So long, spreadsheets -- hello in-memory cloud financial tools

Intervention program for spreadsheet addicts: The key points

- Businesses are rebounding but Finance/Accounting groups getting no new headcount post-2008

- Big changes in financial/managerial reporting tools are here

- New technology leaders well on the way

- Yet, the crack cocaine of accountants, spreadsheets, still has a strong appeal

- Challenge to businesses will be to accept all new kinds and volumes of operational, financial and external data with the tools they have today (or get a more relevant toolset fast)

I have completed several interviews of late with executives from financial software vendors Kyriba, AnaPlan, Adaptive Insights (nee Adaptive Planning) and others. I’ve also interviewed some accounting professionals and how they approach things such as closes, budgeting, reporting, etc.

Let’s start with the latter.

While not scientific, I’ve learned that:

- Businesses are growing but Finance/Accounting headcount is staying flat (i.e., pre-2008 recession levels). Shareholders want more of these departments without paying any more for it.

- The pressure to deliver to growing shareholder expectations is putting pressure on back office executives. The problem is, not all of have the time or technology to make material changes to the way they do things (i.e., processes) and the tools they use (i.e., financial accounting technology). Some are not changing as they believe things are just fine the way they are.

- Spreadsheets, like paper, haven’t gone away. Their presence in Finance/Accounting groups is as entrenched as ever as accounting professionals continue to find ways to make this tool into something it was never designed to be.

- Finance/Accounting may be missing out in its (in)ability to really help the operations of a firm.

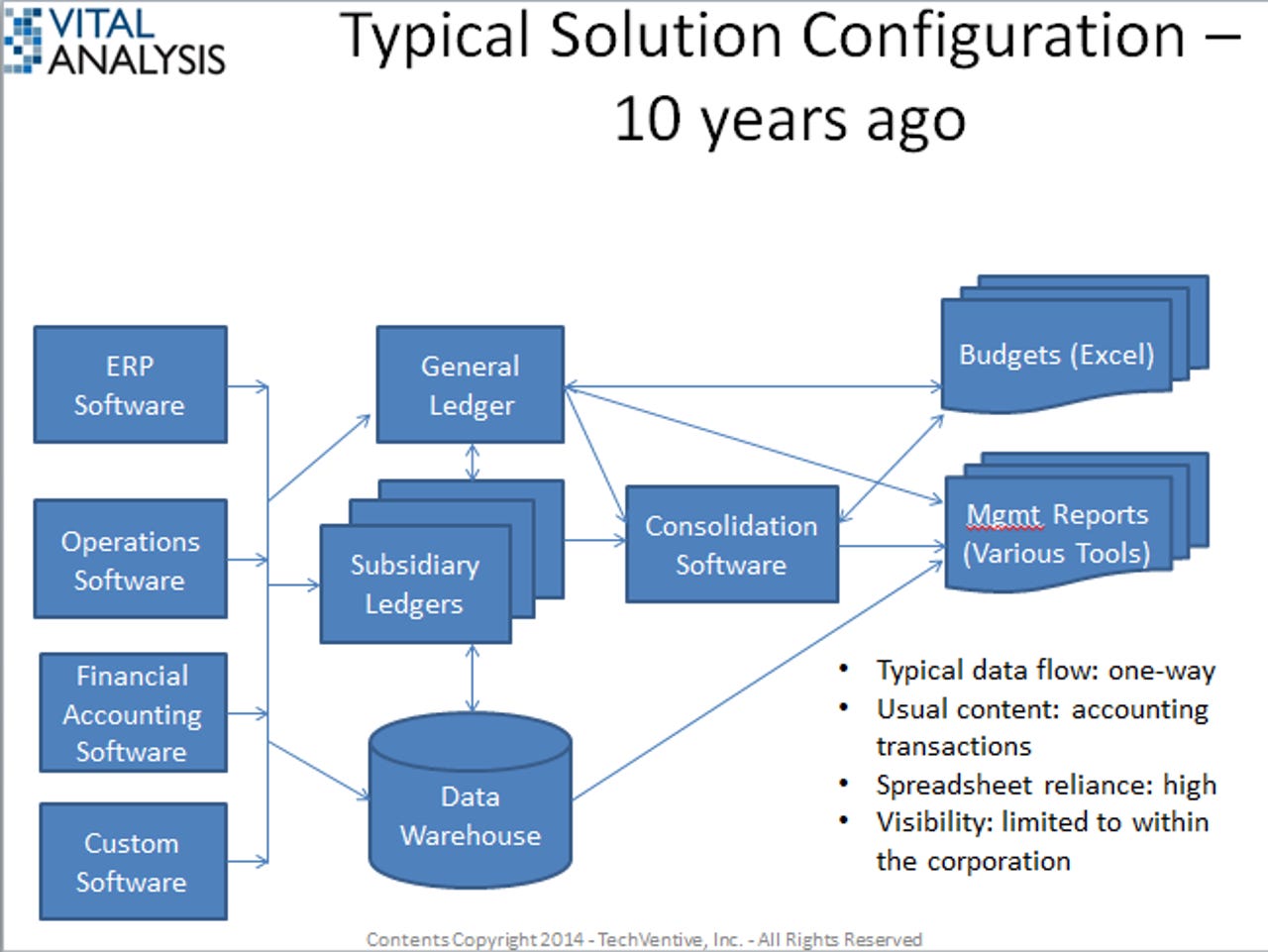

I’ve probably seen a dozen variations of this image over the years. Businesses develop financial budgets from summary data that resides in their General Ledger or Consolidation systems. Operational plans and reports spring forth from the ERP software or some sort of custom data warehouse. In most environments, data flows one-way and people who are skilled in one reporting tool rarely know the nuances of other tools and data sources.

