Verizon's Q4 better than expected with balanced consumer, business wireless net additions

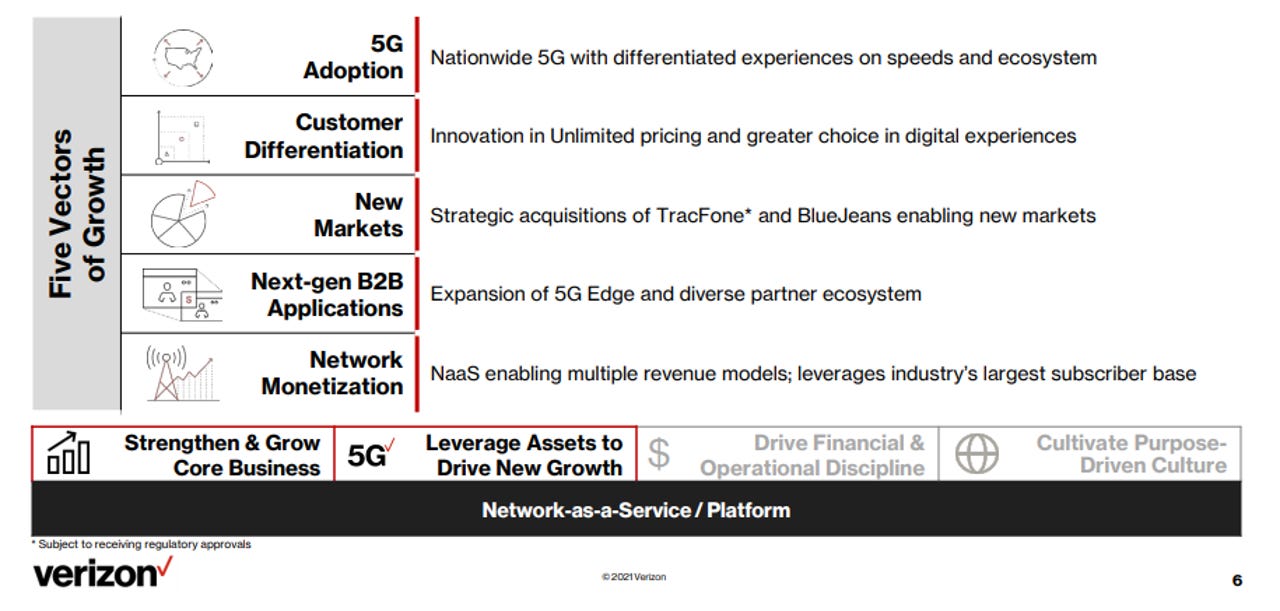

Verizon's growth plans include investment in its B2B unit.

Verizon added 357,000 wireless postpaid consumer connections in the fourth quarter and another 346,000 for business as the company's results were better than expected.

The wireless giant reported fourth quarter earnings of $1.11 a share on revenue of $34.7 billion, down 0.2% from a year ago. Non-GAAP earnings were $1.21 a share.

Wall Street was looking for non-GAAP fourth quarter earnings of $1.17 a share on revenue of $34.43 billion.

Verizon CEO Hans Vestberg said 5G is expanding beyond mobile use cases and the company aims to "create new opportunities for growth across multiple industries." Verizon missed its consumer postpaid phone subscriber total, but 5G connections are going to be about more than just smartphones. In addition, edge computing and IoT deployments will also minimize the importance of phone additions over time.

The company noted that it will continue to invest in Verizon Business. In 2020, Verizon announced the BlueJeans purchase in and followed up with encryption improvements and features for virtual events.

Vestberg said:

You can see also that Verizon Business Group has a year of investments to see that we are putting a foundation to be even stronger for the future, had good growth in the wireless and also in some areas like the public sector, very good performance and also adding a lot of new customers on the enterprise side.

We have other segments we are addressing as well as the next-generation business-to-business application based on our unique mobile edge compute offering that we have with Amazon, also now with Microsoft and many other partners. And finally, the network monetization with our MVNO partners, which are enjoying the best network that we have and we're building.

For 2020, Verizon reported earnings of $4.30 a share on revenue of $128.3 billion, down 2.7% from a year ago.

Among the key items:

- Verizon said consumer revenue was $23.9 billion, down 1.2% from a year ago.

- Verizon's consumer unit had 357,000 wireless retail postpaid net additions. That sum included 163,000 phone net additions, 81,000 tablet losses and 275,000 other connected device additions.

- The company had 92,000 FiOS Internet net additions in the fourth quarter. FioS Video lost 72,000 net customers in the fourth quarter.

- Business revenue was $8.1 billion in the fourth quarter, down 0.3%. Verizon Business added a net 346,000 wireless retail postpaid customers with 116,000 phones, 116,000 tablets and 114,000 other devices.

- Verizon's media business revenue was $2.3 billion in the fourth quarter, up 11.4% from a year ago. The growth was the first quarterly sales gains since Verizon acquired Yahoo in 2017.

As for the outlook, Verizon is projecting non-GAAP 2021 earnings of $5 a share to $5.15 a share.