Clearwire: Q3 sales better than expected; 9.5 million subscribers

Clearwire, the wholesale network provider behind Sprint's current 4G network, said its third quarter sales will top expectations and it will have about 9.5 million subscribers.

The company's CFO Hope Cochran is speaking at a Deutsche Bank leveraged finance conference later Thursday. Clearwire's results may allay immediate concerns about the company's future and help it raise capital.

- The company said third quarter revenue will be $332 million, up 126 percent from a year ago. Wall Street was looking for third quarter revenue of $322 million.

- Clearwire added 1.9 million wholesale subscribers and will end the third quarter with 9.5 million.

- The company’s adjusted EBITDA loss will be half of what it posted in the second quarter.

- Clearwire will have $700 million in cash and equivalents.

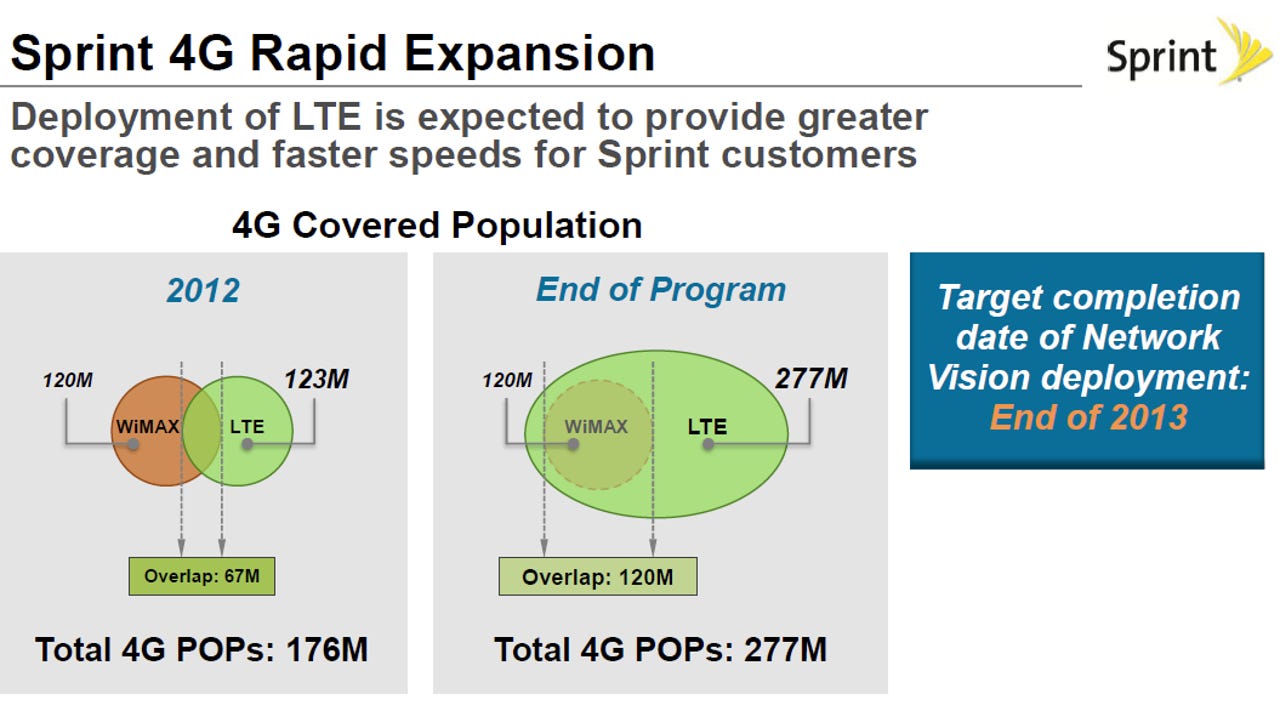

Last week, Sprint held a strategy session with Wall Street analysts last week and downplayed its ties to Clearwire. Sprint instead touted plans to roll out an LTE network and posted a chart where Clearwire will be overrun in a few years. Clearwire's network is WiMax based. Amid that backdrop---and the stock slide that came with it---Clearwire is anxious to show that it's not all doom and gloom.

Also: Sprint to talk finally iPhone 4S financials as if it has a choice | Sprint makes right long-term moves, gets pummeled for them

Those results are ahead of most Wall Street projections. Wells Fargo analyst Jennifer Fritzsche said the results show that Sprint relies heavily on Clearwire---potentially 40 percent of devices sold are 4G. She said:

While we realize the stock remains very much in limbo given Friday's analyst day with Sprint, we believe these results speak loudly to two things: 1) Sprint's customer base strong dependence on the Clearwire network and 2) the company's solid execution with its promised cost cutting initiatives.

Clearwire shares are up 15 percent on the news, but it has been a horrid year overall.