A new Microsoft cloud category to watch: The Microsoft 365 number

Cloud

When Microsoft announces its quarterly earnings, most analysts' eyes are on its "commercial cloud" category. That was the case today, October 23, when Microsoft reported Q1 FY20 earnings, of which $11.6 billion came from commercial cloud. But there's another number Microsoft watchers should be monitoring: Microsoft 365 growth.

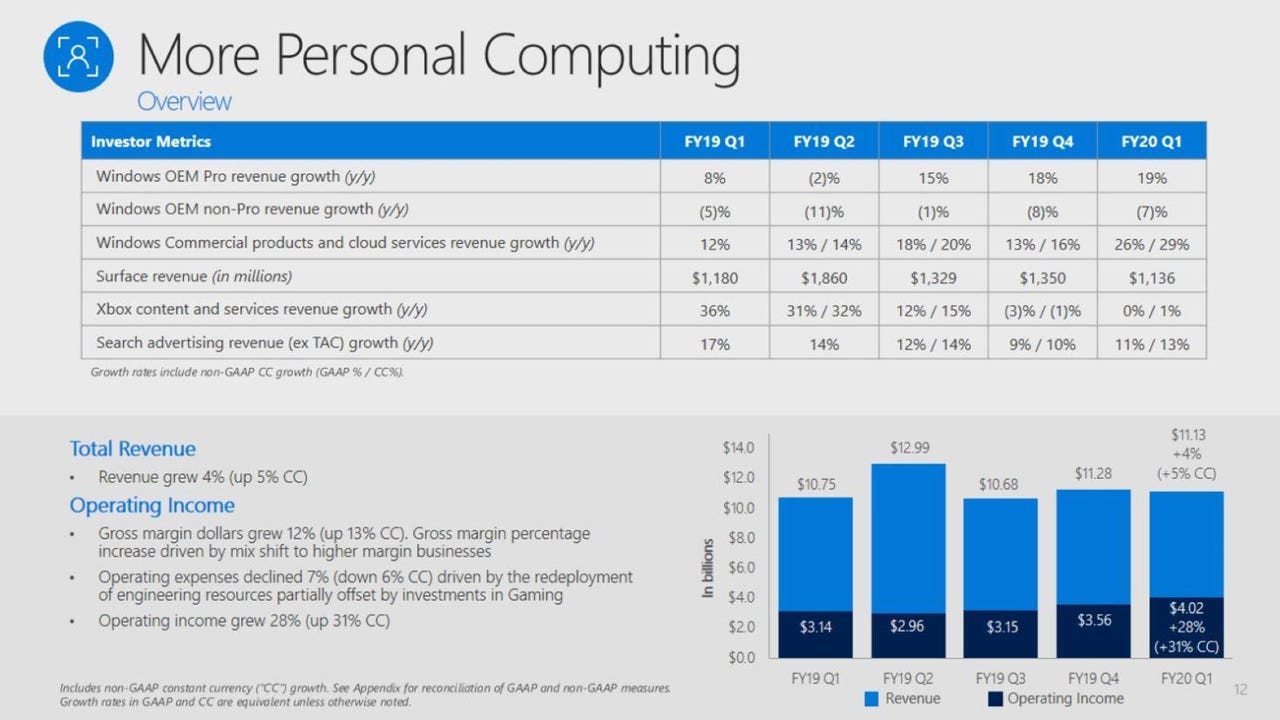

Because of the way Microsoft divides up its reporting categories, it's impossible to calculate this number, which may or may not be by design on Microsoft's part. But one metric to watch is "Windows Commercial products and cloud services revenue growth." (See chart above.) This category was up 26 percent in Q1 FY20 compared to 12 percent in the year-ago quarter. When I asked Microsoft officials what was included here, it was Windows 10 E3 and E5, meaning the subscription versions of Windows 10. Windows 10 E3 and E5, plus Office 365, plus Enterprise Mobility and Security is what comprises Microsoft 365.

As I reported earlier this year, Microsoft is in the midst of a concerted effort to market and sell Microsoft 365 as a unified product and not just a bundle of Windows, Office, and Intune. Microsoft Chief Financial Officer Amy Hood spoke about "healthy demand" for Microsoft 365 during today's earnings call, and she and CEO Satya Nadella emphasized that first line and "mobile-first" workers could become key growth drivers for the suite.

Microsoft's commercial cloud is a Microsoft-made category that includes Azure, Office 356, Dynamics 365, some LinkedIn services and other sundry categories. That means Some of the commercial cloud growth Microsoft reports is attributable to Microsoft 365, but not all of it.

Industry watchers do agree that the lion's share of Microsoft's commercial cloud growth comes from Office 365. And in the first fiscal quarter of 2020, Microsoft officials said Office 365 commercial monthly active users topped 200 million for the first time. Microsoft does not break out its Azure numbers, but officials did say on the analyst call about today's earnings report that the company is seeing "material growth in $10 million-plus contracts" with Azure.

"Windows OEM Pro" revenues were up 19 percent in the quarter (compared to an increase of eight percent in the year-ago quarter). Microsoft attributed the strong growth to "healthy Windows 10 demand," plus momentum ahead of the Windows 7 end of support. This isn't Windows E3 and E5 subscriptions: This is Windows preloaded on PCs. So that business also continues to be strong -- at least for the time being (and likely into Microsoft's Q2 2020, given Windows 7's end of free support date is January 14, 2020).

A few other non-Microsoft 365-related numbers from this quarter worth noting:

Surface revenues were $1.14 billion in Q1 FY 20, compared to $1.18 billion a year ago and $1.35 billion in Q4 19. Microsoft attributed Surface revenue decline of four percent to "timing of product lifecycle transitions." Microsoft launched its Surface Go tablet in this quarter a year ago.

Server products and cloud services revenues were up 30 percent in total for the quarter. Server product revenue was up 12 percent due to, among other things, the end of support of SQL Server 2008 and Windows Server 2008. End of support for SQL Server 2008 happened in July 2019 and Windows Server 2008 is coming in January 2020. Microsoft is offering both sets of customers the option to continue to receive support if they move their workloads to Azure.

Gaming console sales are continuing to decline, and Microsoft officials said gaming revenues were off this quarter by seven percent. In its next fiscal quarter, Microsoft is warning gaming revenues will be down as much as 20 percent as a result of Microsoft's transition to xCloud game streaming and de-emphasis on Xbox console sales.