Dating maven Match spends $1.7 billion on South Korea social chat app maker Hyperconnect

Match Group, purveyors of the popular online dating site, this evening said they'll spend $1.7 billion in combined cash and stock to acquire Seoul, South Korea-based startup Hyperconnect, a firm that has won recognition at artificial intelligence conferences for its facial recognition technology.

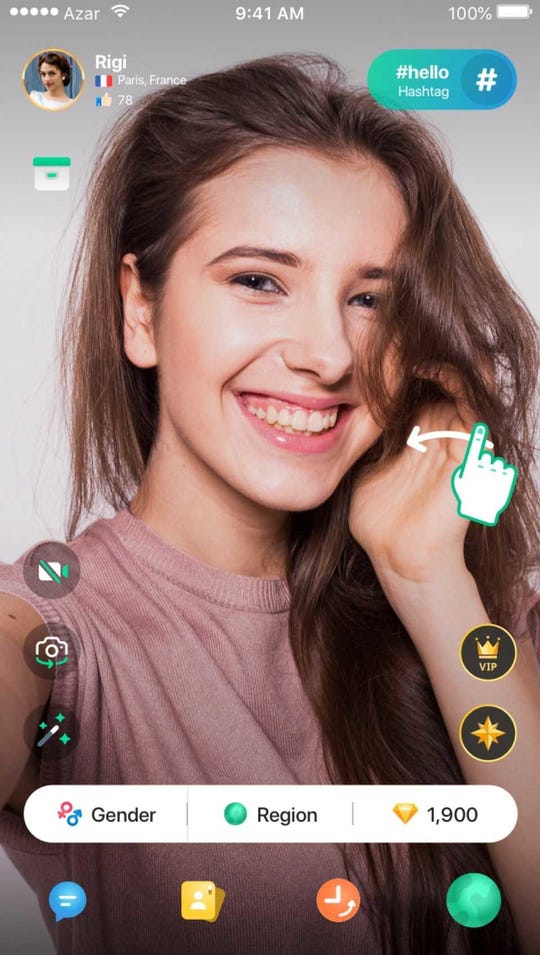

Hyperconnect's Azar app is described as "the highest grossing 1-on-1 live video and audio chat app globally."

Hyperconnect, founded in 2014, states as its mission on its Web site, "A Hyperconnected Humanity Free from Loneliness." The company has developed two social apps, Azar and Hakuna Live. Azar is the "highest-grossing 1-on-1 live video and audio chat app globally," Match noted, with over 540 million cumulative downloads.

Hakuna is described as a "social live streaming app" for group video and audio broadcasts.

Hyperconnect had more than $200 million in revenue last year and is profitable.

The company's researchers have achieved recognition in artificial intelligence circles for work on machine learning topics, including a system of facial recognition, called MarioNETte, which was introduced in 2019 and recognized at that year's ICCV conference.

Said Match CEO Shar Dubey, "As more of our lives move online, people are looking for richer and deeper experiences."

Dubey described the Hyperconnect software as "a powerful tool that enables users to connect with new people and cultures on a global basis."

Added Dubey, "With more than 75% of usage and revenue coming from markets spread across Asia, their product suite and regional footprint squarely complements our own."

The deal follows a report last week by Match of Q4 revenue that slightly exceeded analysts' expectations, and profit per share that was a penny below expectations.

Match forecast this quarter's revenue modestly above consensus, while its full-year revenue outlook was slightly below.