QuickBooks Self-Employed now offers automatic mileage tracking

Intuit is adding a new feature to its QuickBooks online product for independent contractors.

The cloud accounting software provider said users of QuickBooks Self-Employed can now access automatic mileage tracking.

Featured

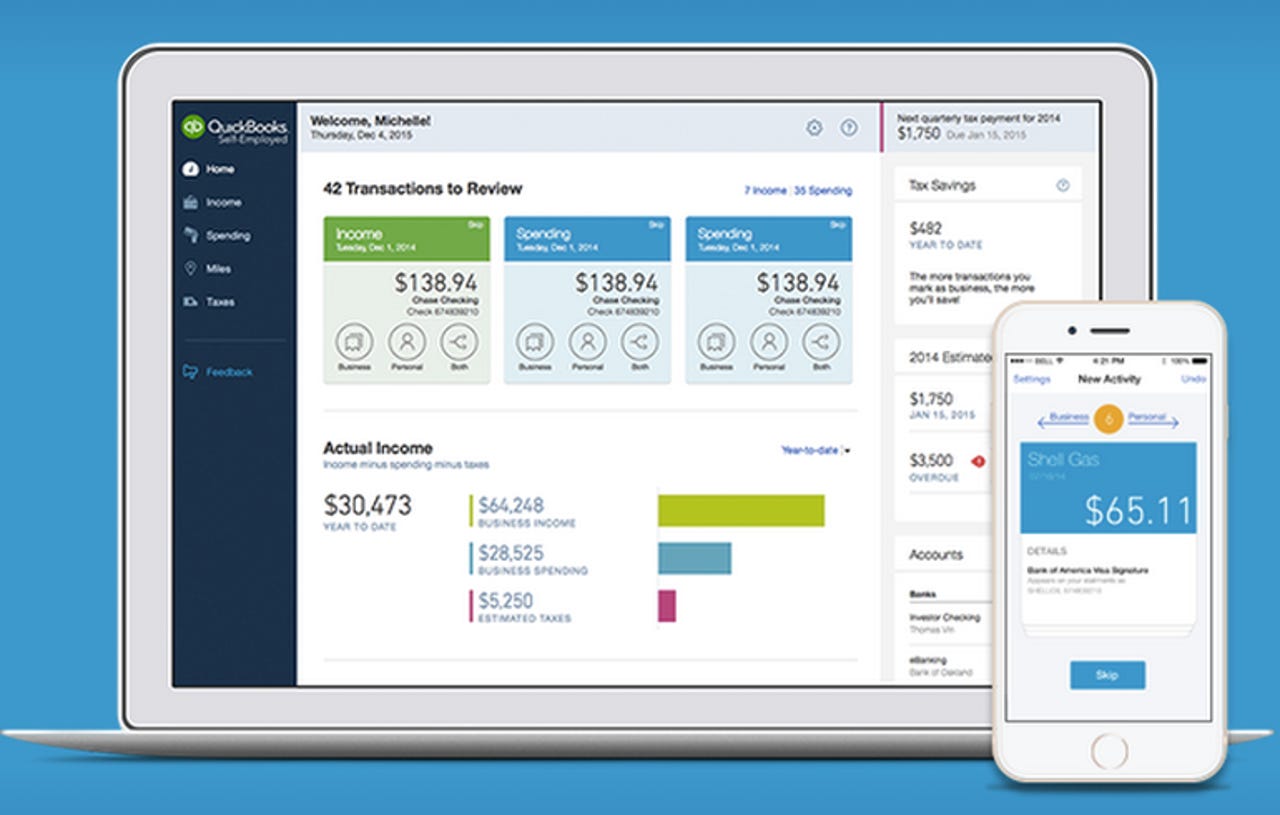

The feature is tied to the platform's mobile app. Once activated, the user's smartphone tracks how many miles are driven and automatically logs the total on to their QuickBooks Self-Employed account. After each trip, users can see what deductions they've earned.

Mileage tracking is a handy feature for many self-employed workers, but especially those in the delivery and driving space. By Intuit's estimates, every 1,000 miles driven can produce up to $500 in deductions. But the IRS needs to see all trips, both business and personal, which makes for a tedious logging process.

Intuit first launched the self-employed iteration of QuickBooks in January 2015, touting the platform for its tax-specific knowhow for freelancers and contract workers -- or what it calls the on-demand economy. The platform can be used to connect financial accounts, track deductions and calculate taxes, in addition to organizing comingled business and personal finances.

So far the platform has been a huge success for Intuit. In its most recent earnings report, Intuit said QuickBooks Self-Employed subscription swelled more than 42 percent, from 35,000 to 50,000.

A year ago Intuit inked deals with TaskRabbit, Fiverr, Uber, Lyft and UpCounsel to provide discounted QuickBooks Self-Employed to those platforms' contract workers. Today the company added eBay, FlexJobs, Incorporate.com, Kelly Services, Moonlighting and NAHREP to its list of partner companies.