Workday grabs mid-market momentum, aims to gain amid Oracle-NetSuite merger

Workday's second quarter sales were better than expected, and it can thank traction among mid-market enterprises that are betting on the company for both financial and human resources software.

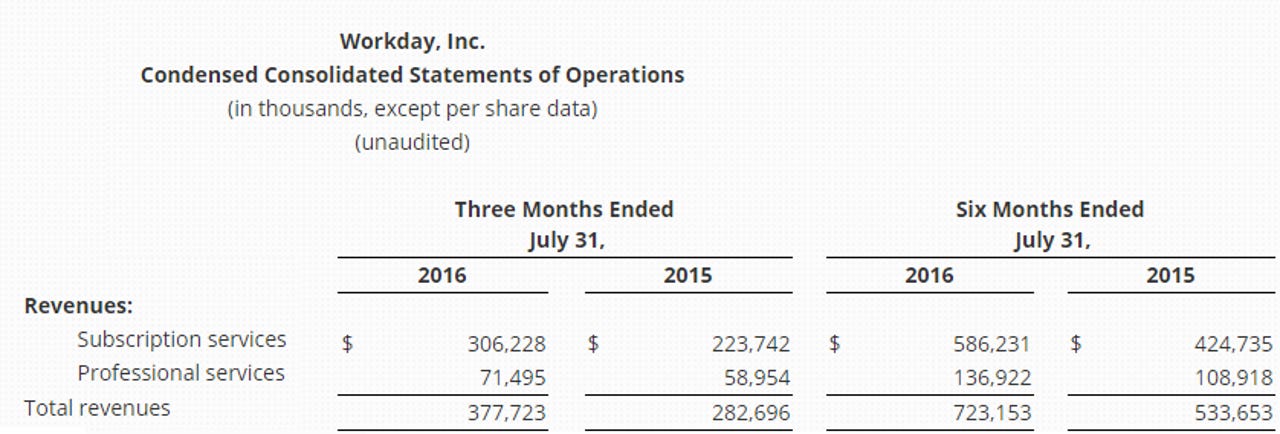

The company posted a non-GAAP second quarter loss of 4 cents a share, 2 cents worse than Wall Street expected, on sales of $377.7 million, up 34 percent from a year ago. Analysts were expecting sales of $372.7 million.

Workday's outlook of third quarter sales of $398 million to $400 million also fell short of Wall Street estimates of $401.1 million.

Also: Workday to use IBM's cloud for development and testing | Workday acquisition of Platfora leaves questions | Workday buys Platfora for visualization, data technology | Robynne Sisco, CFO of Workday, on R&D returns, culture, sales, profits

So, why are Workday shares surging?

Analysts see an inflection point where Workday is gaining platform sales in the mid-market and working larger enterprise sales. Meanwhile, the merger of Oracle and NetSuite has given some enterprises pause. Those enterprises may now look at Workday more. In addition, NetSuite had an integration partnership with Workday rival Ultimate. That partnership may also be in flux with the Oracle-NetSuite merger.

On a conference call with analysts, Workday CEO Aneel Bhusri said the company is having more active platform discussions with enterprise with up to 10,000 employees. "We obviously hope it moves upmarket," said Bhusri.

Workday Co-President Phil Wilmington said a third of the transactions in the second quarter included financial. Wilmington argued that Oracle bought NetSuite largely to defend the mid-market and counter Workday.

Clearly, Workday is seeing Oracle's purchase of NetSuite as an opportunity -- at least for now. In the long run, it's hard to dismiss Oracle and NetSuite. It's worth parsing Bhusri's take:

If people go back to 2011, 2012, right before we went public, I actually had predicted that Oracle would buy NetSuite in the next 12 months. I got the timing wrong, but to me, that was set up to happen at some point. We have been preparing for it probably longer than most.

I think the puzzling thing for me about the acquisition is that when you look at Oracle's traction in cloud applications and you listen to how

their leaders talk about it, it's primarily a mid-market phenomenon. And I can just say from the Workday perspective, Oracle doesn't compete well in large enterprises because their products are not proven at scale. So they seem to be doubling down on the mid market with an acquisition of NetSuite.

We probably see NetSuite in 20% of our opportunities, that would be my best guess. They are definitely an SMB to mid-market player. I've got a lot of respect for what they have done in that segment and we do bump into them.

I think more than anything else it calls to question whether Fusion actually was working, and whether this becomes the primary platform for Oracle apps going forward. Because otherwise, it's fairly confusing and confusion is very good for Workday.

Any time a company is confused as to which product is to buy from a competitor, and we're very clear about which one we have, we only have one code line. I think it bodes well for us. And that's based on what happened when Taleo was acquired and SuccessFactors was acquired that both of those have led to a lot of defections over to Workday.

Add it up and Workday is likely to grab more mid-market momentum and then move up to larger companies. How long the company can press its edge until Oracle and NetSuite rev their engines remains to be seen.