Tableau's business intelligence growth: 7 takeaways

Tableau Software, a business intelligence and analytics player, delivered a strong first quarter with sales growth of 86 percent as its "land and expand" strategy of offering enterprises easier business intelligence is paying off.

The company reported a first quarter net loss of $5.6 million, or 9 cents a share, on revenue of $74.6 million, up 86 percent from a year ago. The non-GAAP net loss was a penny a share. Wall Street was expecting a loss of 11 cents a share on revenue of $63 million.

According to the company, the first quarter results were powered by 120 deals worth more than $100,000 and 1,800 customer accounts. Tableau is also landing cloud customers with analytics as a service.

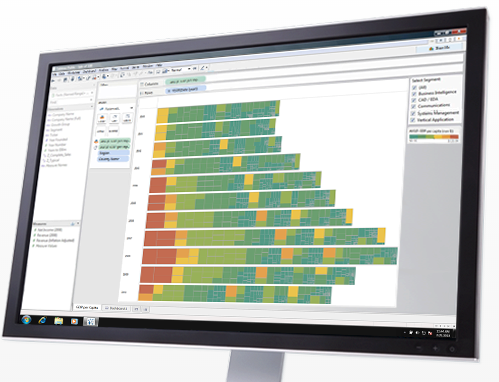

But what's really going on is that Tableau is forging partnerships with a bevy of big data players ranging from 1010data to Splunk to put a visualization front end on log files and other machine data. That big data play isn't paying off yet, but there's time: Tableau is capitalizing on the need to bring self-service analytics to the masses. Traditional business intelligence tools are too complicated and left to a power users in a company.

Featured

Although Tableau's wares aren't perfect and can be complicated, it has been able to pitch smaller enterprises and expand the footprint. Within large enterprises, Tableau starts small with units inside divisions and gets traction. Given that Tableau offers self-service reporting, the company's software has become a favorite of central information technology departments sick of creating reports for executives.

Because of that, it's no surprise that Tableau raised its second quarter outlook. The company now sees second quarter revenue between $75 million and $80 million and 2014 sales between $340 million and $350 million. The operating loss will $10 million to break even for the year.

Here's a look at seven takeaways from Tableau's quarter:

- Hadoop adoption isn't driving Tableau's results yet. Christian Chabot, CEO of the company, said on an earnings conference call:

It's out of the early innings for Hadoop and people are doing much more than just talking about it. But I wouldn't yet call it advanced. It's pretty rare that you meet a customer moving major parts of their database and BI strategies to Hadoop. I think people want to hear that it is, but it isn't happening...Tableau is helping customers access all their data no matter where it lays.

- Tableau isn't replacing core BI systems, but augmenting them in most cases. BI is limited to a few employees who have unique skills to access systems and produce reports.

- The company is primarily focused on organic research and development over acquisitions. "We haven't done an acquisition to data, but that doesn't mean we won't do one," said Chabot. Any deal would be most likely a tuck-in acquisition.

- Tableau 8.2 is on track for a June quarter launch and 9.0 will be available in the first half of 2015. The company has a cloud offering that has been around for nine months, but largely has a licensing model so 8.2 matters. The biggest perk with 8.2 is support for Apple's Mac OS X. The company, however, isn't seeing pent-up enterprise demand for Tableau on Apple systems.

- Central IT departments are leading the Tableau buying charge. Chabot said:

You might say in those first couple years, the IT department's involvement in adopting and championing Tableau was virtually zero. I'm talking about back in '03 and '04 and '05. And ever since then, more opportunities we see have actually been led by IT.

I think one of the reasons is that Tableau's market proposition to customers is a way of doing business intelligence work, analytic work, and executive dashboarding in a framework that is much more agile, easier to use and more self service. IT departments are increasingly championing this as the style they want to roll forward with. Because too often IT departments have, in essence, become a report factory for the rest of the company.

- Tableau Public is a free version of the company's software so data can be shared around the Web. One visualization revolved around cup stacking — stacking plastic cups in sequences as fast as possible. For what it's worth, Germany has the most cup stacking records, but the US is the global leader.

- International revenue is driving growth at Tableau and represented 23 percent of first quarter sales. The company plans to expand heavily abroad. Nevertheless, the US and Canada accounted for 77 percent of total revenue.