Qualcomm delivers solid Q4 as it prepares for 5G commercialization

Qualcomm published its fourth quarter financial results on Wednesday, beating market estimates. The company also Akash Palkhiwala as its new CFO.

Palkhiwala has been serving as interim CFO since August. Previously, he was SVP and finance lead for Qualcomm's QCT business, with responsibility for finance and accounting for all chipset products and segments including Mobile, RF Front End, Compute, Auto, Connectivity and Networking and IoT.

"Akash's deep understanding of our business both operationally and strategically makes him the ideal individual to lead our finance function as we embark on a period that I believe may present the biggest opportunity for growth in Qualcomm's history," CEO Steve Mollenkopf said in a statement.

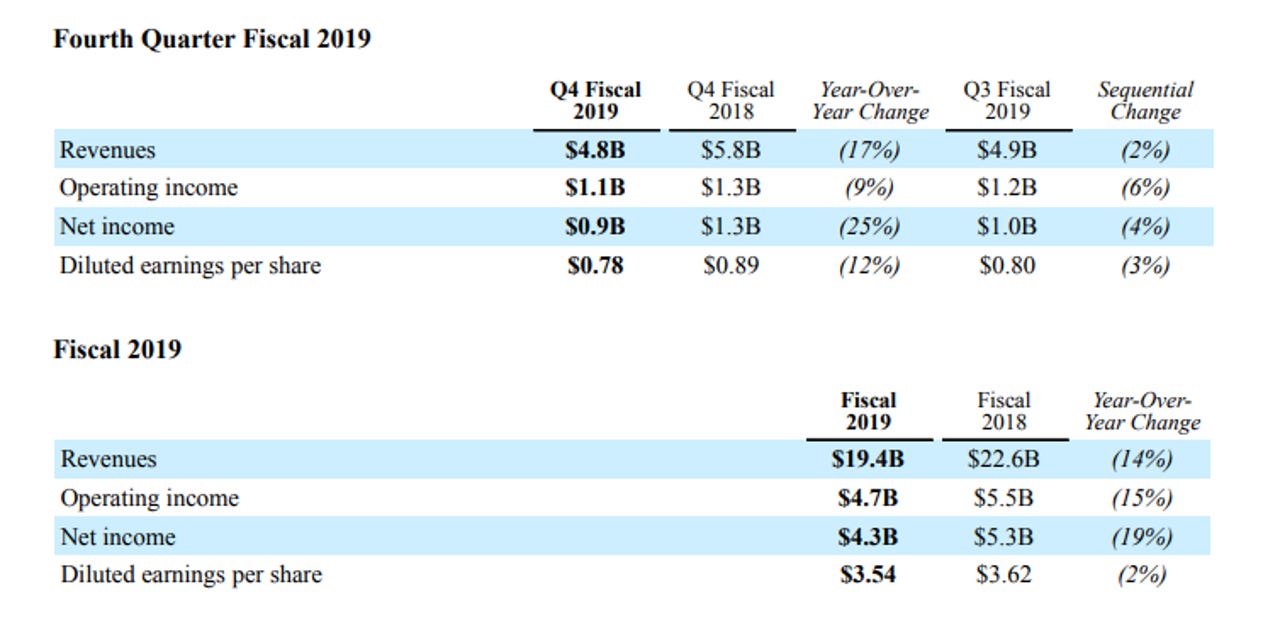

Qualcomm's Q4 non-GAAP earnings per share came to 78 cents, a decrease of 12 percent year-over-year. Revenue for the quarter was $4.8 billion, a decrease of 17 percent year-over-year.

Analysts were looking for earnings of 71 cents per share on revenue of $4.7 billion.

"We delivered a strong quarter, with Non-GAAP earnings per share above the high end of our guidance range, primarily on solid performance in our QTL segment," CEO Steve Mollenkopf said in a statement. "We exit the fiscal year having successfully executed on our strategic priorities: helping to drive the commercialization of 5G globally, completing a number of important anchor license agreements and executing well across our product roadmap. Our technology and inventions leave us extremely well positioned as 5G accelerates in 2020."

Fourth quarter revenues from the Qualcomm Technology Licensing (QTL) segment, Qualcomm's licensing division, came to $1.216 billion, a 4 percent increase year-over-year. QTL accounts for a significant portion of Qualcomm's earnings.

The company's other business segment, QCT (Qualcomm CDA Technologies), accounts for most of its revenue. QCT revenues in Q4 were $3.61 billion, a decrease of 22 percent year-over-year. Within QCT, MSM chip shipments in Q4 reached 152 million, a decrease of 34 percent year-over-year.

Qualcomm noted that in April, the company reached settlement agreements with Apple and its contract manufacturers to dismiss all outstanding litigation between the parties.

Qualcomm's QTL results for Q3 and Q4 included royalties from Apple and its contract manufacturers for sales made in the June 2019 and September 2019 quarters, respectively. QTL revenues in fiscal 2018 and the first six months of fiscal 2019 did not include royalties due on sales of Apple or other products by Apple's contract manufacturers.

Patrick Moorhead, president of Moor Insights & Strategy, attributed Qualcomm's Q4 growth to growth in the smartphone market in units and increased ASP. "It helps that most of Qualcomm's customers are actually paying," he added in a statement to ZDNet.

The 5G outlook also appears positive, Moorhead said, particularly in China, where by the end of 2020 there's likely to be 1 million 5G base stations.

"Qualcomm isn't the only vendor seeing this as TSMC and Qorvo are mirroring this," Moorhead said. "Qualcomm appears to be positioned for volume well given its mainstream choosers and end to end RF capability."

For the first quarter of fiscal 2020, Qualcomm expects revenue between $4.4 billion and $5.2 billion.