Nutanix beats market expectations for Q3

Nutanix reported its third quarter financial results Thursday, beating market expectations.

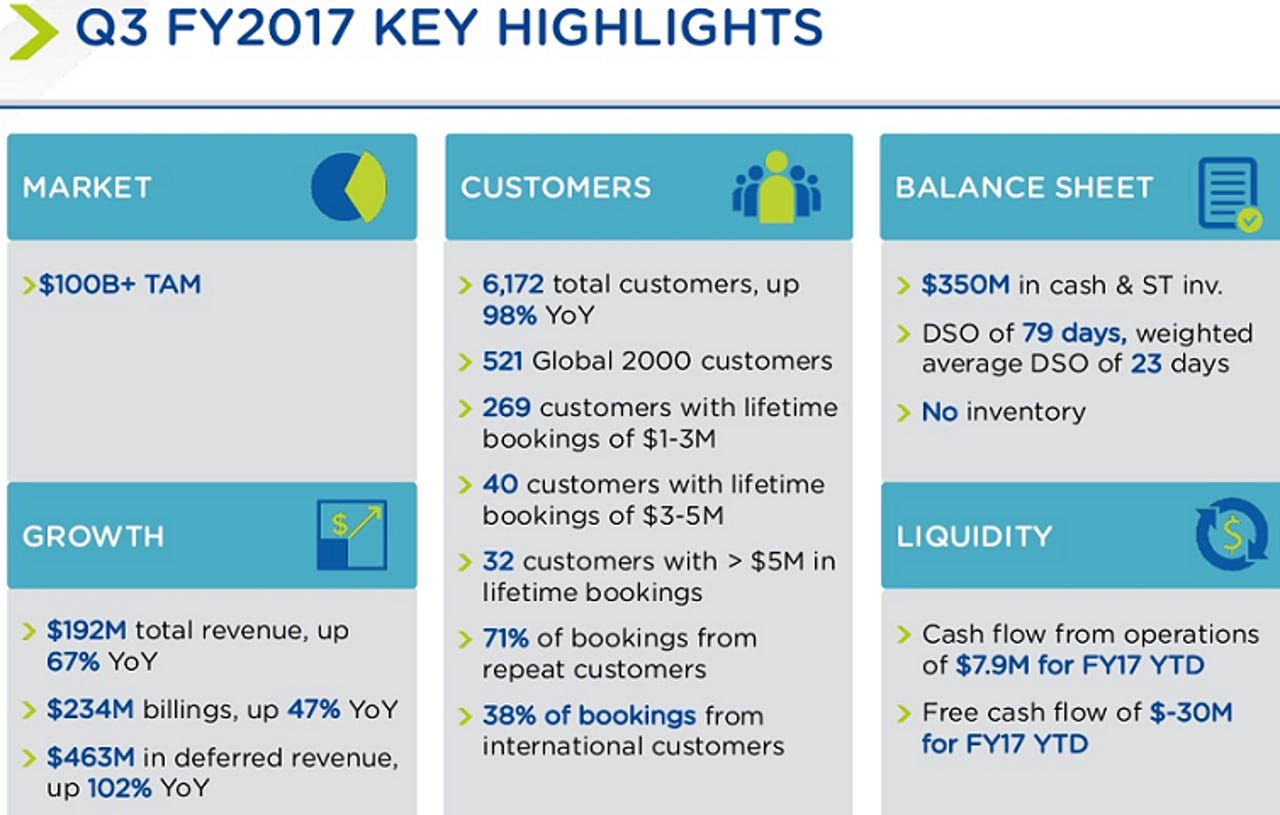

The company reported a non-GAAP net loss of $60.8 million or 42 cents per share. That's compared to a non-GAAP net loss of $40.4 million, or 33 cents per share, in Q3 of fiscal 2016. Revenue came to $191.8 million, up 67 percent year over year.

Wall Street was looking for an adjusted loss of 45 cents a share on revenue of $186.5 million.

Billings for the quarter totaled $234.1 million, up 47 percent year over year.

The company highlighted its record number of large deals, landing 34 customers with deals over $1 million in the quarter. Nutanix ended the quarter with 6,172 end-customers, adding approximately 790 new end-customers. Some of its major customers include Caterpillar Inc., SAIC Volkswagen, and Sprint.

In a statement, CEO Dheeraj Pandey also highlighted Nutanix's expanding market opportunity with HPE, Cisco, and IBM hardware.

"We continue to execute on our strategy of building a cloud operating system that provides our customers maximum choice of hardware platforms," Pandey said. "Our third quarter results reflect our continued focus on the Global 2000 as well as a measurable improvement in the number of larger deals in the quarter, particularly in North America."

For Q4 2017, the company expects a non-GAAP net loss per share of 38 cents on revenue between $215 and $220 million.