Zoho's future in Google's hands?

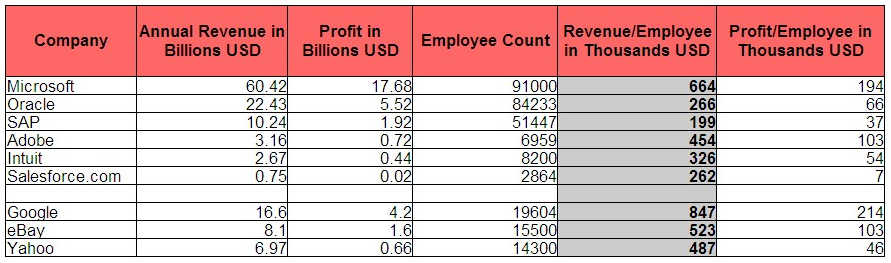

Earlier today, Zoho sent over an intriguing email with a whole bunch of numbers and spreadsheet demonstrating why Google in particular is not likely to be a threat to the company. It makes interesting reading. The argument goes something like this: Google's revenue and profit per employee, almost wholly derived from advertising, is so far ahead of application providers like Microsoft and SAP that it simply isn't worth Google's time or money to invest heavily in the applications part of its business. Here is how Sridhar Vembu, CEO of AdventNet, Zoho's part company describes the position:

We simply don't believe Google has the rational business incentive to go deep into the business/IT software category. The lower revenue and profit per employee figures would be tolerable if there were huge growth opportunities there; but when very successful companies like Adobe and Intuit pull in revenues well shy of a Yahoo, when even the enterprise software leader SAP is only a little over half the size of Google (Google makes more in profit per employee than SAP makes in revenue per employee), it is fairly clear this market is not going to make a material contribution to Google's growth and profitability objectives.

Vembu has a good point. When I think about the history of Google Apps development, once they get past the initial launch, upgrades and new feature additions are released at a glacial pace. But is it that simple? Over on Outside the Lines, Dan Farber is far from convinced:

The problem with Vembu's logic is that Google has an enormous pool of cash to invest in improving the economics of business and consumer productivity software suites. And, part of being a software company is having multiple and adjacent revenue and user data streams. Microsoft is a highly profitable software company with many adjacent divisions. Google Apps won't be as profitable as search, but it will be profitable and ties users into the Google platform and monetization engine.

The part about Google having a stack of cash is perfectly true but I have yet to see firm evidence that Google is truly serious about the applications space. Sure, it has a lot of users and claims an on ramp rate of some 2,000 new customers per day. But that pales into insignificance when compared - for example - with the 500 million that Microsoft claims for its Office suite. Love it or hate it, Microsoft is the 800lb gorilla, not Google. And given the economics that Vembu identifies, his incentive contention, as it relates to Google, seems perfectly sound. Similarly, I see no appetite for contextual ads in business applications. It's simply a model that doesn't fly. Everyone I speak with tunes ads out - I can't remember the last time I noticed one, even though I'm an extensive Google Apps user.

According to Dan, Zoho estimates its revenue per employee will climb form its current low levels to $200,000 to $250,000 per employee once they get into full ramp mode. On current employee numbers, that equates to $48-60 million per annum. That's a piffling amount in the context of the global office applications market. However, the per employee number is way above where Google or Microsoft is today. That gets attention. How Zoho expects to get there remains something of a mystery. I'd speculate that Zoho believes its current 'freemium' model which doesn't consume huge marketing resource will carry it through. I'd like to think the company can deliver on this because that would indicate the emergence of a startup business model that can be successful, when the funding is coming from established resources and not thos eo fht eVC community.

It is interesting to note that after years of pretty much having the office market to itself Microsoft is facing all sorts of competition, especially in the specialist forms of spreadsheet and database applications area. EditGrid, ModelSheet, DabbleDB and blist are names that immediately spring to mind. While they may be no threat today - and may never be a serious threat - it is telling that they all have products going into the market. It may be years before any of these companies achieves commercial success but I believe that in a world starved of innovation, they serve as pointers to the direction office software might go. In that sense, the world and market is big enough for many players to get a piece of the action. At least for the time being.