Workday beats Q2 estimates, raises FY 2019 revenue outlook

Workday published its second quarter financial results Tuesday, beating market estimates and raising its full-year fiscal 2019 revenue outlook.

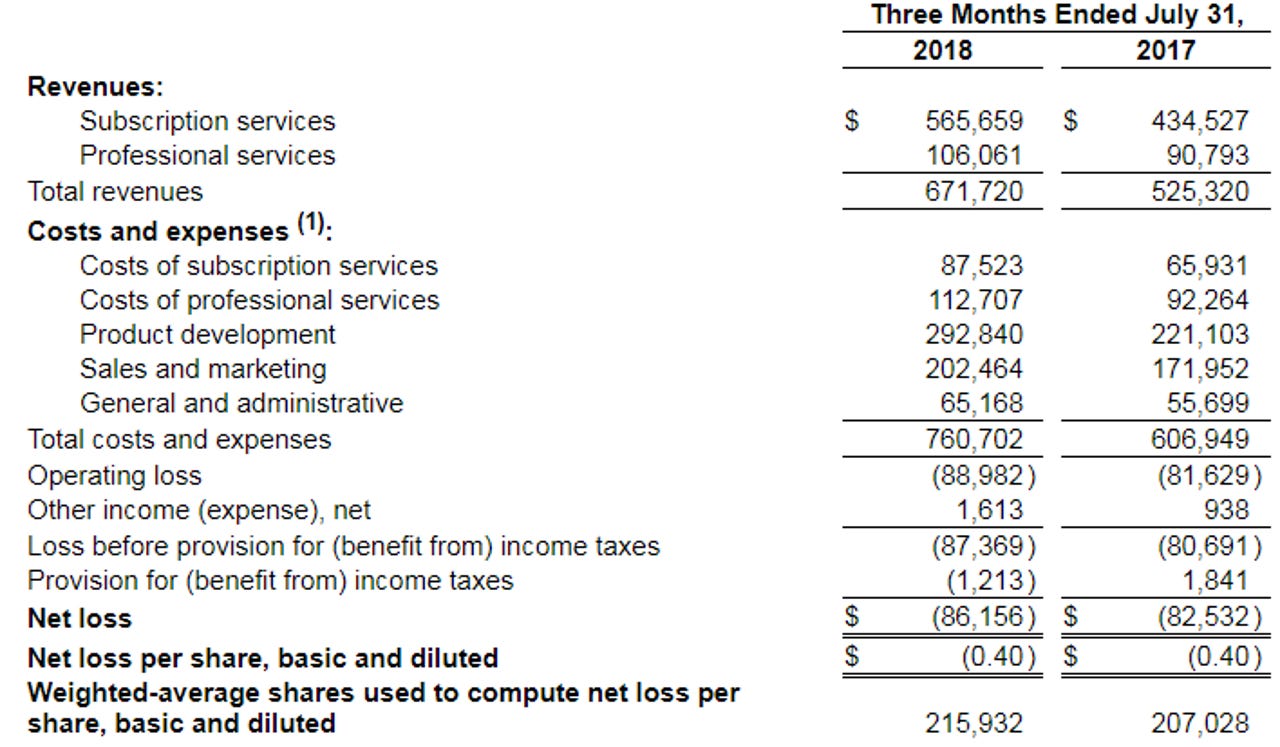

The company reported Q2 non-GAAP net income of 31 cents per share on revenue of $671.7 million, up 27.9 percent year-over-year. Subscription revenue came to $565.7 million, up 30.2 percent year-over-year.

Wall Street was looking for earnings of 26 cents on revenue of $663.09 million.

The company in Q2 increased the number of both finance and HR customers in the Fortune 500, CEO Aneel Bhusri noted in a statement. Subscription revenue came to $565.7 million, up 30.2 percent year-over-year.

Tuesday's report was the first since Workday in June announced its $1.55 billion acquisition of Adaptive Insights, a cloud-based business planning software company. The acquisition, Bhusri said, will "further enable customers to plan, execute, and analyze all in one system."

Workday is raising its fiscal 2019 revenue outlook based on the acquisition and the company's Q2 results, CFO and co-president Robynne Sisco said in a statement.

The company now expects subscription revenue between $2.341 billion and $2.348 billion, or growth of 31 percent.

Workday expects Q3 subscription revenue to be between $609 million and $611 million, representing 31 percent to 32 percent growth.