Palantir sees slowing growth in 2021, but upbeat on expanding its enterprise

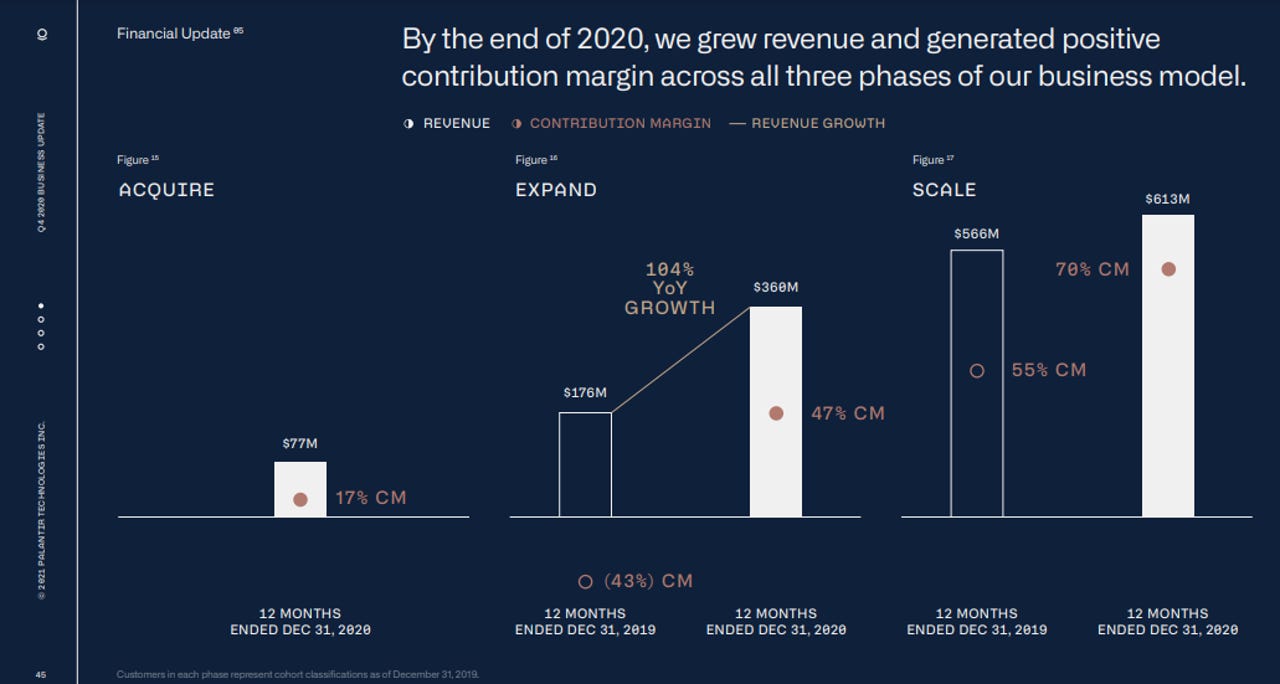

Palantir Technologies said revenue growth in 2021 is expected to slow to about 30% in 2021 compared to 47% in 2020.

The company reported better-than-expected fourth quarter sales and logged more than $1 billion in annual revenue as it landed 21 deals in the worth $5 million or more.

Palantir, best known as an analytics software firm with government and public sector customers, reported fourth quarter revenue of $322.1 million, up from $229.36 million a year ago.

Wall Street was looking for fourth quarter sales of $300.7 million.

Palantir reported a net loss of $148.34 million, or 8 cents a share. Fourth quarter non-GAAP earnings were 6 cents a share, 4 cents ahead of estimates, according to IBES data from Refinitiv.

While the company's reputation was forged based on big government contracts, Palantir is working to expand its enterprise reach via partnerships with IBM. Palantir's long-term outlook is to hit $4 billion in revenue in 2024. The company projected first quarter revenue growth of 45%.

On a conference call with analysts, Palantir operating chief Shyam Sankar said the company's approach to automated data management and software will grow the total addressable market. Sankar said:

Broadening the market is not about Palantir. Life is about Palantir automated. It's about the power of Apollo, it's about software that manages itself. Look at our archetypes investments, like this means with a few clicks you can deploy end-to-end powerful use cases, use cases that would have cost millions of dollars and taken many months can now be deployed in minutes. It's about software-defined data integration and modularity. That means that you get 100% of the power of Palantir, but with the ease of self-managing software. And these are examples of why we're confident in our long-term growth of being greater than $4 billion in 2025.

Indeed, the company has a lot of runway acquiring enterprise customers. Palantir had 8 customers in the Fortune 100 and 12 in the Global 100.

The company's recent launch of its platform, called Foundry 21, is designed to be more modular with better data integration, no-code apps and a mobile offering. The knock on Palantir historically is that it required more high-touch implementations and consultants. A recent demo day generated more inbound inquiries from potential customers.

Sankar said that Foundry 21 could even reach into the small and mid-sized business market.

Among the key data points:

- 12 deals in the fourth quarter were worth $10 million or more.

- The company inked a 3-year $44 million deal to expand a contract with the FDA.

- 61% of revenue came from Palantir's top 20 customers, down from 67% in 2019.

- Fourth quarter new contracts include Rio Tinto, PG&E, bp, U.S. Army, U.S. Air Force, FDA, and NHS.

- Average revenue per customer in 2020 was $7.9 million, up 41% from a year ago.