HPE losing server market share as Dell extends lead during Q3

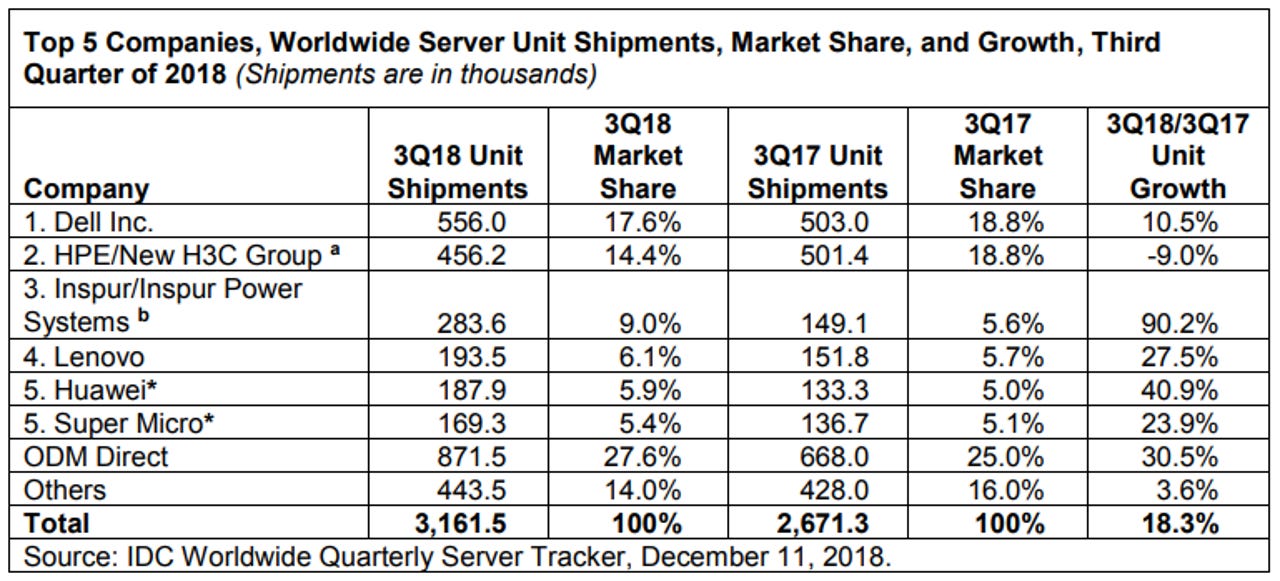

Dell Inc has claimed pole position in the International Data Corporation's (IDC) server shipment tracker for the third quarter of 2018, shipping 556,000 units -- $4 billion-worth -- during the period.

While Dell's revenue grew, its market share dropped from 18.1 percent in Q3 2017 to 17.5 percent in Q3 2018. It shipped 53,000 more units than it did in the corresponding period a year prior, however.

SEE: Cloud v. data center decision(ZDNet special report) | Download the report as a PDF(TechRepublic)

Coming at a close second to Dell was HPE, which produced $3.8 billion in revenue during the three month period.

HPE shipped 456,200 units, down from the 501,400 it distributed in Q3 2017.

While its revenue was only $200 million less than Dell, its market share took a 3 percent year-on-year tumble, claiming 16.3 percent of the market in the third quarter of 2018.

Increasing their market share this quarter was Inspur, Lenovo, and Huawei.

Inspur -- which combined with Inspur Power Systems as a result of the joint venture with IBM -- sold 134,500 more servers this quarter than it did in Q3 2017, generating $1.7 billion in revenue.

Lenovo also grew its revenue, now boasting a 6.2 percent market share from the 193,500 units it shipped during the quarter.

Huawei this quarter shipped 187,900 servers, generating just over $1 billion in revenue -- up 75.6 percent from the $600 million it made a year prior.

A total of $23.4 billion in revenue was generated from server shipments globally in Q3 -- an increase of 37.7 percent. Worldwide server shipments increased 18.3 percent year-over-year to 3.2 million units.

The Asia Pacific, excluding Japan, was the fastest growing region in Q3 2018, IDC said, with year-on-year revenue growth of 46.5 percent.

China's revenue grew 67.1 percent in the quarter, the United States grew 43.7 percent, while Europe, the Middle East and Africa (EMEA) grew 24.5 percent, Canada grew 20 percent, Japan grew 14 percent, and Latin America grew 7.7 percent.

IDC also noted that demand for x86 servers increased by 41 percent in Q3 2018 to $21.8 billion in revenues. Non-x86 servers grew only 3.9 percent year-over-year to $1.6 billion.

AI, blockchain, servers, smartphones and more: Research round-up

READ ALSO

It's a good time to make servers as the cloud buildout, Intel's Purely platform and an enterprise upgrade cycle drive demand.

IT infrastructure spending shifting toward cloud deployments

Traditional IT infrastructure spending is losing steam as private and public cloud build-outs accelerate, according to IDC.

Cloud computing will virtually replace traditional data centers within three years

Cloud data center traffic will represent 95 percent of total data center traffic by 2021, says Cisco.

Public cloud, private cloud, or hybrid cloud: What's the difference?

Trying to understand and articulate the differences between public, private, and hybrid cloud? Here's a quick breakdown.