HP's Q4 tops estimates, but mixed bag

Hewlett-Packard reported better than expected fourth quarter results and indicated that its turnaround plans are progressing.

The company reported a fourth quarter profit of $1.4 billion, or 73 cents a share, on revenue of $29.1 billion, down 3 percent from the same quarter a year ago. Non-GAAP earnings for the fourth quarter were $1.01 a share. Wall Street was looking for HP to deliver fourth quarter non-GAAP earnings of $1 a share on revenue of $27.9 billion.

As for the outlook, HP projected first quarter earnings to be 82 cents a share to 86 cents a share on a non-GAAP basis. Wall Street was looking for 85 cents a share. For fiscal 2014, HP projected non-GAAP earnings to be $3.55 to $3.75 a share. That outlook was in line with its previous estimates. Wall Street expects $3.65.

In a nutshell, HP CEO Meg Whitman has managed to make HP more efficient. The company's key units with the exception of enterprise all saw revenue declines.

Whitman said on an earnings conference call:

As you all know in fiscal 2013 we focused on improving our operations, driving better cash flow and rebuilding our balance sheet. These foundational improvements are critical early step in our turnaround and I'm extremely proud of the results we delivered in this area.

A few key points worth noting:

- The company reported fiscal 2013 earnings of $5.1 billion, or $2.62 a share, on revenue of $112.3 billion, down 7 percent from a year ago.

- HP said that it cut its net debt position by $1.3 billion. HP ended the year with $12.16 billion in cash and equivalents and long term debt of $16.6 billion.

- The company spent $3.13 billion on research and development for the year ended Oct. 31. That sum accounts to 2.5 percent of revenue. HP said that spending was low because the company restructured its R&D efforts for Unix-based systems. "Innovation is at the core of HP," said HP CFO Cathie Lesjak, who added that R&D spending will rise. "We're still very much committed to driving the right R&D at the right time and the right place."

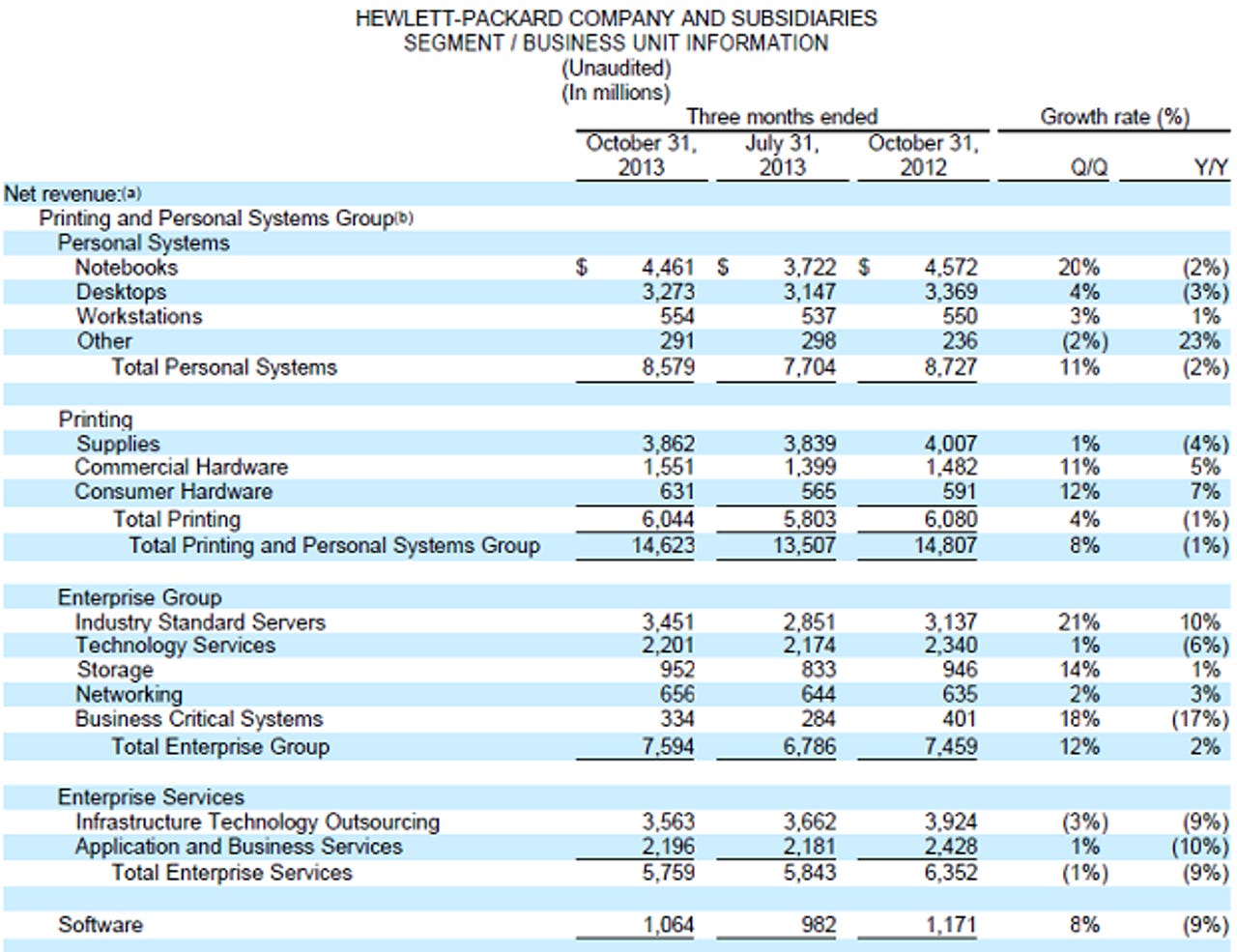

This chart unfolds HP's various units. The key points:

- x86 servers sold well in the fourth quarter.

- Commercial printers fared well as did consumer. Notebooks and desktops were off from a year ago.

- "Other" in the personal systems group, most likely tablets, saw growth of 23 percent in the fourth quarter off of a small base.

- HP's software business took a hit as sales fell 9 percent in the fourth quarter.

Here's a look at the key charts from HP's presentation. All regions saw revenue declines in the fourth quarter.

HP is seeing some slight growth for commercial PC sales, but consumer revenue fell 10 percent.

Storage and networking revenue was up slightly in the fourth quarter. Converged infrastructure has a better growth rate and 3Par delivered revenue growth of 64 percent. Whitman said converged infrastructure revenue will grow faster and become more than half of enterprise group revenue soon.

HP's software group is a disappointment no matter how you slice it. Licensing revenue took a hit in the fourth quarter.

Lesjak said software revenue comparisons were hurt by a large General Motors deal inked in the fourth quarter a year ago. License revenue is hurt by a shift to software as a service models.

Lesjak said:

SaaS revenue was up 18% over the prior year with higher bookings growth across all business units particularly in Autonomy, IT Management and Fortify on-demand. We have received great feedback from our customers and partners on Haven, our Big Data analytics platform, and going forward we are focused on delivering new, innovative solutions.