Are quantum computers good at picking stocks? This project tried to find out

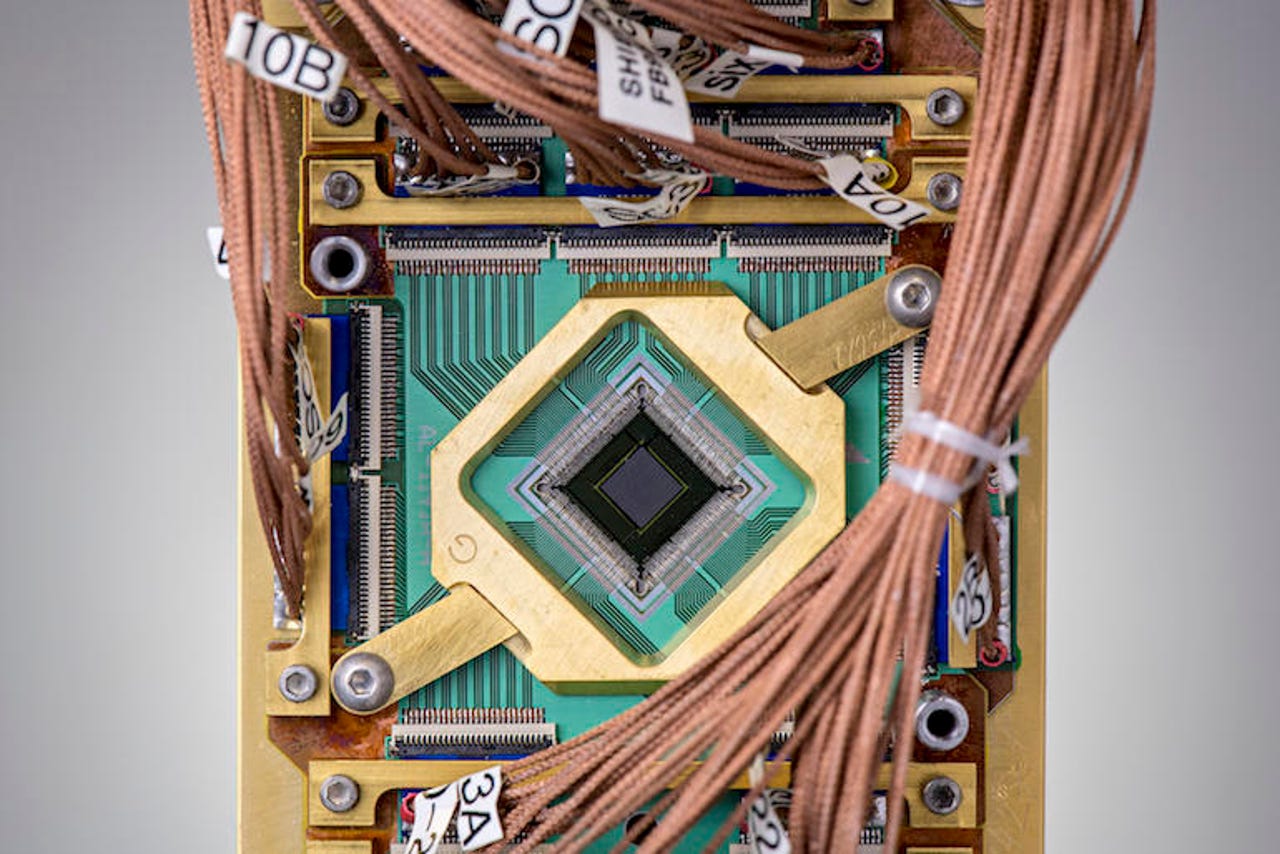

The researchers ran a model for portfolio optimization on Canadian company D-Wave's 2,000-qubit quantum annealing processor.

Consultancy firm KPMG, together with a team of researchers from the Technical University of Denmark (DTU) and a yet-to-be-named European bank, has been piloting the use of quantum computing to determine which stocks to buy and sell for maximum return, an age-old banking operation known as portfolio optimization.

The researchers ran a model for portfolio optimization on Canadian company D-Wave's 2,000-qubit quantum annealing processor, comparing the results to those obtained with classical means. They found that the quantum annealer performed better and faster than other methods, while being capable of resolving larger problems – although the study also indicated that D-Wave's technology still comes with some issues to do with ease of programming and scalability.

Quantum Computing

The smart distribution of portfolio assets is a problem that stands at the very heart of banking. Theorized by economist Harry Markowitz as early as 1952, it consists of allocating a fixed budget to a collection of financial assets in a way that will produce as much return as possible over time. In other words, it is an optimization problem: an investor should look to maximize gain and minimize risk for a given financial portfolio.

