Sandisk: All the wrong Flash memory moves

Sandisk's first quarter results were messy and the outlook wasn't much better. The problem: Sandisk is making all the wrong moves and focusing on the wrong customers in the Flash memory market.

As a result of its market misses, Sandisk is being squeezed by Intel on the solid state drive market in the data center and Samsung and Toshiba for ultrabook designs. SanDisk reported first quarter earnings of $114 million, or 46 cents a share (statement). Non-GAAP earnings were 63 cents a share on a revenue of $1.21 billion and a net income of $156 million. Wall Street was expecting SanDisk to report first quarter earnings of 70 cents a share on revenue of $1.23 billion.

Meanwhile, it's unclear what Sandisk can do to dig itself out of its financial predicament. Officially, Sandisk said that weak pricing and demand has been a problem. The real issue is that Sandisk is diversifying into mobile and SSDs too late.

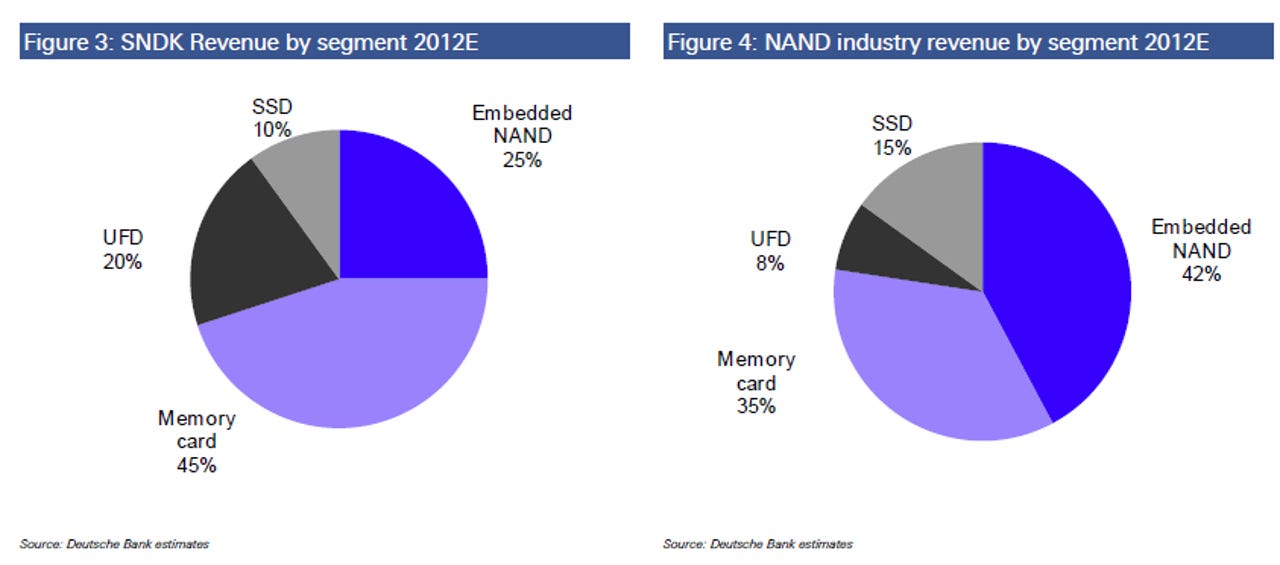

Deutsche Bank analysts Bob Gujavarty highlights how Sandisk is missing the ball in a handy chart.

Gujavarty added:

We believe Sandisk's disappointing first half performance is a function of the company being focused on the wrong customers and the wrong markets. We note Sandisk has lost revenue share since 2008 and this share loss appears to be accelerating in 2012.

Other analysts were busy downgrading Sandisk too. Piper Jaffray analyst Jagadish Iyer said that Sandisk is going through qualification for its embedded memory products for handset vendors. In the meantime, Sandisk is being squeezed on pricing for its OEM products.

Another issue for Sandisk is that it isn't an Apple iPhone supplier.

JMP Securities analyst Alex Gauna wrote in a research note:

The iPhone claims another competitive victim in terms of SanDisk now suffering reduced NAND card demand with certain mobile OEMs and carriers/bundlers. This threat has been out there for some time but the fully embedded approach in mobility appears to have now decidedly settled matters...

While we clearly underestimated the adverse implications of SanDisk exposure to wireless platforms competing with the iPhone, we continue to have confidence in SanDisk engineering capabilities and are thus inclined to believe management assertions that it has second half embedded design win visibility into tier-one mobile OEMs, including Apple.