SEC clears Apple tax strategy, despite 'Holy Grail of tax avoidance' claim

The U.S. government has yet to find anything untoward about the state of Apple's tax affairs, four months after chief executive Tim Cook and other senior staff were grilled by a Senate subcommittee on the matter.

In a letter, dated September 5 and addressed to Apple chief financial officer Peter Oppenheimer, the U.S. Securities and Exchange Commission (SEC) said it completed its review of the company's latest filing (via AllThingsD), and would not be taking action at this time.

Read this

Over the past year, Apple and other technology companies have been under pressure from U.S., U.K., and European tax authorities over reports that they do not pay the full amount of tax in the jurisdictions they operate.

As per SEC rules, Apple must disclose its finances, its taxes, and its tax arrangements quarterly and at other times with the U.S. government.

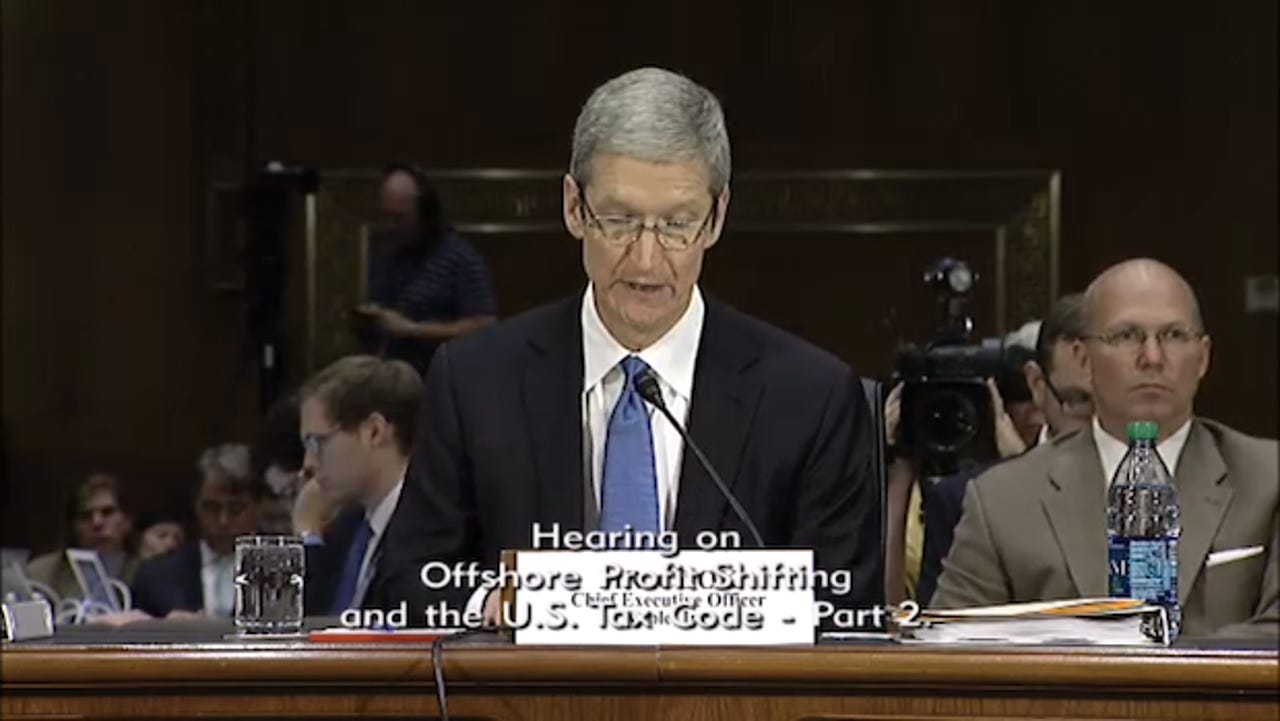

In May, Apple was singled out by the U.S. Senate Permanent Subcommittee on Investigations, in which Cook had to fend off some tough questioning from the panel of politicos.

Sen. Carl Levin (D-MI), the committee's chair, said Apple was "exploiting" a tax loophole in U.S. tax code. He claimed: "Apple successfully sought the holy grail of tax avoidance. It has created offshore entities holding tens of billions of dollars while claiming to be tax resident nowhere."

While tax evasion is a federal crime in the U.S. and other jurisdictions, tax avoidance remains an unchecked loophole in many Western states.

Ahead of the questioning, Apple released a statement claiming it "does not use tax gimmicks."

The iPhone and iPad maker took to multiple pages to trumpet its contribution to the U.S. economy, as well as others in which the company has major offices, such as in Ireland, in which it stated it paid close to $6 billion in taxes to the U.S. Treasury for the fiscal year of 2012.

The company generates close to two-thirds of its revenue from non-U.S. markets and keeps the vast majority of it in those markets for local investments. Cook said the cash would not be repatriated, citing the U.S.' tax rate of 35 percent on all incoming transfers.

In the September letter, the SEC has yet to find anything wrong with Apple's tax arrangements. But the ordeal isn't over for the company yet. Should the investigation take a broader swipe at the technology industry's tax arrangements — legal or otherwise — Washington could be in for a lengthy battle with Silicon Valley.