2019 online holiday shoppers will be looking for in-store pickup, Salesforce predicts

The holiday shopping season always feels rushed, but this year it actually will be: Thanksgiving is six days later than it was last year. With the traditional shopping season cut short by nearly a week, certain digital commerce strategies may pay off for retailers, according to research from Salesforce. For one thing, in-store pickup services for online customers may offer a competitive edge.

Specifically, Salesforce forecasts that e-commerce sites offering in-store pickup will see 28 percent higher revenue share during the last five days of the holiday season, compared to brick-and-mortar retailers without the same service.

Shoppers are simply more active on a site when a retailer offers in-store pickup, Salesforce says. In fact, it expects retailers with in-store pickup to attract 48 percent more active digital shoppers to their sites in the last five days before December 25 versus those that don't. Salesforce defines active shoppers as those who create baskets, start checkouts, engage in site search or perform similar high-engagement activities.

These predictions are calculated using aggregated shopping data from Salesforce Commerce Cloud activity -- that amounts to data from more than half a billion global shoppers across more than 30 countries. Salesforce also relied on a proprietary study of e-commerce sites and a survey of more than 10,000 consumers.

In-store pickup is now an option at major big box retailers like Best Buy, Target and Walmart. For these retailers, the concept opens up the opportunity to drive digital sales while leveraging existing store infrastructure, technology and teams.

- SEE: Amazon adds Counter pickup service in US, partners with Rite Aid

- Target bolsters Q2 sales growth with Shipt same-day delivery, in-store pickup services

In its last earnings report, Target noted that revenue from the company's existing digital channels climbed 34 percent, with the majority of that growth stemming from in-store pickup and its other same-day fulfillment options. In-store pickup, along with Target's Drive-Up service and its same-day delivery service Shipt, more than doubled their sales over a year.

However, the trend isn't limited to retailers with a physical presence. Earlier this year, Amazon launched its Counter program, offering customer pickup sites at Rite Aid stores in the US. The e-commerce giant launched the program with more than 100 locations and plans to add thousands more, with additional retail partners. The Counter program could help Amazon eliminate challenging last-mile delivery issues. Meanwhile, Amazon is investing heavily to make one-day shipping the default for customers.

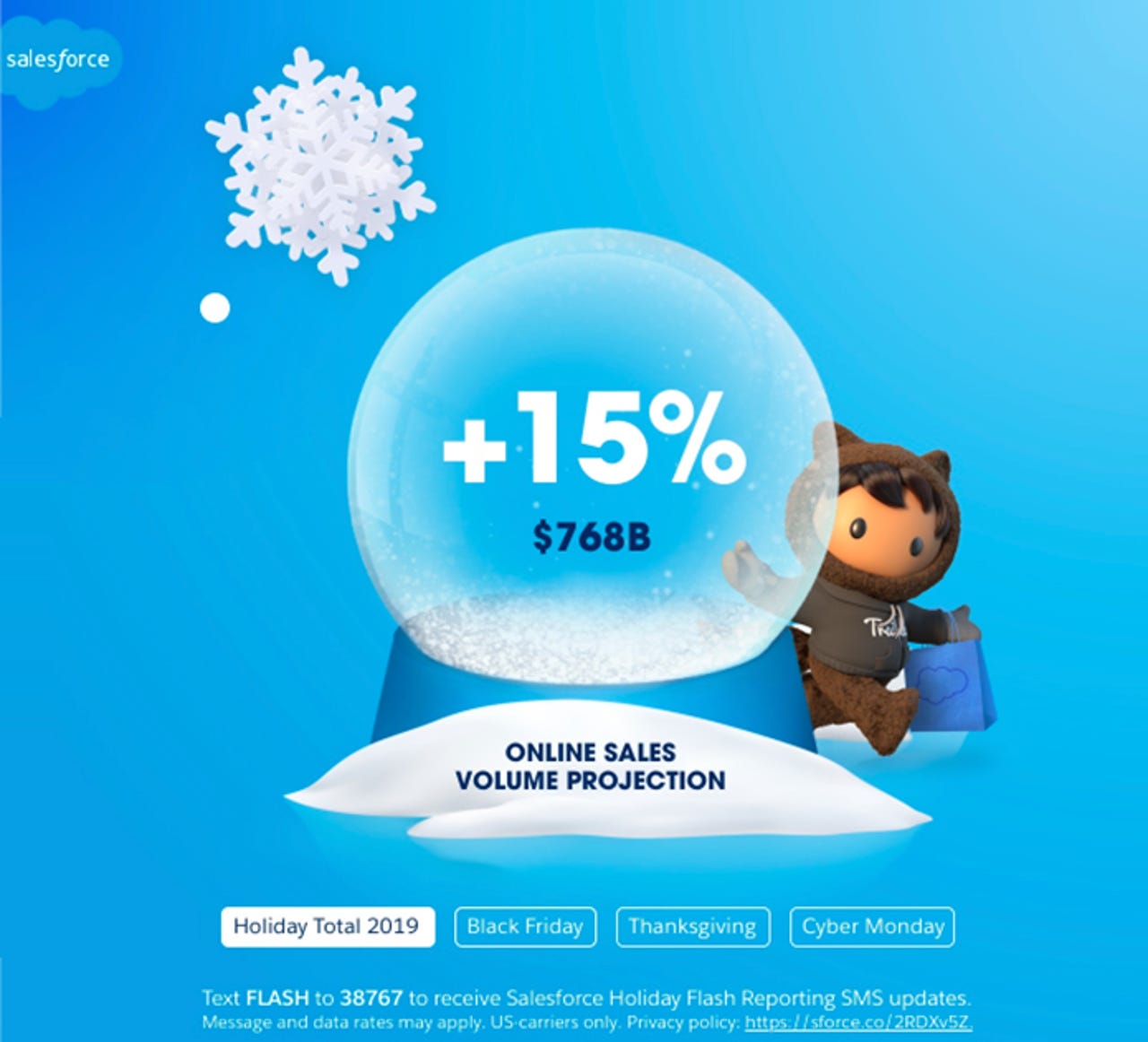

Overall, online retailers can expect healthy holiday sales, in spite of the shorter shopping season, Saleforce says. The CRM company expects US digital commerce revenue to grow 13 percent year-over-year for the holiday season (from November 1 to December 31), with total sales reaching $136 billion in the US and $768 billion globally.

Due to the shortened holiday shopping period, the Tuesday and Wednesday before Thanksgiving should be bigger shopping days than usual, Salesforce says. The company predicts digital revenue on those days will grow 22 percent year-over-year. For Black Friday (the day after Thanksgiving), digital revenue is forecast at $7.3 billion in the US and $39.6 billion globally. Cyber Monday is expected to bring in an additional $8.2 billion in the US and $32.2 billion globally.

Meanwhile, more than half of digital orders, 52 percent, will come from mobile devices this season, Salesforce forecasts. Most visits to e-commerce sites, 70 percent, are expected to come from a mobile device.

Shoppers will be paying close attention to their inboxes, according to Salesforce's survey results. As many as 68 percent of shoppers say they pay more attention to retailers' emails during the holidays. A notable portion of shoppers, 20 percent, say Instagram will be their preferred source of holiday shopping inspiration. That figure grows to 37 percent among Generation Zers.