Nutanix beats Q4 estimates

Nutanix published its fourth quarter FY 2018 financial results on Thursday, besting market expectations. However, shares were down in after-hours trading on a light Q1 outlook.

The company posted a non-GAAP net loss of $19 million, or 11 cents per share, on revenue of $303.7 million. A year prior, non-GAAP losses came to $26 million, or 17 cents a share, on revenue of $252.5 million.

Wall Street was looking for a net loss of 21 cents per share on revenue of $300.57 million.

"We ended the year on a high note with a record quarter on many fronts, positioning us extremely well for the future," Founder and CEO Dheeraj Pandey said in a statement. "We will continue to invest in talent and hybrid cloud technology while incubating strategic multi-cloud investments."

Pandey cited recent acquisitions, such as its purchase of the desktops-as-a-service business Frame. "Frame increases our addressable market, brings another service to our growing platform, and adds employees with insurgent mindsets who will help us continue to challenge the status quo," he said.

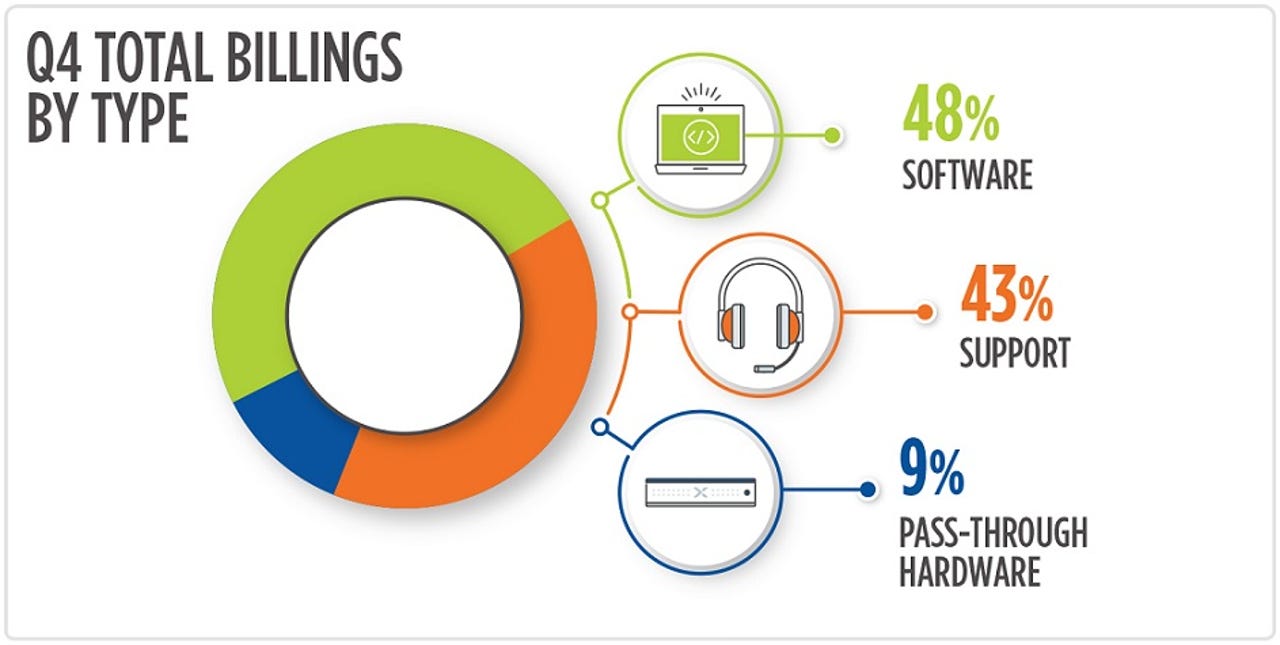

Software and support revenue for the quarter totaled $267.9 million, growing 49 percent year-over-year. Meanwhile, Q4 software and support billings came to $359.2 million, growing 66 percent year-over-year.

For the full fiscal year 2018, Nutanix reported a non-GAAP net loss of $101.5 million on revenue of $1.16 billion.

For Q1 FY 2019, Nutanix expects to post a non-GAAP loss per share between 26 cents and 28 cents, on revenue between $295 million and $310 million. Analysts on average have expected Q1 non-GAAP losses to come in at 22 cents per share, with revenue coming to $311.8 million.