Telefonica, BT & Vodafone lead carbon survey but RIM stays back of the pack

The annual Carbon Disclosure Project (CDP) survey of the global 500 largest listed public companies is out and it makes for sober reading for the Telco industry. The Telco sector is the only industry sector that did not have a company making it to the highest performance ranking band. From the survey commentary:

This is surprising given that the telecommunications sector is increasingly seen as providing technology that can support emissions reductions activities.

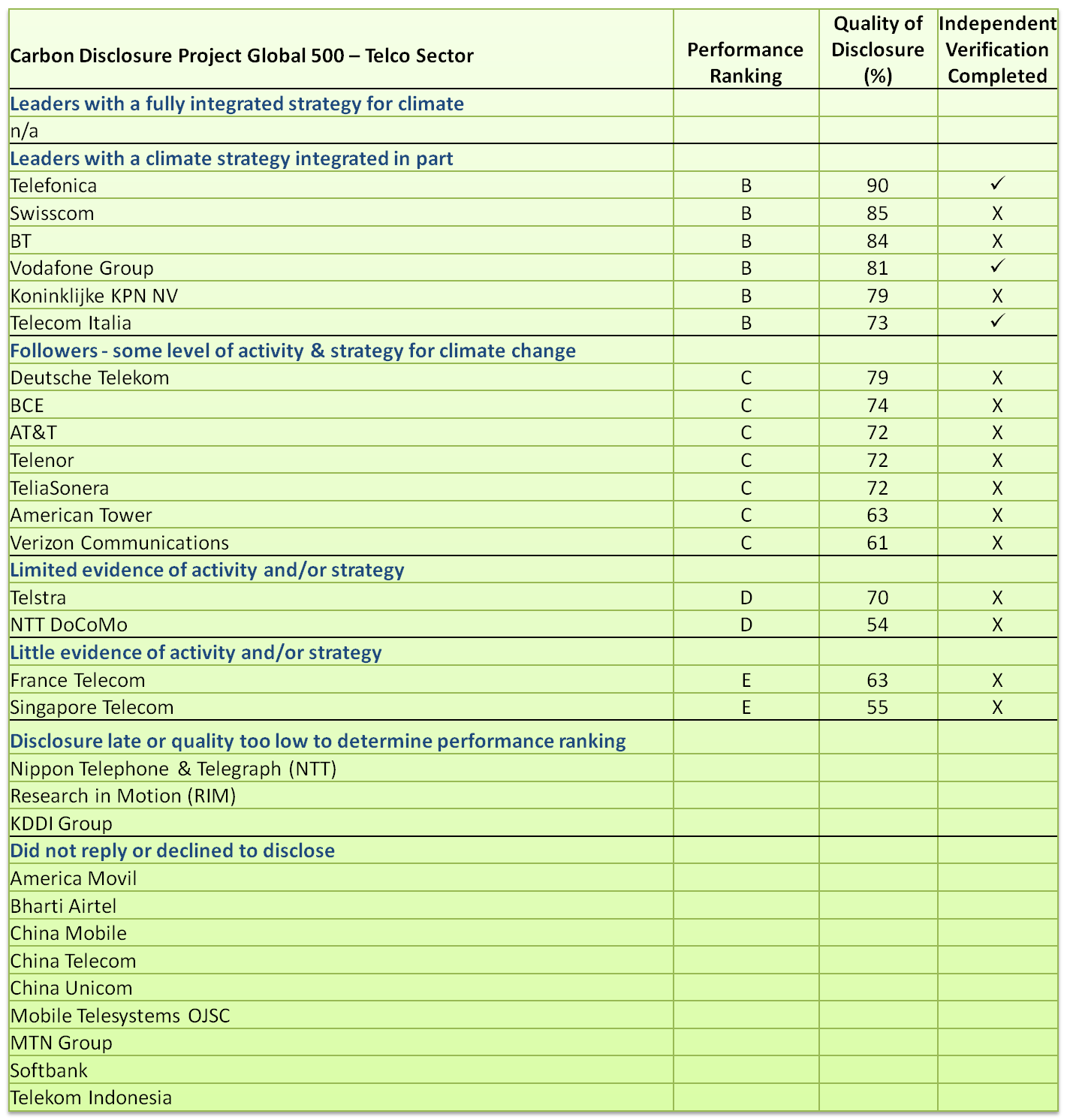

BT, Telefonica, Vodafone, Swisscom and Koninklijke all show strong quality in reporting quality, some strategic integration of the climate strategy to the business model and a reasonable performance delivery. US telco titans Verizon and AT&T languish in the third tier while RIM shows a surprisingly poor result with the data provided below the quality threshold to rank. China Mobile, the world's largest mobile phone operator with 600 million subscribers, did not respond to the survey request. Only three out of the twenty nine companies analysed have had have their carbon emissions data independently verified by a third party. (click below for better viewing)

The telco sector result will come as something of a disappointment to McKinsey, The Climate Group and the Global eSustainability Initiative (GeSI) who together in 2008 issued the Smart 2020 white paper which calculates the ICT sector is capable of delivering a 15% reduction in total global man made GHG emissions by 2020 through the deployment of smarter technologies.

For a run down on the IT sector see also: G-500 Survey: climate pays but tech lags, Cisco leads but Apple & Amazon won't play ball

The 10th annual CDP survey, carried out on behalf of 551 institutional investors carrying more than $70 trillion in assets, adds to what has become the most important voluntary data base of carbon emissions activity. CDP claims that carbon leaders in their survey have out performed the market by returning 85% compared to 43% for the average between 2005 - 2011. Is this all down to carbon related energy savings and eco innovation? No, but it does indicate that well managed businesses also take climate seriously as a strategic business risk and opportunity. The S&P 500 results will be out shortly which will provide a more granular view particularly on the US market.

Disclosure: I am employed by SAP who is a partner with CDP and a survey participant. As always, views are my own only. Please see my bio.