SEE: Hiring Kit: Computer Hardware Engineer (TechRepublic Premium)

As the number of assets in the portfolio multiplies, the difficulty of the calculation exponentially increases, and the problem can quickly become intractable, even to the world's largest supercomputers. Quantum computing, on the other hand, offers the possibility of running multiple calculations at once thanks to a special quantum state that is adopted by quantum bits, or qubits.

Quantum systems, for now, cannot support enough qubits to have a real-world impact. But in principle, large-scale quantum computers could one day solve complex portfolio optimization problems in a matter of minutes – which is why the world's largest banks are already putting their research team to work on developing quantum algorithms.

To translate Markowitz's classical model for the portfolio selection problem into a quantum algorithm, the DTU's researchers formulated the equation into a quantum model called a quadratic unconstrained binary optimization (QUBO) problem, which they based on the usual criteria used for the operation such as budget and expected return.

When deciding which quantum hardware to pick to test their model, the team was faced with a number of options: IBM and Google are both working on a superconducting quantum computer, while Honeywell and IonQ are building trapped-ion devices; Xanadu is looking at photonic quantum technologies, and Microsoft is creating a topological quantum system.

D-Wave's quantum annealing processor is yet another approach to quantum computing. Unlike other systems, which are gate-based quantum computers, it is not possible to control the qubits in a quantum annealer; instead, D-Wave's technology consists of manipulating the environment surrounding the system, and letting the device find a "ground state". In this case, the ground state corresponds to the most optimal portfolio selection.

This approach, while limiting the scope of the problems that can be resolved by a quantum annealer, also enable D-Wave to work with many more qubits than other devices. The company's latest device counts 5,000 qubits, while IBM's quantum computer, for example, supports less than 100 qubits.

The researchers explained that the maturity of D-Wave's technology prompted them to pick quantum annealing to trial the algorithm; and equipped with the processor, they were able to embed and run the problem for up to 65 assets.

To benchmark the performance of the processor, they also ran the Markowitz equation with classical means, called brute force. With the computational resources at their disposal, brute force could only be used for up to 25 assets, after which the problem became intractable for the method.

Comparing between the two methods, the scientists found that the quality of the results provided by D-Wave's processor was equal to that delivered by brute force – proving that quantum annealing can reliably be used to solve the problem. In addition, as the number of assets grew, the quantum processor overtook brute force as the fastest method.

From 15 assets onwards, D-Wave's processor effectively started showing significant speed-up over brute force, as the problem got closer to becoming intractable for the classical computer.

To benchmark the performance of the quantum annealer for more than 25 assets – which is beyond the capability of brute force – the researchers compared the results obtained with D-Wave's processor to those obtained with a method called simulated annealing. There again, shows the study, the quantum processor provided high-quality results.

Although the experiment suggests that quantum annealing might show a computational advantage over classical devices, therefore, Ulrich Busk Hoff, researcher at DTU, who participated in the research, warns against hasty conclusions.

"For small-sized problems, the D-Wave quantum annealer is indeed competitive, as it offers a speed-up and solutions of high quality," he tells ZDNet. "That said, I believe that the study is premature for making any claims about an actual quantum advantage, and I would refrain from doing that. That would require a more rigorous comparison between D-Wave and classical methods – and using the best possible classical computational resources, which was far beyond the scope of the project."

DTU's team also flagged some scalability issues, highlighting that as the portfolio size increased, there was a need to fine-tune the quantum model's parameters in order to prevent a drop in results quality. "As the portfolio size was increased, a degradation in the quality of the solutions found by quantum annealing was indeed observed," says Hoff. "But after optimization, the solutions were still competitive and were more often than not able to beat simulated annealing."

SEE: The EU wants to build its first quantum computer. That plan might not be ambitious enough

In addition, with the quantum industry still largely in its infancy, the researchers pointed to the technical difficulties that still come with using quantum technologies. Implementing quantum models, they explained, requires a new way of thinking; translating classical problems into quantum algorithms is not straightforward, and even D-Wave's fairly accessible software development kit cannot be described yet as "plug-and-play".

The Canadian company's quantum processor nevertheless shows a lot of promise for solving problems such as portfolio optimization. Although the researchers shared doubts that quantum annealing would have as much of an impact as large-scale gate-based quantum computers, they pledged to continue to explore the capabilities of the technology in other fields.

"I think it's fair to say that D-Wave is a competitive candidate for solving this type of problem and it is certainly worthwhile further investigation," says Hoff.

KPMG, DTU's researchers and large banks are far from alone in experimenting with D-Wave's technology for near-term applications of quantum computing. For example, researchers from pharmaceutical company GlaxoSmithKline (GSK) recently trialed the use of different quantum methods to sequence gene expression, and found that quantum annealing could already compete against classical computers to start addressing life-sized problems.