It is an “islands of automation” world and spreadsheets are often used to try to piece together data fragments from one data source to another. This is an imperfect world, to say the least.

I’ve had the opportunity to listen in to management meetings in firms with this reporting environment. People start having great heated arguments debating whose report is more complete or accurate. These grownups are coming to blows over what another executive has defined to be a “customer” or “supplier”. It’s a tragic-comedic situation.

The critical problems with this reporting world are that:

- There is no single repository for business data (financial and operational)

- No one comprehensive data dictionary exists

- Controls over the data exist for only a portion of the reporting and data capture systems. Spreadsheet systems, if you can call them that, are often absent effective dating, restart/recovery technology, etc.

Over time, Financial/Accounting groups have compounded the problem by piling on more and more spreadsheets. They’ve added baling twine, bubble gum and bandages to the imperfect solution and have created a monster.

The problem has gotten even more troubling as new kinds of data are being utilized by businesses and shoehorning these data types into the old solutions and patchwork remedies just won’t work.

It’s obvious to me that Financial/Accounting types must change their toolset. They must find a better tool (than spreadsheets) for much of their planning, consolidation, reporting and value creation activities. They have to change as the old ways are at the end of their useful life. The old ways and tools do not scale or scale very elegantly.

Yes, I know some spreadsheet purist will probably point out that spreadsheet technology has continued to improve over the years. Spreadsheets can now support things like pivot tables. But, let’s get real for a minute.

The typical PC spreadsheet application was designed as a personal productivity tool and was never designed to crunch through big data feeds (e.g., social sentiment information) or point of sale (POS) data from major retailers. Moreover, correlating data from some of these sources with one or more other sources is just not what a spreadsheet was designed to do.

Try this exercise

Tech Pro Research

Pretend to be a new hire in your firm’s Financial/Accounting organization. Document all of the spreadsheets in use throughout the year. How many have current documentation, procedures, etc.? How consistent are the spreadsheets and data types found within them? Do they look like they were all built by one person at one time or by a committee of strangers over a multi-year period? Can you tell immediately who updated each and every cell and when this happened? Can you see the history of changes to any one report?

I recently interviewed a corporate accountant who was being trained at her new employer. She described how this group used spreadsheets to do most every accounting task in the company. Unfortunately, these spreadsheet “systems” were rife with problems. If documentation existed, it was often massively out-of-date. When using the spreadsheets or spreadsheet templates, numerous errors were present and rarely got permanently fixed. No audit trails exist for who and when these spreadsheets were completed. And, the problems just kept coming.

The best part of the story is that this company wants to go public in the next year or so. I’d bet against that happening as no reputable auditor will sign-off on this mess.

Spreadsheets aren’t bad, per se

It’s just that well-meaning people use them in inappropriate ways or use them as permanent fixes to their reporting shortcomings. Spreadsheet usage in financial circles can become like an addiction. And, now may be the time for an intervention. Do you have the courage to say: “I’m a spreadsheet addict and I’ve got a problem”? If you are, read on.

Periodically, Financial/Accounting types have to realize that their old, shop-worn but very comfy technologies are no longer relevant to their new, demanding work environment. Today, a lot of Finance groups need to downsize the number of disparate reporting systems and spreadsheets that they actively use. The diversity, lack of commonality/standards and difficulty in reconciling data across this environment is not a good thing. It’s a time wasting, value-destroying problem and it needs to go away. It has to go away as the organization they work for is awash in new data feeds and the old tools aren’t serving the rest of the business well, if at all.

Financial/Accounting departments should move to a different, more unified reporting environment. This environment:

- Puts more data types (financial, operational, big data and external) into one system

- Uses more powerful computing platforms (i.e., in-memory databases)

- Collapses the number of reporting tools in use to a small number

- Provides clean and obvious audit trails

- Expands the user base of this data beyond the financial/accounting boundaries

What are some of the new tools? Here are some examples:

Adaptive Insights

Adaptive has undergone a rebranding in recent weeks as its product line has evolved measurably from its lone planning tool a couple of years ago. The software now sports functionality for budgeting/planning, a solid consolidation module, corporate performance management and in-memory analytics tool for marrying financial, operational and external together in a single cloud-based in-memory database.

Adaptive now has about 2000 customers in about 100 countries. Its rapid growth has attracted a blue-chip investor group including Norwest (an early PeopleSoft investor), Bessemer and salesforce.com. Their latest investment round is being earmarked for more sales growth, new products and international expansion.

