Intel hit with chipset design flaw in Sandy Bridge rollout

Intel said Monday that it discovered a design flaw in a chipset circuit and has "implemented a silicon fix." The chip giant also said it will work with PC makers to handle returns and repairs.

Specifically, Intel found a design problem in a support chip, the Intel 6 Series, which is code-named Cougar Point. In a nutshell, chipsets with Serial-ATA ports could degrade over time and hurt the performance of hard drives and DVD drives.

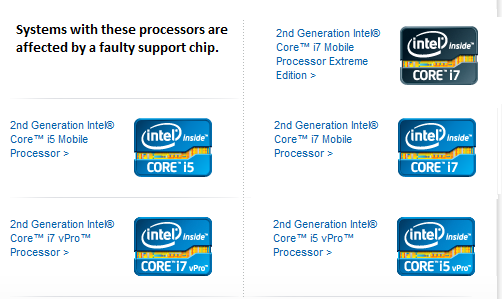

This potentially faulty chipset was used in Intel's latest Core processors, or Sandy Bridge.

In a statement, Intel said:

Intel has stopped shipment of the affected support chip from its factories. Intel has corrected the design issue, and has begun manufacturing a new version of the support chip which will resolve the issue. The Sandy Bridge microprocessor is unaffected and no other products are affected by this issue.

The company said it will deliver an updated version of the chipset in late February with full volume in April. Intel added that it will work with PC makers to handle returns of the chipset and support motherboard replacements.

At least Intel caught the issue early. The faulty support chip has only been shipping since Jan. 9. Customers impacted will be those that bought second-generation Core i5 and Core i7 systems.

This recall will also lead to a financial hit relative to previous expectations. For the first quarter, Intel said the chipset problem will cut revenue by $300 million as it "discontinues production of the current version of the chipset and begins manufacturing the new version." The total cost to repair and replace systems will be about $700 million.

Intel added that the issue, which technically occurred in the fourth quarter, will cut previously reported margins to 63.5 percent, down from a reported 67.5 percent. Intel will also take a first quarter charge that will cut margins by 2 percent. Revenue projections for 2011 aren't changed.

Since Intel was updating its outlook, the company said it also closed the purchase of Infineon, which will be known as the Intel Mobile Communications Group. The McAfee deal will close by the end of the first quarter.

Here's Intel's outlook, which excludes McAfee at this point:

- For the first quarter, Intel expects revenue to be $11.7 billion, give or take $400 million. The previous outlook was $11.5 billion, give or take $400 million. Gross margins will be about 61 percent, down from the previous outlook of 64 percent.

- The company is projecting revenue growth in the "mid-to high teens" compared to its previous estimate of 10 percent. For 2011, gross margins will be 63 percent compared to the previous outlook of 65 percent.

- For 2011, R&D spending will be $8.2 billion, up from a previous outlook of $7.3 billion.

Bottom line: Intel takes a hit on the chipset design flaw, but things could have been much worse.

Related: