HP beats Q2 estimates with strong notebook, printer sales

HP published its second quarter financial results on Thursday, beating market estimates thanks to strong sales of notebooks and printers. The year-over-year growth rate benefited from the prior year impact of Covid-19 and supply chain disruptions. Personal Systems benefited from strong demand related to working and learning from home, with Chromebooks now representing 20% of HP's total Personal Systems units.

The company raised its outlook for the second half of the fiscal year, even though it expects supply chain challenges to last through the end of 2021.

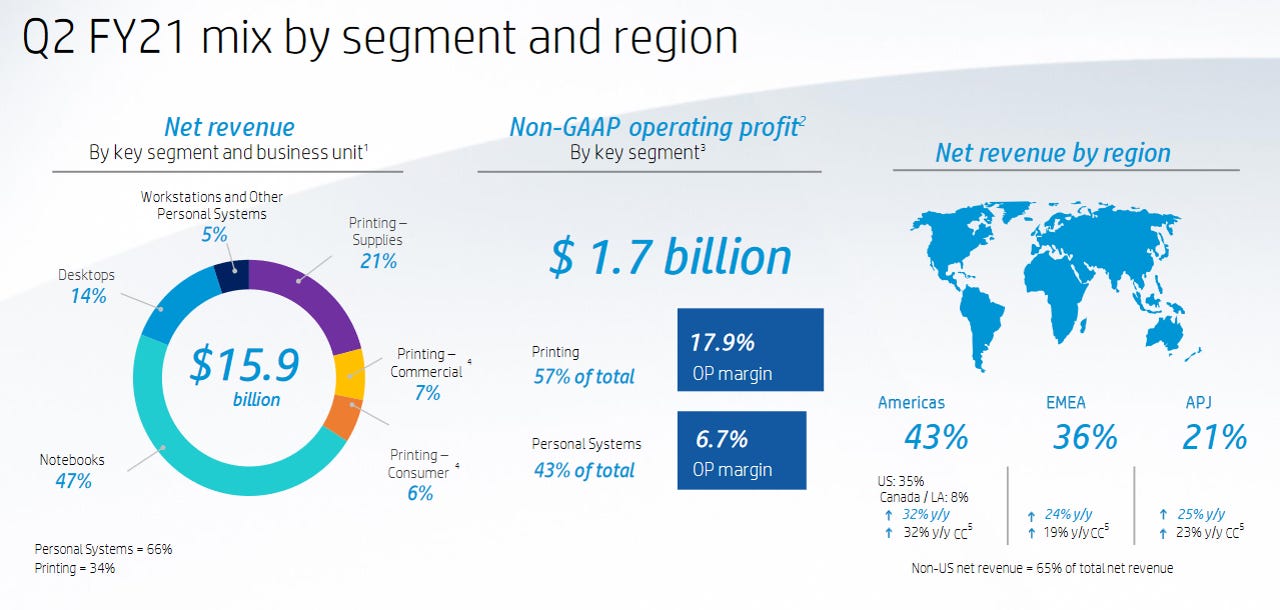

For the second quarter, HP's non-GAAP diluted net EPS was 93 cents. Second quarter net revenue was $15.9 billion, up 27.3 percent from the prior-year period.

Analysts were expecting earnings of 89 cents per share on revenue of $15 billion.

"We delivered another strong quarter, with double-digit top and bottom line growth. HP technology is increasingly at the heart of hybrid work and we are benefitting from exceptional demand for our products and services," President and CEO Enrique Lores said in a statement. "Our performance and our positive outlook for the full year reflect the relevance of our innovation, the resilience of our business model, and the operational excellence of our teams."

On a conference call later, Lores said, "It is important to note that these results are against the backdrop of industry-wide component shortages and supply chain challenges. Currently, there is not enough supply to keep up with the robust demand, and the resurgence of Covid in Southeast Asia is creating additional pressure on our supply chain. We expect supply constraints to continue at least through the end of 2021."

Overall Personal Systems revenue came to $10.6 billion, up 27% year-over-year. Within that segment, commercial net revenue increased 10% and consumer net revenue increased 72%. Notebook revenue was up 47% to $7.49 billion, while desktop revenue was down 8% to $2.23 billion. Workstation revenue came to $407 million, down 7%, while "other" revenue within Personal Systems was up 14% to $434 million.

Total units shipped were up 44%, with notebooks units up 63% and desktops units down 5%.

On the conference call, Lores noted that HP is the top vendor in the education market, where PC sales have more than doubled due to remote learning.

"At the same time, however, the number of PCs per 100 students remains in the single digits," he said. "As an industry, we still have a long way to go to close this digital device. And as a company, we have a big opportunity to be part of the solution."

HP's other business segment, Printing, saw revenue increase 28% year-over-year to $5.3 billion. Consumer net revenue increased 77% and Commercial net revenue increased 34%. Supplies net revenue was up 17%.

Total hardware units were up 42%, with Commercial hardware units up 22% and Consumer hardware units up 45%.

For the third quarter, HP expects a non-GAAP diluted net EPS to be in the range of 81 cents to 85 cents.

Growth trends in Q3 will reflect tougher year-over-year comparisons, CFO Marie Myers said Thursday, particularly in Personal Systems. "We expect supply constraints to continue to negatively impact our ability to meet demand in PCs and printers at least through the end of calendar 2021," she said.

She cited steps HP has taken to optimize its factory footprint "to enable a best-in-class supply chain network and enhanced supply resiliency" while reducing the company's cost structure.

Lores noted the long-term opportunities the company is eyeing, such as the growing importance of cybersecurity.

"Eighty-eight percent of IT decision makers tell us their cyber risk has increased during the pandemic," he said. "This presents a huge opportunity for us to expand our security offerings and deliver the most secure and resilient pieces and printers. With our brand differentiated portfolio, HP is uniquely positioned to capitalize on this secular trend. "