Atlassian Q3 solid, shares down on mixed guidance

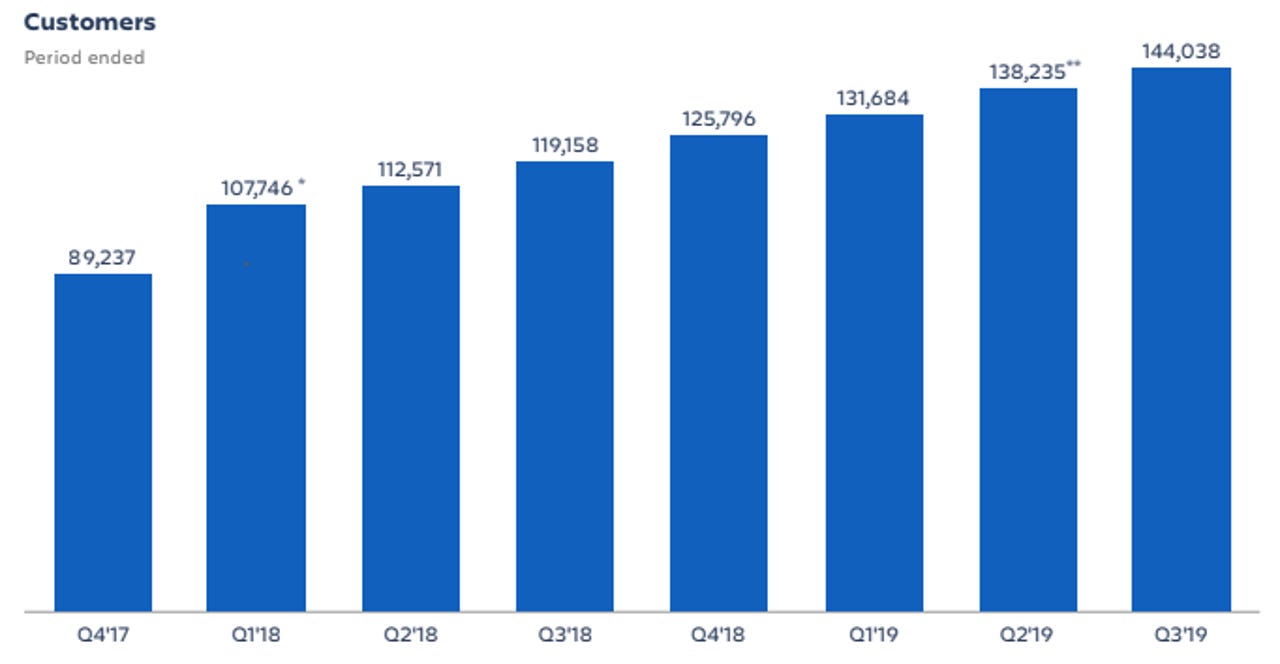

Collaboration and productivity software company Atlassian delivered better-than-expected third quarter financial results on Wednesday buoyed by strong customer momentum. The company grew its customer count on net by 5,803 for the quarter. It ended Q3 with a total customer count on an active subscription or maintenance agreement basis of 144,038. Nonetheless, mixed Q4 guidance sent the company's shares down more than 10% after market.

As for the rest of the numbers, the San Francisco-based company reported a net loss of $202.8 million, or 85 cents per share. Non-GAAP earnings were 21 cents per share on revenue of $309.3 million, up 38% from a year ago.

Wall Street was expecting the company to report earnings of 18 cents per share on revenue of $304.65 million.

Atlassian's subscription revenue remained strong, rising to $166.5 million. The company reported a free cash flow of $127.1 million, an increase of 47% year over year.

For Q4, Atlassian is expecting revenue in the range of $329 million to $331 million, with EPS of 16 cents. Analysts expect the company to report fourth quarter earnings of 19 cents per share on revenue of $327.2 million.

For the full fiscal year 2019, the company is expecting revenue in the range of $1.205 billion to $1.207 billion with earnings of 82 cents per share. For the year analysts expect earnings of 82 cents a share on revenue of $1.2 billion.