Integrated Reporting: can it solve the sustainability information gap?

Most firms these days produce glossy sustainability reports chock full of nirvanic eco images and number charts which mostly trend up and to the right. But is this reporting exercise of practical use to anyone beyond the PR set who have a stake in keeping the merry go round turning? Can stakeholders use the information to make capital investment decisions whether financial, human, intellectual, social or natural? And while we're at it, lets question the public utility of current public financial disclosure practice with its narrow boundaries and slavish focus on compliance. It's hardly been successful in alerting the public before the global banking crisis and other corporate scandals of recent years overtook.

A better model is needed and today the International Integrated Reporting Committee (IIRC) will launch a discussion document - Towards Integrated Reporting, Communicating Value in the 21st Century - outlining its vision for a more integrated reporting framework that brings financial, non financial and sustainability reporting together to provide a more accurate accounting of value creation.

According to the IIRC, at the heart of the problem is an asymmetry of information for stakeholders due to a lack of information integration or connectedness:

...critical interdependencies that exist are not made clear, for example, between:

- strategy and risk,

- financial and non-financial performance,

- governance and performance, and

- the organization’s own performance and that of others in its value chain.

The discussion paper is a brave first step by the IIRC, a 39 member multistakeholder committee (of which only 7 are women, ....*cough*) comprised of some of the world's leading thinkers on sustainability and accounting. The reforms in mind are summarized below relative to the status quo:

- Thinking - Integrated Reporting reflects and supports integrated thinking for an organization’s value creation process.

- Stewardship - An Integrated Report displays an organization’s stewardship not only of financial capital, but also of the other “capitals” (manufactured, human, intellectual, natural and social).

- Focus - An Integrated Report focuses on an organization’s strategic objectives and its ability to create and sustain value in the future, as well as, past financial performance and financial risks.

- Timeframe - Integrated Reporting specifically factors in short, medium and long term considerations.

- Trust - Integrated Reporting emphasizes transparency, rather than focusing primarily on a narrow series of mandated disclosures, and helps to build trust.

- Adaptive - Integrated Reporting offers a principles-based approach which drives greater focus on factors that are material to particular sectors and organizations.

- Concise – Integrated Reporting is concise and material, not long and complex.

- Technology enabled – Integrated Reporting takes advantage of new and emerging technologies to link information within the primary report and to facilitate access to further detail online.

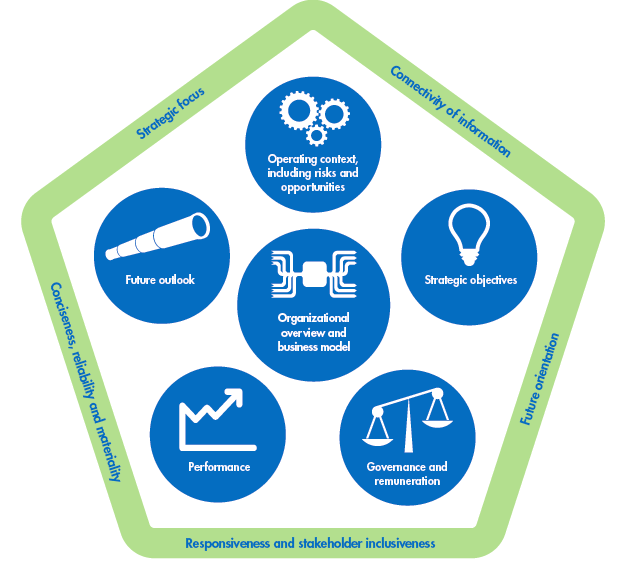

Below is the IIRC vision for the future of reporting with the guiding principles embedded in the outer ring and key content components detailed in the centre. Notice not a single mention of the term sustainability, corporate social responsibility. The assumption is that sustainability is embedded into a truly integrated model of disclosure.

Here's my take on the opportunities and challenges for a CFO undertaking a more integrated reporting approach.

