Why data center automation is accelerating: It's in everyone's best interest

Data center automation is likely to accelerate due to a series of trends--hardware as a service, cloud, multi-cloud and agility--that are all converging.

When we first looked at the state of data center automation in 2018, the buzzwords were software defined and digital transformation. However, a TechRepublic survey found that 60% of respondents didn't automate any data center functions yet.

What a difference three years and a COVID-19 pandemic made.

Today, data center automation sits in the middle of a series of trends including multi-cloud, public cloud, hardware-as-a-service models and the need to automate for agility. Simply put, data centers are headed to autopilot in a hurry.

Gartner predicts that by 2025, 60% of organizations will use infrastructure automation tools to deploy compute. According to IDC, 75% of Global 2000 IT organizations will adopt automated operations practices by 2023 to support demand.

Those estimates may be conservative. Why? The burden of data center automation has shifted to vendors instead of customers.

Three years ago, enterprises were expected to invest in data center automation. With adoption of cloud computing, which only accelerated during the pandemic, multi-cloud deployments are becoming the norm. Consider:

Cloud vendors have automated their data centers for a simple reason: Automation boosts profit margins. It's one thing for the customers to get around to automating a data center. It's another game entirely for the likes of Amazon Web Services, Microsoft Azure and Google Cloud. The more cloud giants can automate the more of the savings they can keep while lowering prices. Fun fact: Cloud spending is expected to surge 23% in 2021 to $332.3 billion, according to Gartner.

Traditional data center vendors--Cisco, Dell, HPE--are all moving toward hardware as a service model. In this model, vendors will increasingly manage their own gear. More automation means less overhead and more margin. Gartner projects that 15% of new on-premises computing deployments will involve pay-per-usage models by 2025.

HPE CEO Antonio Neri said as-a-service and more automation will be two big building blocks for its product strategy with HPE Ezmeral. "Our strategy is to be true open source, autonomous, intelligent, and secure, and be able to connect all their edges and all their clouds in a very automated way," said Neri.

Sam Grocott, senior vice president of Dell Technologies Business Units Marketing, said: "We're going to shift to everything as a service."

Multi-cloud deployments are becoming the norm. These deployments are often built on hybrid platforms such as IBM's Red Hat unit or VMware. You need a heavy dose of automation to orchestrate workloads. Using artificial intelligence and machine learning for compute operations will require automation.

In fact, Red Hat CEO Paul Cormier in an interview with ZDNet argued that the hybrid cloud is the new data center.

And if you like to buy infrastructure for your own data center, the chances are good that you'll go for hyperconverged systems that simplify compute, storage and networking with a good dose of automation.

Add it up and data center automation is accelerating with better IT budgets driven by digital transformation. Some of that IT budget is going to be driven by the savings from automating the data center.

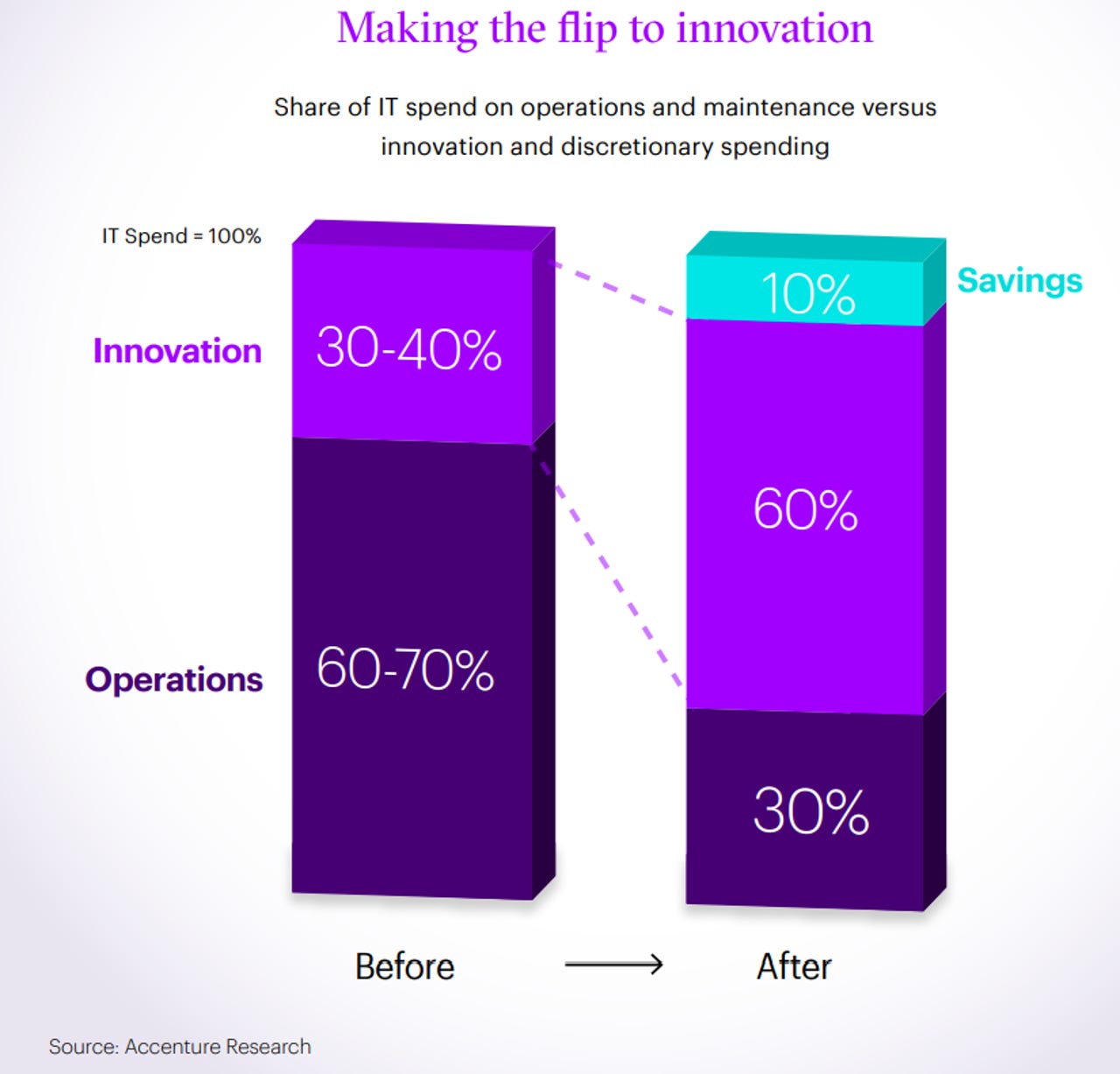

Accenture's recent look at leading companies coming out of the COVID-19 pandemic is instructive. The leading companies in digitizing operations are growing 5x faster than the laggards. In fact, some of these companies have flipped their IT budgets where innovation is 60% of the budget with operations being 30%. You can't get to that view without automation and those aforementioned trends.

Accenture said:

Based on our experience working with major clients across the world, most IT budgets today have a 70/30 split: 70% for operations and maintenance and 30% for innovation and discretionary spending. The flip occurs when organizations migrate their IT estate to the cloud and free up capital to invest in innovation activities, such as automating software development cycles and building capabilities to deploy new technologies. The IT budget doesn't increase, and maintenance and operations are not ignored but rather become more cost-effective because of the cloud.