Their most recent release has enhanced usability and user experience features. Collaboration functions were also enhanced. While the software looks more Excel-like than ever, it differs from many spreadsheets with enhanced collaboration functionality that contains a process tracker, workflow, approvals, task manager, organizational driven workflow, notes and conversation capabilities.

One of their customers is using the software to capture and monitor the maintenance, wear & tear, and costs of thousands of pieces of mining equipment. The financial benefits of this system rapidly covered the costs of implementing this solution. It’s an Internet of Things meets financial reporting world at this customer. Their use of Adaptive includes mine servicing, fleet utilization and sensor feedback as part of the solution. One Adaptive executive described the solution as “operational cloud deployment at the hard end of business”.

Anaplan

Anaplan is a relatively young company that’s grown quite rapidly and is now on their third round of venture funding (salesforce.com is one of their backers).

Last year, they discussed with me their ‘modeling as a service’ solution that married operational and financial data in an in-memory, cloud technology. The software could serve more than financial types as it offered business insights to more users in more operational roles. The software supported what-if scenarios, modeling and consolidation. Last year, the company had already attracted the attention of two major systems integrators and the business of several Fortune 500 firms.

Today, Anaplan has expanded its product focus and messaging. Anaplan is now a rapidly growing provider of “cloud-based modeling and planning (tools) for sales, operations and finance”. Their software permits the rapid construction of dashboards that are populated with the data found in a variety of internal and external data sources. One Anaplan customer has populated some 7 billion cells in their data model. Anaplan reports that some users are doing territory planning and promotions management from this toolset.

Anaplan’s CEO, Fred Laluyaux, told me that they weren’t trying to build “an Excel spreadsheet in the cloud”. To that point, part of what these new tools offer is a more visual look at the massive amounts of data that firms must analyze. Where spreadsheets are a personal productivity tool, these new generation solutions are business productivity tools – the difference is significant.

Tidemark

Tidemark provides a number of enterprise planning and analytics tools. Its all-cloud suite has modules for:

- Financial planning

- Operational planning

- Metrics management

- Labor & expense planning

- Model & analyze profitability

As one of the newest players in this space, they also possess some of the most interesting cloud and in-memory technology. I hope to do a comprehensive review of Tidemark soon. Stay tuned.

Kyriba

Kyriba fills a different niche from Adaptive and Anaplan. Kyriba deals with treasury functions via a cloud-based technology suite.

Featured

The treasury world shares a lot of the same pain points and spreadsheet abuses found in the reporting scenarios above. For example, many treasurers must contend with a variety of different, disjointed technologies to see their cash positions across multiple banks. These must be married to data from Accounts Payable and Accounts Receivable systems to see what upcoming payments are planned, which checks have recently cleared, what payments are in arrears, etc.

Pulling all of this data together in a visible, singular solution is often tough to do even for firms with only one material banking relationship. In gets more complicated when Treasury must also factor in trade promotions, season sales and other factors that impact purchases of raw materials and/or customer payments.

Treasury functions will regain importance in many corporations as the economy grows and interest rates inevitably rise. With rising interest rates, a company’s cost of capital will increase, debt service costs will increase and customers may get tardy in making payments. Cash is the lifeblood of businesses and close attention to same can be the difference between market success and bankruptcy.

Risk management is also a concern. Businesses must manage exchange rate fluctuations and hedges. Timely visibility to these risks (and positions) is a key treasury need.

Kyriba’s portfolio of solutions includes products for mobile users, mid-market firms and large enterprises. The large enterprise solutions include products for: cash and liquidity management, payment management, bank relationship management, financial transactions, risk management and trade solutions.

Other products

I’ll be doing more research on the space and I’ll be covering more vendors like ReVal, Prophix, Host Analytics and others. But, it’s clear that Financial/Accounting tools have moved to cloud platforms.

Why is cloud the deployment method of choice now? Like users in other application areas, Financial/Accounting types like software that the vendor (not the user or IT) maintains. Some products are especially easy and quick to implement, too.

In-memory is also becoming a must-have technology component, too. Established vendors like SAP (with HANA) and Oracle are pushing their in-memory capabilities as they can materially reduce reporting timeframes and make the running (and re-running) of complicated multivariate financial algorithms a super quick snap. Years ago, I worked with a client in Houston, Texas, that had a mainframe–based financial modelling application. Anytime they fired that baby up, it dimmed the lights across all of South Texas. Today’s tools run on third party cloud systems with the scalable computing environments that also possess a lot of in-memory capacity for just this sort of analysis.

What’s also clear is that the data crush hitting Finance/Accounting will not be solved by adding more spreadsheets or more cells/dimensions to existing spreadsheets. The variety of data coming into businesses (e.g., video, tweets, etc.) was never part of the initial design considerations that spreadsheet software creators envisioned. Their ‘vision’ was for a different time, a different kind of business and different kind of data. The business world has changed. It’s time that reporting changes, too.

Disclosure: You’ll probably hear me expound on these topics at length at several vendor’s user conferences, webinars, etc. this year. I’ll continue to research the sector and will likely produce a white paper or two on these matters. Next week, I’m even doing a webinar on the financial close processand after that a webinar on treasury.