HP creates multi-year "value creation" plan to fend off Xerox

HP on Monday announced a three-year strategic and financial value creation plan" to drive earnings growth and fend off Xerox's takeover bid. The plan includes a capital return program aiming to return $16 billion to HP shareholders during fiscal 2020 to fiscal 2022.

Xerox's revised proposal, announced on February 10, "meaningfully undervalues HP, creates significant risk and compromises the future of our company," HP CEO and president Enrique Lores said in a statement.

At the same time, HP said it is reaching out to Xerox "to explore if there is a combination that creates value for HP shareholders that is additive to HP's strategic and financial plan."

For the time being, HP's board is "united in its full support of the company's strategy and team," Chip Bergh, chair of HP's board of directors, said in a statement.

Under the multi-year plan, HP said it expects to deliver $3.25 to $3.65 non-GAAP diluted net EPS by 2022. Non-GAAP operating profit in fiscal 2022 should fall between $4.7 billion to $5.1 billion.

"HP is out of the gate strong in Q1, with outstanding earnings and a robust plan to create significant value for shareholders," Lores said in a statement. "Our three-year financial targets reflect a company at the top of its game, combining the industry's best innovation with disciplined cost management and aggressive capital returns to support a compelling investment in both the short and long term."

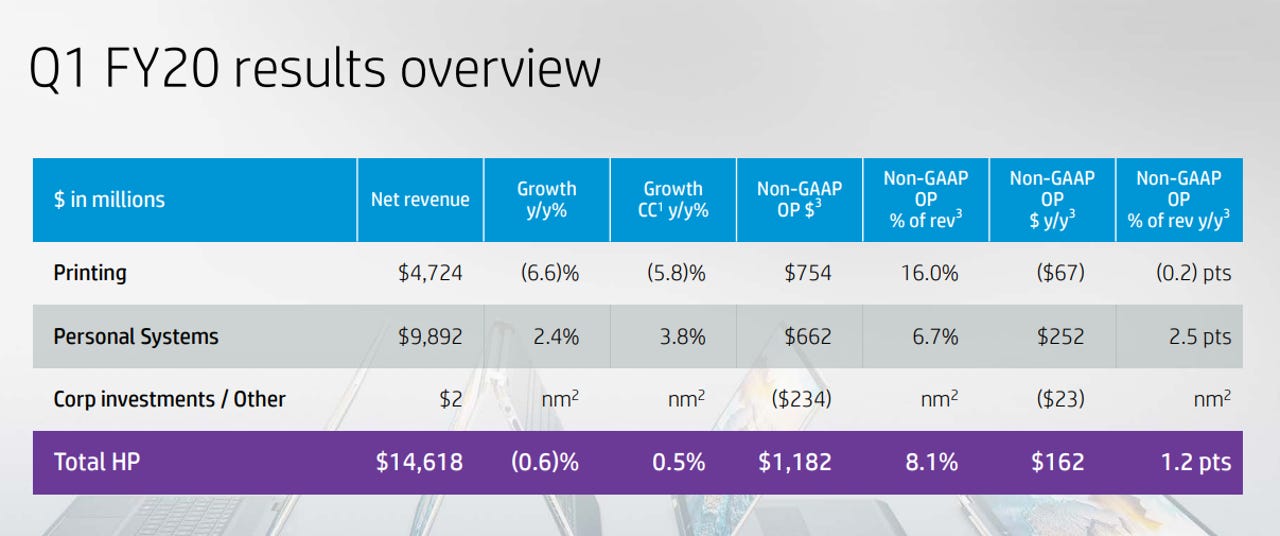

For the first quarter, HP's non-GAAP diluted net EPS came to 65 cents. Net revenue was $14.6 billion, down 0.6 percent from the prior-year period

Analysts were expecting earnings of 54 cents on revenue of $14.63 billion.

Personal Systems net revenue in Q1 came to $9.89 billion, up 2 percent year-over-year. Commercial net revenue increased 7 percent and Consumer net revenue decreased 7 percent. Total units were up 4 percent, with Notebooks units up 2 percent and Desktops units up 7 percent.

Q1 Printing net revenue was $4.72 billion, down 7 percent year-over year. Total hardware units were down 10 percent with Commercial hardware units down 1 percent and Consumer hardware units down 13 percent. Supplies net revenue was down 7 percent.

For the second quarter, HP expects non-GAAP diluted net EPS to be in the range of 49 cents to 53 cents. Analysts are looking for earnings of 54 cents on revenue of $13.92 billion.

HP's $16 billion capital return program represents approximately 50 percent of HP's current market capitalization. The company also increased its total share repurchase authorization to $15 billion, up from the $5 billion share repurchase authorization announced in October 2019. The capital return program should include the repurchase of at least $8 billion of HP shares over 12 months, following HP's 2020 annual meeting.

HP's three-year strategy also includes plans to drive growth within both the Personal Systems business and Printing.

For Personal Systems, the company is increasing target operating margins from 3.5 percent to 5.5 percent. HP said it can capture new business as the market grows "by reinventing computing experiences, increasing lifetime value of devices in areas such as gaming, and accelerating services and solutions growth by expanding into adjacent markets."

Meanwhile, in the Print segment, HP is establishing a long-term target operating margin range of 16 percent to 18 percent. It plans to grow the business in part by "increasing the recurring nature of print revenue... and growing its graphics and 3D portfolio to lead the analog to digital transformation."

HP also outlined its opposition to Xerox's Feb. 10 proposal, which offered $24 per share for all of HP's outstanding shares. The proposal, HP said, "does not compensate HP shareholders for the value of HP executing on its strategic plan and transfers value from HP shareholders to Xerox shareholders."

Furthermore, HP argued, it "creates an irresponsible capital structure that would jeopardize the future value of the combined company" and "overstates the potential synergies by including HP's existing plans for independent cost reductions and productivity gains."

While HP is in talks with Xerox, any agreement needs to address those three issues, Lores said on a conference call Monday.

"First, we need to make sure that the value exchange between the two companies reflect the real value of each of them," he said. "Second, the resulting entity needs to have a capital structure that makes sense and that will be able to address the needs of the businesses that we will be running. And third, it needs to be based on synergies that are realistic and that can be achieved. This is a conversation that we think is possible to have at this point."