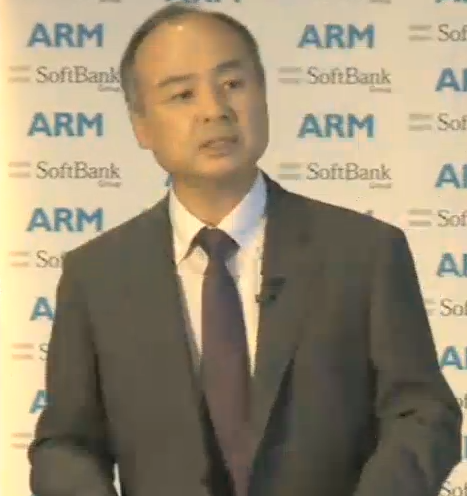

SoftBank CEO Son says ARM a multi-decade bet on the Internet of things

SoftBank CEO Masayoshi Son said his $31.4 billion purchase of ARM Holdings is a bet that the Internet of things shift is just beginning and that further investment in the mobile chip designer will pay off over the next two decades.

Anyone who has witnessed or lived through a SoftBank acquisition knows Son thinks, takes on debt and invests for the long run. Son's bet on ARM is one that revolves around the concept that the Internet of things (IoT) will dominate the tech space for decades to come.

"I always make investments at the beginning of a paradigm shift. You have to go to the front of the edge," said Son on a conference call. "IoT is going to explode over the next 10 years."

Son also noted that cows, sheep, streetlights and everything will be connected. ARM's annual revenue of $1.5 billion is "still small, but this is just the beginning," said Son. "I'm not investing for the past. I'm investing for the future. ARM is one of the few companies who can say they can grow exponentially."

SoftBank touted its internal rate of return of 44 percent. Those returns have been driven by investments in Alibaba Group, Yahoo Japan and Yahoo.

Analysts on the call were wondering about SoftBank's debt levels, but Son dismissed concerns. He quoted Yoda and noted that you have to believe in the force (you can't make this up). Son's point was that debt levels at SoftBank can be lowered and generate a good return.

Why do these financial matter?

Son's bet on ARM is one that revolves around scaling the business and hiring more engineers. SoftBank has to accelerate ARM's domination in the mobile computing space, keep key customers and continue to expand into new markets. "I will support ARM and enhance. I say go, go, go. Hire more engineers. They're the foundation of the company," said Son.

Previously: SoftBank to buy chip designer ARM for £24.3bn as it takes aim at Internet of Things | ARM snaps up IoT, imaging specialist Apical in $350m deal | SoftBank operating chief Arora out, Son to stay as CEO

For ARM to receive that investment, Son was asked about distractions. One distraction for SoftBank is its investment in Sprint, a purchase that goes against Son's rule to invest early in a technology shift. Son said he was more confident than ever about Sprint and its ability to self-fund its operations. He did note that SoftBank's master plan with Sprint didn't work out. "My desire was to acquire T-Mobile and combine it with Sprint, but the U.S. government didn't like that idea. My mistake," said Son, who added that he considered selling Sprint, but there weren't buyers.

After the detour into SoftBank's financials, Son returned to his ARM and IoT theme. ARM can be an IoT leader, said Son, who made another connected sheep reference to make his point. And in the future there will be synergies with other SoftBank holdings because ARM processors will connect things to the company's wireless holdings such as Sprint.

"There are all kinds of direct and indirect synergies. This year they will be small. And next year they will be small. Ten years from now those synergies will be gigantic. In 10 years to 20 years from now people will be jealous," said Son.