.

Hybrid IT accounts for the bulk of the company's revenue, bringing in $6 billion in Q2, up 7 percent year-over-year. Within that segment, compute revenue was up 6 percent, storage revenue was up 24 percent, datacenter networking revenue was up 2 percent and Pointnext revenue was up 1 percent.

In HPE's "intelligent edge" category, revenue came to $710 million, up 17 percent year-over-year. HPE Aruba Product revenue was up 18 percent, and HPE Aruba Services revenue was up 10 percent.

Financial Services revenue was $916 million, up 5 percent year-over-year.

Tech analyst Patrick Moorhead noted that HPE has now had four quarters of year-on-year growth.

"This isn't an anomaly--it appears the company is on track with its one-two punch of hybrid IT and intelligent edge," he said in a statement. "The company has shown leadership in composable infrastructure, IoT-OT edge compute, and edge wireless networking for mobile build-outs. In the future, it will be important for HPE to quickly stitch its new assets like Plexxi together as they fully enable composability. The ingredients are first class, but the taste of the meal is what counts most."

For Q3, HPE estimates non-GAAP diluted net EPS to be in the range of 35 cents to 39 cents. It raised its full fiscal 2018 outlook to between $1.40 and $1.50.