Apple stays top of slowing wearables market

Wearable device shipments grew by 1.2 percent during the first quarter of 2018 to number 25.1 million units, according to research firm IDC, marking a decrease from the 18 percent year-on-year growth a year ago.

According to the firm's Worldwide Quarterly Wearable Device Tracker report, growth slowed due to a 9.2 percent decline in shipments of basic wearables, which IDC has defined as those that don't run third-party apps. Higher-priced smart wearables, meanwhile, from vendors such as Apple and Fitbit, grew 28.4 percent.

"Additional sensors, years of underlying data, and improved algorithms are allowing pillars of the industry like Fitbit and Apple to help identify diseases and other health irregularities," said Jitesh Ubrani, senior research analyst for IDC Mobile Device Trackers. "Meanwhile, roughly one third of all wearables included cellular connectivity this quarter, which has allowed new use cases to emerge."

Watches and wrist bands accounted for 95 percent of shipments during the quarter, IDC said. Apple was once again the top wearables vendor for the quarter, with 4 million devices shipped, followed by Xiaomi, which shipped 3.7 million; Fitbit, with 2.2 million; Huawei, at 1.3 million; and Garmin, with 1.3 million devices.

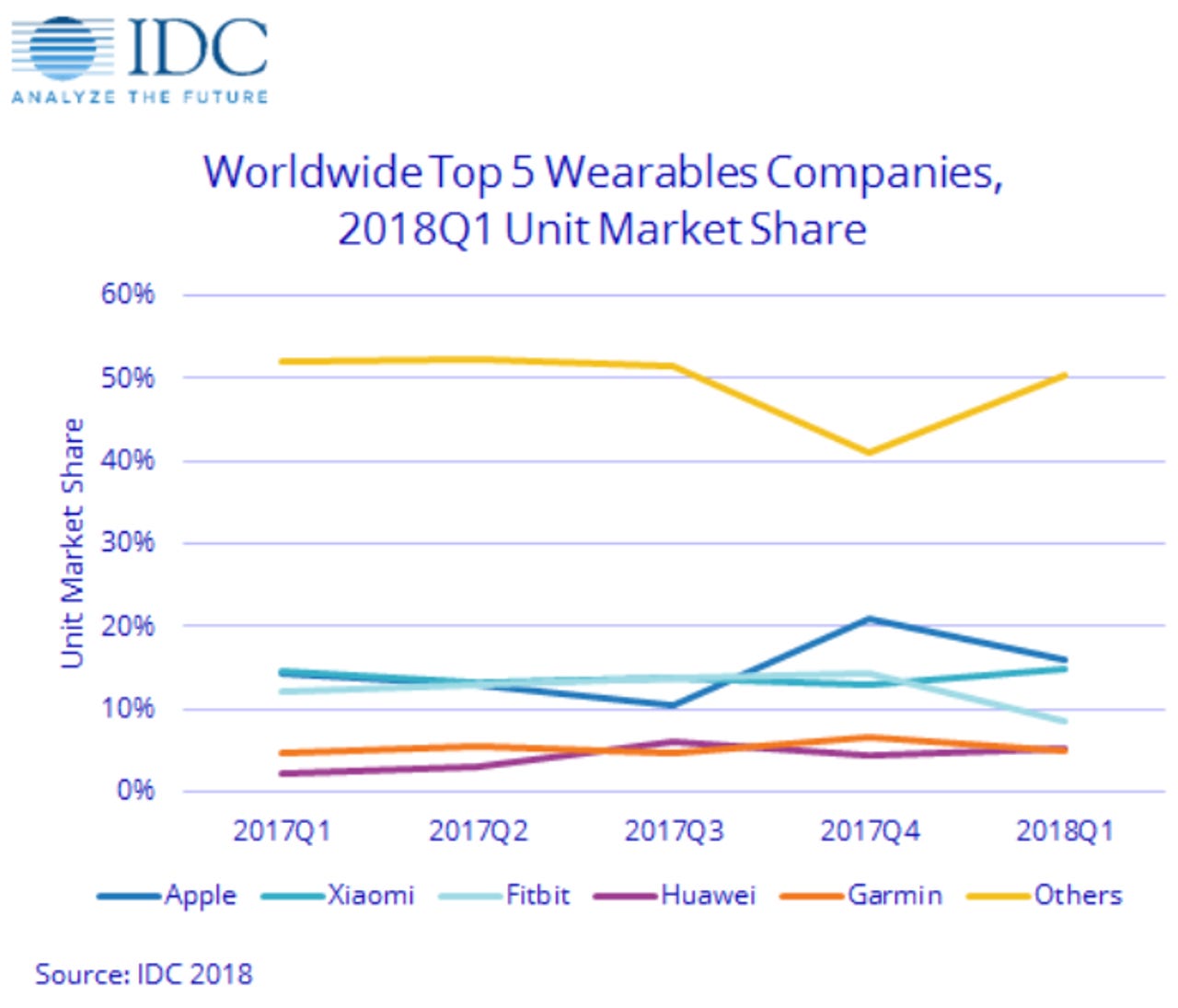

Apple -- whose growth outpaced the entire market, IDC said, partly due to its cellular-connected watch entering additional markets -- increased its market share from 14.3 percent in Q1 2017 to 16.1 percent in Q1 2018.

Second-placed Xiaomi took a 14.8 percent market share for the quarter, followed by Fitbit, with an 8.7 percent market share following a year-on-year decline of 28.1 percent as it continues its business transformation.

Huawei, meanwhile, more than doubled its market share growth, from 2.1 percent in Q1 2017 to 5.2 percent in Q1 2018, helped by a wide portfolio of smart watches, kids' watches, fitness trackers, and ear-worn devices. Garmin, whose market share rose from 4.6 percent to 5 percent over the year, was helped by its music and payment features and the Connect IQ platform.

