Qualcomm buys NXP in deal valued at $47 billion, diversifies into Internet of things

Qualcomm said Thursday it will buy NXP Semiconductor for $47 billion in a move that sets the mobile chip giant up for the broader Internet of things and automotive market.

Under the terms of the deal, Qualcomm will pay $110 a share in cash for NXP for an enterprise value of $47 billion. NXP, a Dutch company, acquired Freescale Semiconductor in March 2015.

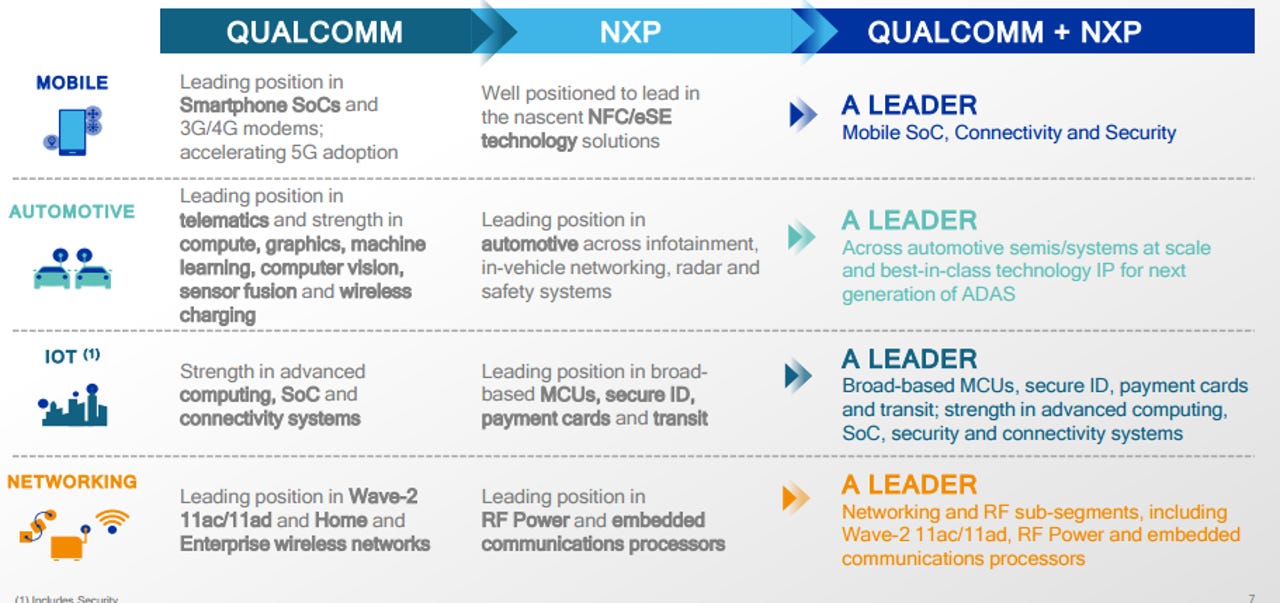

By combining NXP, which makes mixed-signal chips and has a broad footprint in microcontrollers, automotive, networking and security, with Qualcomm's mobile presence the combined company is well equipped to go after Internet of things markets, smart cities and a similar areas.

The combined company will have annual sales of about $35 billion.

Qualcomm makes systems on chips, 3G and 4G modems and plays in the security space. When combined with NXP's Internet of things footprint, the company should be able to go after larger deployments.

Ultimately, the purchase of NXP allows Qualcomm to diversify from mobile, which is a slowing market as smartphones become saturated. Forty eight percent of Qualcomm's revenue will come from mobile when the NXP deal closes, down from 61 percent as a standalone company. Auto and IoT will be 29 percent of the combined company's revenue.

Qualcomm CEO Steve Mollenkopf said the combination of its technology with "NXP's leading industry sales channels and positions in automotive, security and IoT" will allow it to expand its addressable market.

On a conference call, Mollenkopf said autonomous vehicles are a key reason for the acquisition of NXP.

In automotive we will lead across multiple verticals at scale combining our expertise in compute and multimedia with NXP's leadership and the complete car infotainment system, secure car access, body and in vehicle network and safety.

As many of you know auto business design cycles are multiyear and strong customer relationships are high barrier to entry.

We see significant opportunity ahead as the growth of semiconductor content in cars is expected to outpace the rate of vehicle production growth itself.

Together we have the technology and expertise to win in the next generation of -- and autonomous driving vehicles. We believe that the development of -- will be similar to that of the smart phone.

He later elaborated.

I think we view the car and the Internet of things to be very similar to what I would've looked at for handsets in the year 2000 timeframe. Meaning the technology and the pace of innovation in automobile and IOT will increase dramatically. I think we look at it as a tremendous opportunity to extend the technology roadmap that we have in mobile in really drive those two businesses, or those opportunities going forward.

According to Qualcomm, the addition of NXP will be "significantly accretive" to non-GAAP earnings. Qualcomm also said there will be about $500 million in cost savings two years after the deal closes.

Qualcomm will fund the purchase with cash and by issuing $11 billion in new debt. It will use offshore cash to cut its leverage.