Uber's future may be more about Uber Eats, Uber Freight than ride sharing

Uber Technologies lost nearly $3 billion in its first quarter due to COVID-19 shutting down the ride sharing business, but Uber Eats and Uber Freight may show the way forward.

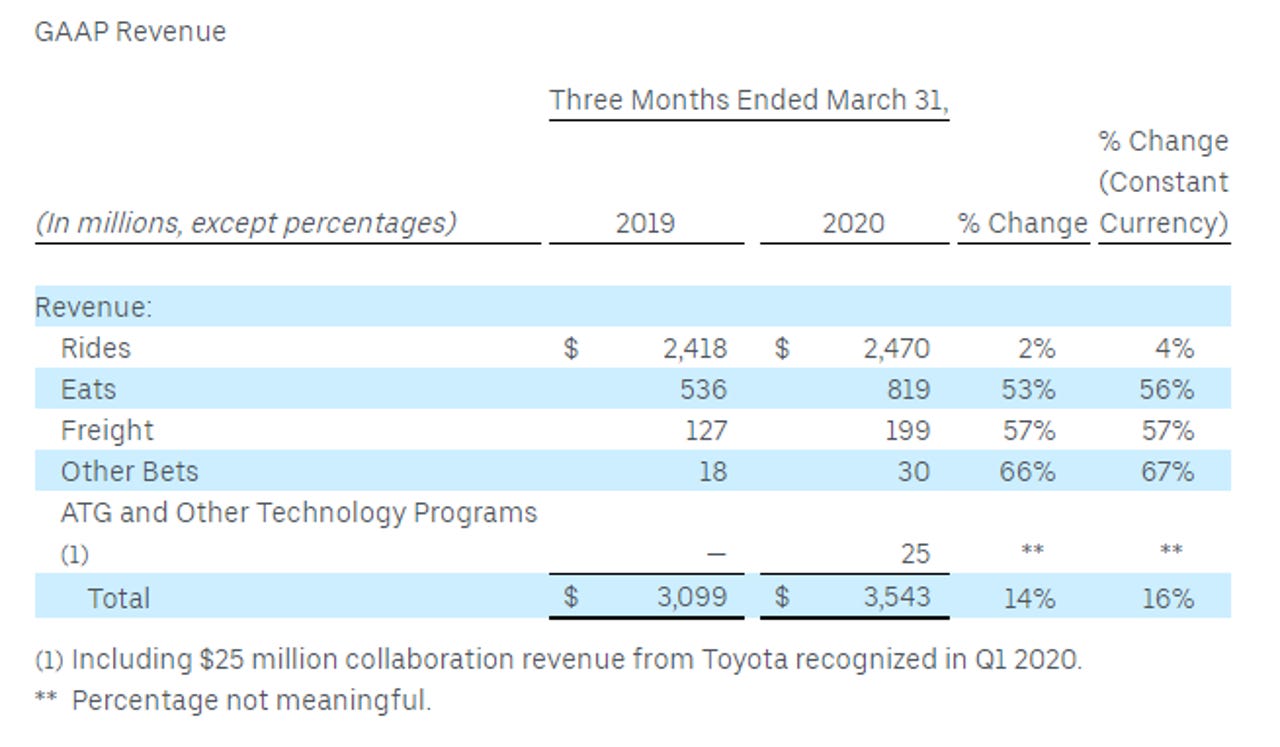

Make no mistake about it. Uber's quarter, like Lyft's results the day before, were shaky. Uber's net loss was $3.9 billion on revenue of $3.5 billion, up 14% from a year ago. Like many companies, Uber delivered a solid January and February and then collapsed in March due to stay-at-home orders due to the COVID-19 pandemic.

- Uber will lay off 3,700 full time workers due to COVID-19

- Uber revamps app functionality, introduces hub to keep drivers in alternative work

- Uber vs. Lyft: How the rivals approach cloud, AI, and machine learning

Uber's biggest issue to date is that it loses more money as it scales. However, Uber CEO Dara Khosrowshahi did say that it saw a surge in food delivery via Uber Eats and Uber Freight showed strong growth. Khosrowshahi said Uber's ride-sharing business will improve as economies open back up.

That final point remains debatable given social distancing and changing consumer behavior, but Uber's bet is that it has the financial resources to "ensure our core Rides and Eats businesses emerge from this crisis stronger than ever."

On a conference call, Khosrowshahi said:

Eats crossed the $25 billion gross bookings annual run rate. Additionally, there's been a tremendous increase in restaurant sign-ups, leading up to rapid improvement in selection in major markets like the U.S. as well as behavioral shifts by the willingness of -- on the part of fine-dining establishments to sign up for delivery. We believe these trends are here to stay and will result in an expansion of the entire category. Some of you will recall my commitment on our Q3 2019 call to invest aggressively only in markets where we're confident we can establish or defend a #1 or #2 position.

Indeed, the COVID-19 pandemic has Uber Eats approaching $1 billion in revenue a quarter. Uber did say that Uber Rides improved adjusted EBITDA in the first quarter but lost more money on Eats. Freight adjusted EBITDA also fell but did ad load bundle and multi-stop load features.

The big takeaway from Uber's results is this: Yes, the company is known for ride sharing, but you have to wonder if future results will be driven by ventures for such as business-to-business, food delivery and freight. After all, new consumer behavior may dictate that ride sharing makes less sense than it used to.

Khosrowshahi said:

I won't sugarcoat it. COVID-19 has had a dramatic impact on Rides, with the business down globally around 80% in April. Still, there are some green shoots driving restrained optimism. We've seen week-on-week growth globally for the past 3 weeks. This week is tracking to be our fourth consecutive week of growth.

Last week, we saw 9% trip growth and 12% gross bookings growth globally week-on-week. We believe the U.S. is off the bottom. U.S. gross bookings were up last week by 12% overall week-on-week, including New York City, up 14%; San Francisco, up 8%; Los Angeles, up 10%; and Chicago, up 11%. Perhaps more interestingly, gross bookings in large cities across Georgia and Texas, these are 2 states that have started opening up significantly, are up substantially from the bottom at 43% and 50%, respectively. Hong Kong is back to 70% of pre-crisis gross bookings levels. And in India, we began operating again in designated green and orange zones which account for more than 80% of the country's 733 districts. In France, a survey of riders who are active before COVID shows 2/3 expected to take their next Uber ride within a month. 90% expected to do the same in less than 3 months, and 98% of all riders say they will take a trip again suggesting pre-COVID usage will build back steadily. Nevertheless, it's very early days. Our expectation is that the recovery will vary geographically and will be nonlinear.