Opportunities:

- Embarrassment avoidance- the scale & frequency of voluntary multi channel sustainability disclosure from the sustainability silo has now reached a tipping point. The CFO/CIO need to take charge to avoid embarrassing disclosure of duff data.

- Greed is good- sustainability is a driver not only of risk avoidance but for innovation towards new revenue streams. Just take a look at GE, Philips, Unilever Nestle & Nike to name a few. However, CFOs & CIOs must put a sound information platform under sustainability led business transformation initiatives to guide them towards their objectives.

- Cost savings - some firms are spending upwards of $500k anually on sustainability reports between data collection, design, audit etc. Effective sustainability reporting is getting too expensive not to consolidate & leave in the silo.

- Innovation of process - sustainability reporting provides an additional lens for senior management to gain insight on performance. It also provides insight on non financial capital on which the firm depends and how to better and manage these factors. Management of water, air quality, climate, talent are now or will be a competitive advantage for the future for some or all firms.

- Innovation in reporting - the IIRC vision does help the CFO get beyond compliance disclosure and focus engagement on and with the key stakeholders that are impacted or can impact the firm. Expect this to be a two way process not a monologue.

And the challenges:

- Sustainability strategy or a sustainable strategy? - An integrated reporting approach presupposes the firm has an integrated strategy. My experience tells me that a truly integrated strategy for sustainability is still rare for all but a few leaders.

- Overstretched CFO - in the midst of economic turbulence the CFO is already well stretched to become more effective and more efficient so sustainability risks falling off the table or worse - become way too diluted in the integration. Last year's IBM CFO survey showed that although integration was a high priority for CFO's, they felt they fell short on capability to deliver it.

- Overcoming fragmentation- CFO's already have difficulty integrating data currently spread across geography, hierarchy, systems and various finance disciplines including accounting, internal audit, governance, risk & compliance. Add to this the complexity of retrieving data from across the value chain and relating to items that have been traditionally uncosted externalities.

- Immature systems and standards - while the IIRC outlines a good framework for reporting, the reality is that many firms have not yet built the robust information architecture to support sustainability reporting to the same level of quality as currently achieved by financial reporting. This will take time and investment. The same for standards bodies. By the way, given the multi stakeholder claim on an integrated report, we must see much more in the way of social media integration in reporting than is currently the case. Watch for innovation here.

- Vested interests - the corporate sustainability professionals must stand out of the way and allow operational and financial professionals take the lead on sustainability. Will they do so quickly and quietly? The same challenge is posed for some of the standards bodies for reporting and assurance. On the flip side, integration could see the Big 4 consolidate their influence over the development of sustainability reporting and assurance standards. Not everyone would agree this would make for ideal stewardship.

- Which capital markets? - the IIRC assumes that the CFO will measure and manage the return on all forms of capital. But is the CFO measuring the return on capital for each type eg. human, financial, social, ecological OR is the CFO translating what each means in terms of financial capital? If the latter then its business as usual, if its the former then the CFO must come to terms with valuing inputs previously uncosted such as fresh air, water, a high performing education system etc. In other words, market failure and the complexities of sustainability accounting remain even if we move the deck chairs around. Other interventions will be required.

- Business integration- if the goal is to integrate & embed sustainability into the business, is reporting the best place to start? Or to borrow a phrase: 'if you want to get to there would you really start from here?' This taps into a question of timing - is the management discipline of sustainability yet sufficiently mature to be deep six embedded to business strategy and process? A leading Chief Sustainability Officer complained to me recently that he had enough problems retrieving sustainability performance data and linking it to internal management reporting to drive business performance without yet worrying about new external reporting protocols.

This discussion paper is an interesting opener in a debate that will run for some time. Personally, I'm bullish about the outcome. The next exposure draft is due out in 2012 and the IIRC are looking for broader input to that. Read the paper here and email your ideas to dpresponses@theiirc.org.