Oracle's hardware focus: Brilliant, bust or sideshow?

Was Oracle's acquisition of Sun Microsystems brilliant or a bust in the making?

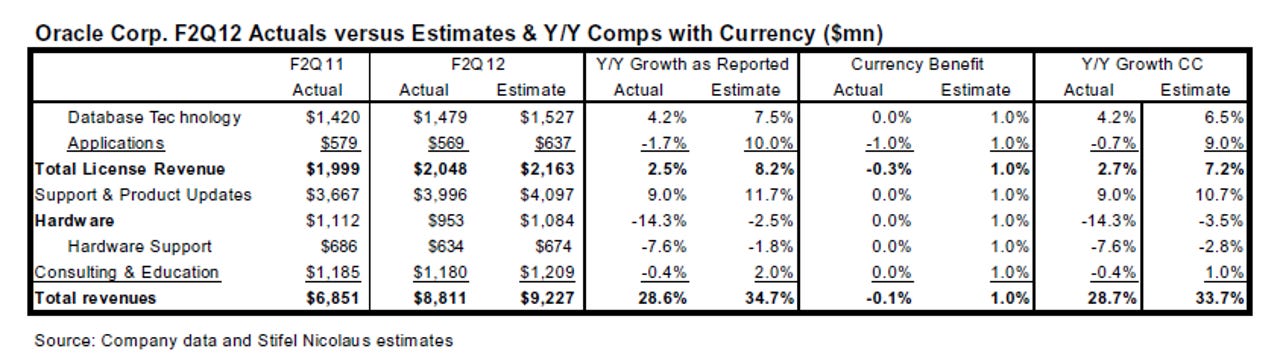

After another quarter of hardware revenue disappointment, an earnings conference call dominated by Exadata---a business that's less than 5 percent of Oracle's revenue---you have to wonder whether the company is distracted. Oracle closed the Sun purchase in Jan. 2010. Two years in and Oracle's hardware business is still in transition. Meanwhile, Oracle is facing threats in its core businesses.

More: Oracle CEO glosses over poor quarter by lashing out at competitors | Oracle's Q2 falls short, hardware revenue slides, outlook light | Enterprise software's maintenance model faces triple threat

All Oracle executives talked about Tuesday was Exadata and various Exa- lines. Here's a sampling:

Oracle CFO Safra Catz:

Hardware systems revenue was $953 million for the quarter, due in part to a product transition to T4 processor-based products, as some customers moved to qualify the new servers and significantly slowed buying the older systems. We saw good early demand for the new SPARC SuperCluster but only released the product for general availability at the very end of the quarter, allowing us to ship only a couple. In sharp contrast, Exadata and Exalogic growth saw significant acceleration this quarter, with triple digit growth rates over last year's Q2. Hardware gross margins were 51% for the quarter on the lower volumes.

Oracle CEO Larry Ellison:

This past Q2, Oracle sold over 200 Exadata and Exalogic engineered systems. In Q3, we plan to sell over 300 Exadata and Exalogic engineered systems. In Q4, we plan to sell over 400 Exadata and Exalogic engineered systems. That would make our annualized Q4 engineered system sales approximately $1 billion. Then we plan to double those sales again next fiscal year. As our engineered system business gets larger, it will drive revenue growth in our overall hardware business.

And Oracle President Mark Hurd's testy finale when questioned by Nomura analyst Rick Sherlund about hardware sales and whether the company could triple Exadata sales.

There is no more difficulty in selling Exadata. There is no issue with pipeline. It is quite the opposite. We set a goal of tripling the installed base, that was our goal, and we probably won't triple it. We'll probably increase it by 2.5 times. If that was your question, are we going to triple, and you added up the numbers and said look, more like 2.5 than triple, that's right. We're only going to grow it by 2.5 times. We had a very aggressive set of targets, and we are taking huge amounts of share from IBM at their high end. We're taking share from Teradata, Netezza, everybody. This business, again, will be at a $1 billion run rate at the annualize our Q4 numbers, and it will be $2 billion the following year. But will we have hit our units tripling? No, we'll probably fall a little short of that. This is an exciting opportunity for us, and we're not out of doing that tripling yet. To color it, will the results for Exadata, Exalogic be stellar and extraordinary or merely spectacular? We might just be spectacular, and you caught us.

On one hand you can understand Oracle's frustration. It's ditching low-margin hardware units. It has momentum with its Exa line of integrated systems coming from a small base. And the transition will take time. Realistically, you can't call the Sun deal a bust just yet. Give it a year.

However, I can't help but wonder if all of this Exa-talk is really a distraction from a few key issues. The biggest issue is the triple threat facing Oracle's entire business. Customers are questioning on-premise apps, high maintenance and looking to modernize. Meanwhile, IT budgets are tightening. Accenture, Red Hat and Oracle all disappointed to varying degrees.

So instead of talking up hardware, perhaps Oracle needs to focus on a more cautious customer and one that's increasingly looking at software as a service. Cowen analyst Peter Goldmacher said in a research note:

While there was weakness across the board in both software and hardware globally, the most troubling sign of distress was on the Maintenance line. Maintenance, a 95%-ish net margin business, was down sequentially for the first time in 23 quarters (excluding fall '08) and was down for both software and hardware. We believe this is because every product in Oracle's arsenal is under pressure as customers are increasingly canceling maintenance contracts as they look to cut costs and buy more contemporary technology. Investors must start thinking about the Rimini St trial in late '12. Management commented on poor close rates in 2Q as the reason for the miss but dismissed it is as an operational issue that better pipeline management would solve. Given recent disappointing tech earnings results (Accenture and Red Hat), we are less optimistic than management is on its ability to bounce back in 3Q. Oddly, the focus of the call was the Exadata business, less than 5% of revs.

That comment nails it. As Hurd and Ellison talk Exa non-stop it's possible that Oracle's entire model is being challenged.