'ZDNET Recommends': What exactly does it mean?

ZDNET's recommendations are based on many hours of testing, research, and comparison shopping. We gather data from the best available sources, including vendor and retailer listings as well as other relevant and independent reviews sites. And we pore over customer reviews to find out what matters to real people who already own and use the products and services we’re assessing.

When you click through from our site to a retailer and buy a product or service, we may earn affiliate commissions. This helps support our work, but does not affect what we cover or how, and it does not affect the price you pay. Neither ZDNET nor the author are compensated for these independent reviews. Indeed, we follow strict guidelines that ensure our editorial content is never influenced by advertisers.

ZDNET's editorial team writes on behalf of you, our reader. Our goal is to deliver the most accurate information and the most knowledgeable advice possible in order to help you make smarter buying decisions on tech gear and a wide array of products and services. Our editors thoroughly review and fact-check every article to ensure that our content meets the highest standards. If we have made an error or published misleading information, we will correct or clarify the article. If you see inaccuracies in our content, please report the mistake via this form.

Balance digitizes B2B purchasing

The total transaction volume for e-commerce between businesses stands at almost $22 trillion a year.

That proves that there is plenty of room to scale the digital B2B marketplace. That's why companies like Balance aim to make B2B e-commerce as easy and frictionless as possible.

Balance represents a significant step forward in that domain of B2B payments, shaving the standard 7 to 10 business day window for processing transactions down to a much friendlier 20 seconds for the vast majority of purchases. That includes some nifty features that render purchase significantly easier for both buyers and sellers. While we haven't achieved full one-click functionality yet for B2B payments, Balance is certainly the next best thing.

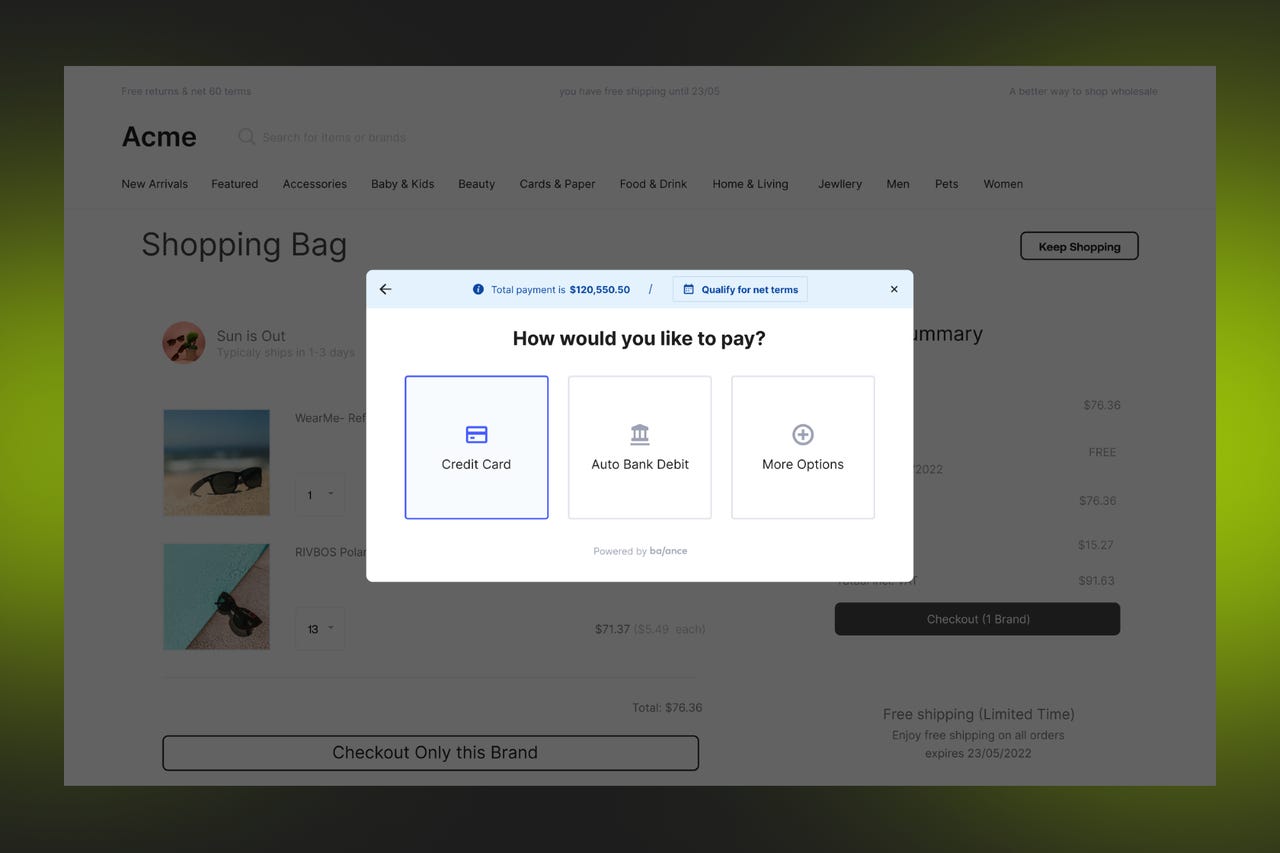

That starts on the buyer side, where purchasers place their order and select from a variety of payment methods. They can pay with credit card, checks, wire transfer, or ACH. Then, they choose how they want the transaction handled. That involves, everything from an instant transfer to more standard business-friendly terms like payment on delivery, installment payments, or customized milestone payments that can push off full payments as long as 90 days.

Of course, that extended weight is just what a seller is trying to avoid. Thankfully, Balance has worked out the process for merchants as well, offering instant payouts for sellers. As the ultimate underwriter of the deal, Balance offers net payment terms that work for both sides, giving buyers the time they need to make their payment while ensuring sellers get their money without all the invoicing, waiting, and chasing that often happens in B2B deals.

And the numbers don't lie. Businesses who use Balance to facilitate their transactions report the number of repeat customers more than doubled, thanks largely to the added convenience and reduced overhead.

Businesses can try out Balance now with no commitment – and all it costs are the usage-based processing and financing fees, even for credit card payments or deferred payments of up to 120 days. Check out the Balance website now and see how their revolutionary process could change the face of all of your company's B2B deals.

Prices are subject to change.