Outside of watches and wristbands, smart clothing grew by 58.6 percent year over year, in particular step-counting shoes. Hearables with features such as coaching, audio modification, and language translation, as well as wrist-worn devices for kids and personal safety, will be differentiators for vendors going forward, IDC suggested.

Wearables shipments will hit 222.3 million units by 2021, IDC previously said, helped by form factors such as earwear and connected clothing featuring fitness tracking, audio augmentation, and personal assistants.

"Users can expect a wider array of devices going forward," said Ramon Llamas, research manager for IDC's wearables team. "These won't necessarily replace the wearables we have today, but other products that we use on a regular basis."

PREVIOUS AND RELATED COVERAGE

<="" p="" rel="follow">

- <="" p="" rel="follow"> <="" p="" rel="follow">

<="" p="" rel="follow">

<="" p="" rel="follow"> <="" p="" rel="follow">Wearable payments: A gimmick that might take off

After using an NFC-enabled ring to make payments for a month, it's easy to see how wearable payments could become the norm in Australia.

Apple watchOS 5 adds new activity, communication features

The new communication features come in the form of a new Walkie-Talkie mode that works over cellular and WiFi, along with more interactive notifications.

Fitbit ships more than a million Versas since launch, fastest selling Fitbit ever

This smart sensing fabric is in everything from gaming gloves to shoes

BeBop is capitalizing on the rush to make the world measurable with novel fabric sensors that go anywhere

Google and Levi's unveil internet-connected jacket

It's been a while, but the smart jacket for everyday commuters is finally here, and it's expensive.

Samsung launches NB-IoT GPS smart tag

Samsung Electronics' Connect Tag is the first of its kind to use the narrowband IoT (NB-IoT) network and can be used to track pets, children, and personal items.

A smart toilet may be the future of IoT healthcare(TechRepublic)

Revon CEO Ted Smith explains why data scientists, medical specialists, and developers are all vital to the healthcare industry's digital transformation.