Tech Data: IT distributor squeezed by mobile shift, system miscues

Tech Data's fourth quarter earnings weren't pretty as the massive information technology distributor was squeezed by profit margins associated with the post-PC era and an ongoing hangover due to an SAP implementation. The integration of SDG, a key acquisition, was another factor.

Earlier this week, the company reported fourth quarter earnings of $83.5 million, or $2.17 a share, on $7.5 billion, up 5 percent from a year ago. Non-GAAP earnings, which excluded a one-time gain, were $1.48 a share. Wall Street was expecting fourth quarter earnings of $1.76 a share.

In many respects, Tech Data, along with Ingram Micro, highlights the flow of technology products and how they reach end buyers. CEO Bob Dutkowsky noted:

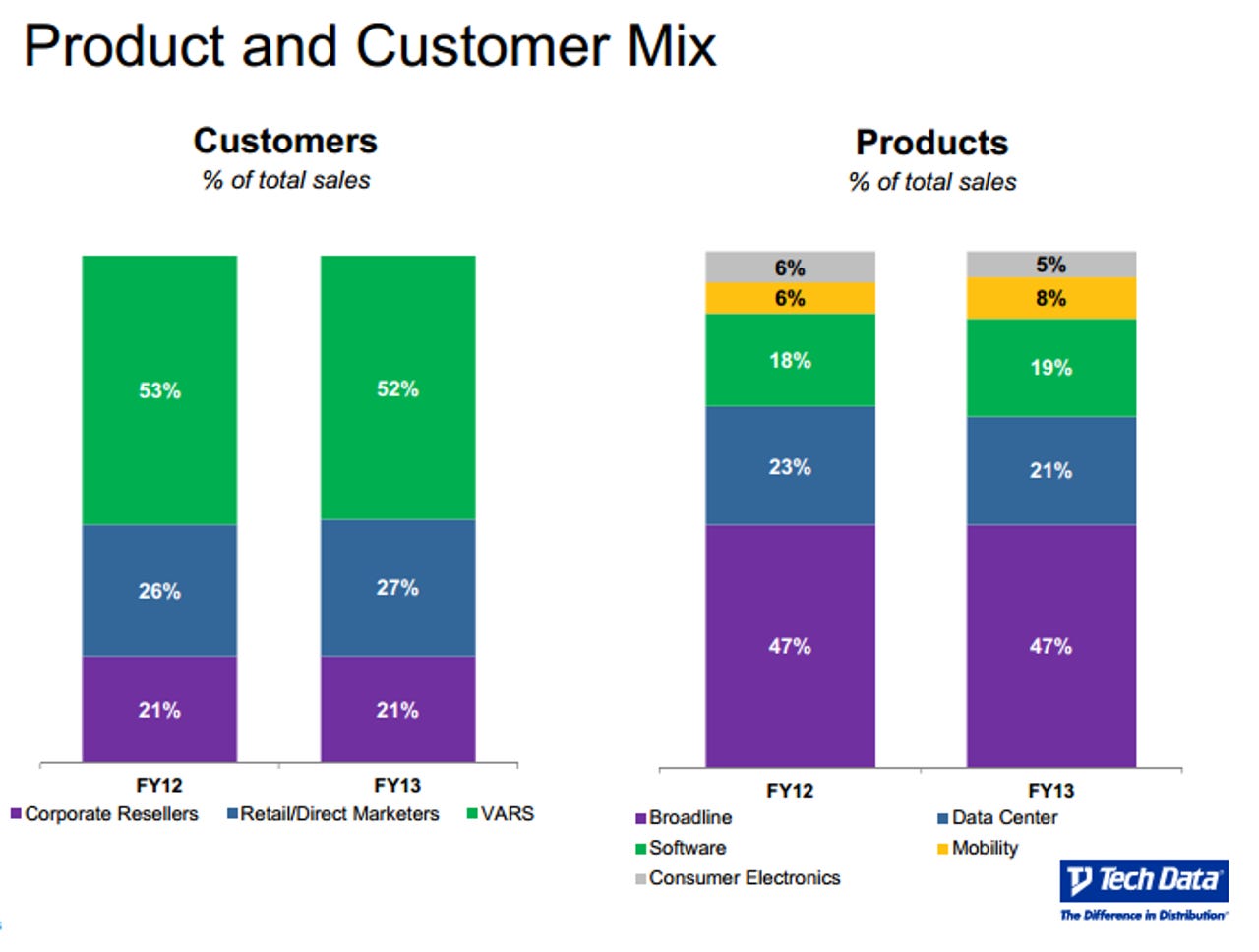

A shift in the product mix to higher sales of mobile phones, tablets, and software. Because these are less complex sales of high-velocity products, they carry tighter gross margins. In a strong demand environment, these high-velocity products help absorb our fixed-cost structure, resulting in good operating leverage. In a softer demand environment, like the one we experienced in Q4, it was more difficult to drive the desired operating leverage, which significantly impacted our earnings in the quarter.

Dutkowsky repeatedly came back to the mobile shift on the company's earnings conference call. For instance, Tech Data sold and distributed $2 billion in tablets in the 2013 fiscal year, up from $1 billion a year earlier. The year before that Tech Data's tablet sales were $300 million.

CFO Jeff Howells said:

The world has moved to tablets and smartphones and mobility products, and the good news is, we've diversified into those product categories. I think on the overall basis, with the move to those products, in both regions, we had less opportunity this year to earn incremental rebates by exceeding baseline sales goals with a variety of vendors, which ends up being a very positive impact on gross and operating margins as you hit cliffs and earn those back-end dollars. Probably more so in the Americas than Europe as a result of the loss earlier in the year of some market share, or more or less some growth opportunity in various vendor categories.

The other notable factor behind Tech Data's earnings results was an SAP implementation that struggled in the second quarter. In the fourth quarter, the hangover from lost customers continued for Tech Data.

Dutkowsky noted:

The second factor that impacted gross margins was our continued recovery in the US to regain the momentum we lost from our SAP deployment in Q2. The team is making excellent progress winning back business, and as a proof point, our sales in the US came in above plan in Q4. We are standing firm on our commitment to regain share by leading with service, not price. However, the year-over-year sales decline, combined with a shift in product mix, resulted in lower back-end rebate dollars from vendors, which had a negative effect on gross margins in Q4.

Specifically, Tech Data implemented sales, inventory and credit management modules from SAP. The goal of the project was to use the same systems in the U.S. and Europe. In regulatory filings, Tech Data recapped the SAP project:

While the system conversion and overall implementation went well, our execution in the U.S. was negatively impacted, as the changes in the flow of information impacted our service levels with certain customers as well as our productivity and ability to make critical margin management decisions during both the second and third quarters.

The fix for Tech Data is twofold:

- Move higher end systems for data center projects to offset the meager mobile margins.

- Recover from the SAP project and train employees on the new processes.