HPE plans to go all-in on everything as a service with heavy dose of Greenlake

Hewlett Packard Enterprise said it will pivot to completely be an as-a-service company across all of its products and that transition will have more than a few financial moving parts.

Tarek Robbiati, CFO of HPE, outlined the company's transition to selling its hardware and software on consumption based contracts. What's interesting is that HPE is making a business model shift that has typically been reserved for software vendors.

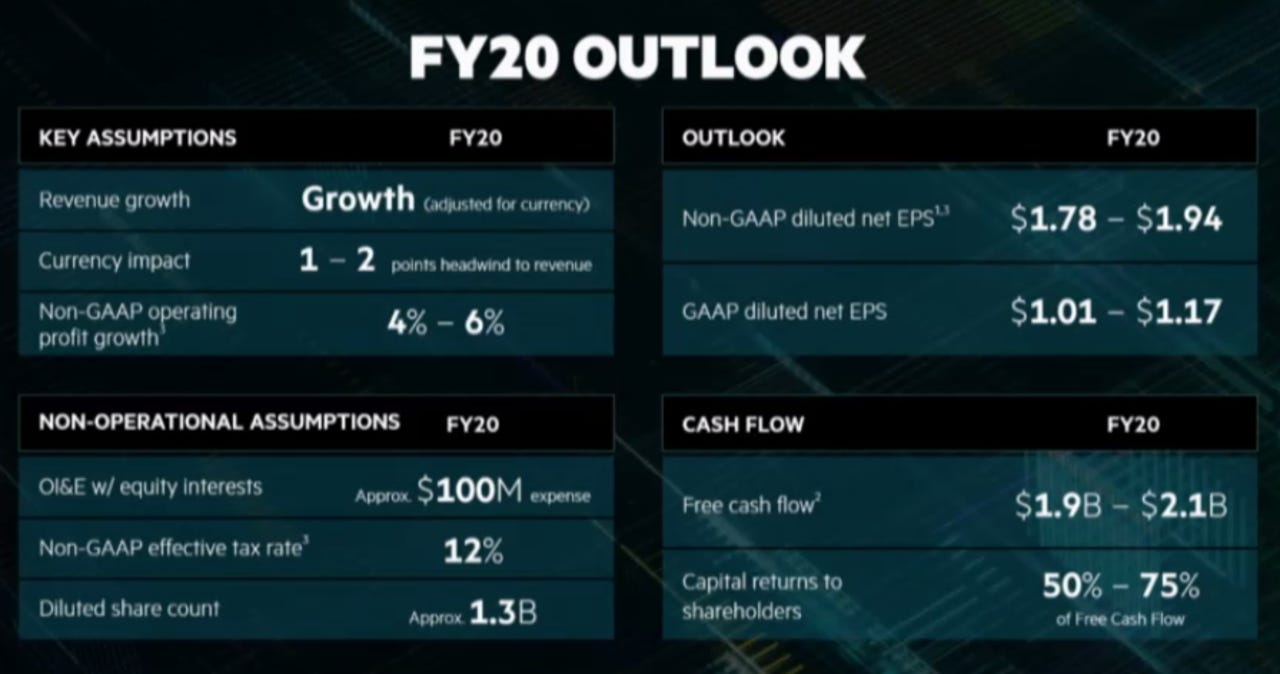

For fiscal 2020, HPE is projecting non-GAAP earnings of $1.78 a share to $1.94 a share relative to Wall Street estimates of $1.80 a share. HPE is balancing investing in the business with shareholder returns.

CEO Antonio Neri outlined HPE's plan, which involves a heavy dose of HPE Greenlake and a subscription-based model.

Neri said it will outline its new version of HPE Greenlake, which will aim to automate functions and make CIOs more of a service provider. HPE's structure aims to bridge edge computing with hybrid cloud deployments as well as data management software between. "The burden of managing infrastructure will be taken off of CIOs," said Neri.

"HPE will continue to expand out its cloud portfolio from edge to cloud. In the future, everything will be delivered as a service with a consistent experience," said Neri.

Neri added that HPE will leverage HPE Financial Services to manage infrastructure and free up cash flow for customers for reinvestment. "It's about consuming what customers really need," said Neri.

HPE's value prop will revolve around providing an experience that uses Greenlake to save money for customers moving data between clouds. HPE's long-term model from fiscal 2019 to fiscal 2022 expects a compound annual growth rate of 1% to 3% with storage, high performance compute and edge computing showing the best results. The company plans to invest further in those markets by improving gross margins and becoming more efficient.

More HPE: