Amazon beats Q3 earnings estimates, misses on revenue

Amazon published its third quarter financial results on Thursday, beating earnings estimates but falling short on revenue. Shares dropped in after-hours trading.

Meanwhile, Amazon Web Services continued to grow at a rapid clip, now pushing a run rate of $27 billion. At this time a year ago, its annualized run rate was $18 billion.

Amazon's net income in Q3 came to $2.9 billion, or $5.75 per diluted share, on revenue of $56.57 billion.

Wall Street was looking for earnings of $3.14 per share on revenue of $57.1 billion.

In a statement, CEO Jeff Bezos highlighted the momentum behind Amazon Business, the company's B2B platform. He reiterated that Amazon Business has reached a $10 billion annual sales run rate and is serving private and public-sector organizations in eight countries Amazon Business rolled out new benefits earlier in the week.

"Amazon Business is adding customers rapidly, including large educational institutions, local governments, and more than half of the Fortune 100," Bezos said. "These organizations are choosing Amazon Business because it increases transparency into business spending and streamlines purchasing, with increased control."

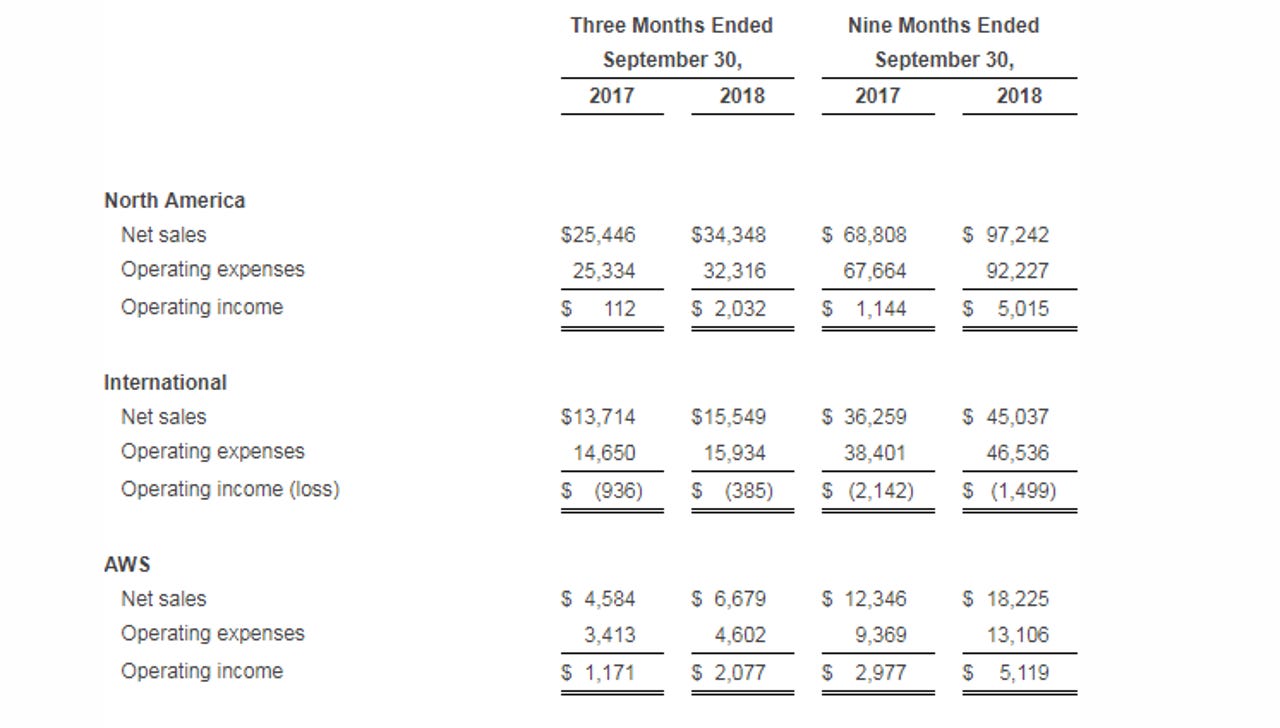

Amazon Web Services' net sales came to $6.7 billion for the quarter, growing 46 percent year-over-year. Growth in the key segment is slightly slower than it was in Q2 (49 percent) but faster than it was in Q3 2017 (42 percent).

AWS accounted for just 12 percent of Amazon's net sales, but the segment's operating income was $2.1 billion.

The segment is still going strong, even as Microsoft continues to quickly build up its Azure cloud business. Yesterday, Microsoft reported that Azure revenue growth was up 76 percent.

"We're very happy with the growth in the business," CFO Brian Olsavsky said on a conference call with reporters on Thursday, with respect to AWS. In addition to seeing momentum with enterprise customers, he said AWS has benefited from "gaining greater efficiencies in our infrastructure costs."

The operating margin for AWS is up to 31 percent this quarter, Olsavsky noted.

"A lot of that is based on efficiencies of our data centers, not only for the AWS business but also for our Amazon consumer businesses, AWS's biggest customer," he said. "If you look at capital leases which is where we spend money for the data centers, it's up only 9 percent year-over-year trailing 12 months, and it was up 69 percent last year at the end of the year."

Meanwhile, in Amazon's North America segment, net sales in Q3 came to $34.35 billion, up 35 percent year-over-year. Operating income was $2 billion.

International net sales came to $15.55 billion, up 13 percent, with an operating loss of $494 385 million.