Slack's Q2 above estimates, but company struggles to gain CIO attention amid pandemic

Slack delivered better-than-expected second quarter financial results on Tuesday, touting steady growth in paid subscribers and strong adoption of its Connect product that was launched during the quarter. However, the company's stock fell nearly 18% in late trading after its revenue growth throughout the pandemic failed to impress Wall Street.

During a call with analysts, Slack CEO Stewart Butterfield acknowledged some key challenges the company has faced since the start of the pandemic. Even though Slack is designed to assist with remote work, overburdened CIOs are going with faster fixes to solve immediate problems.

Here's part of Butterfield's comments from the earnings call:

As I mentioned earlier, in Q2, we felt some macro-related headwinds in the installed base. We price on a per seat basis. And when our customers downsize, freeze hiring or hire more slowly, net dollar retention is negatively impacted. That impact is direct. And because of our fair billing policies and the substantial number of smaller customers on monthly plans, it shows up much more quickly than it would for others in our industry. On the enterprise side, there was also more budget scrutiny, especially from new categories with longer adoption curves. Even when leaders understand the deep impact that Slack can have for them, the urgency at the moment favors short-term solutions to solve immediate problems. CIOs have a lot on their plates right now.

The pandemic has obviously had both positive and negative effects on our business. We believe that positive changes will have greater impact and will persist as part of a permanent structural shift in the way that we work. On the other hand, the negative effects will dissipate as we emerge from the pandemic and related economic uncertainty. In the meantime, we have rapidly adapted our go-to-market tactics to the current environment, leaning into our product leadership as well as ROI-based use case specific selling and marketing oriented around distributed and remote work. We are also investing in CIO outreach and using Slack Connect as a lever to drive broader deployment discussions. As IT departments begin their return to longer-term strategic priorities, we see these messages resonating.

As for the numbers, Slack reported a Q2 net loss of $68.6 million, or 13 cents per share. On a non-GAAP basis, Slack's EPS broke even at zero cents per share on revenue of $215.9 million, up 49% year over year. Last quarter, Slack reported revenue of $201.7 million. Wall Street was expecting a non-GAAP net loss of 3 cents per share on revenue of $209.1 million.

Slack's billing for the quarter also reflect its challenges during the pandemic. Slack said Q2 billings were $218.2 million, compared to estimates for $232.9 million.

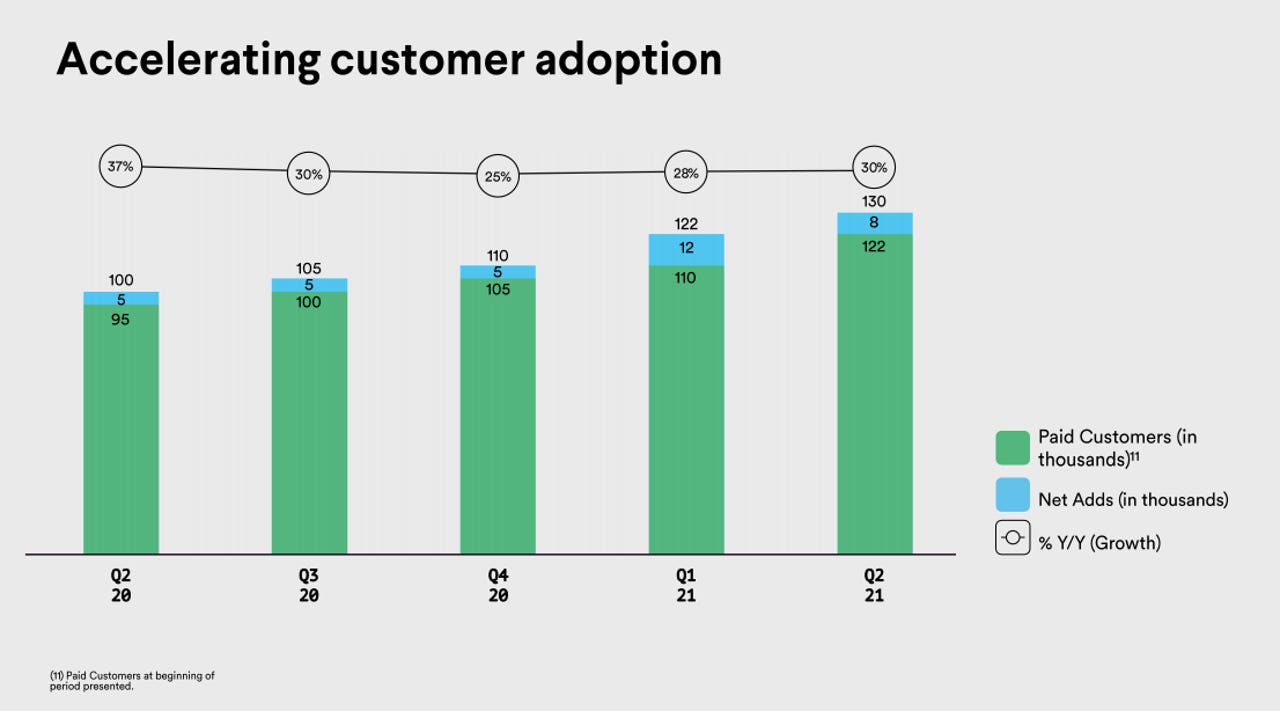

Slack hasn't issued an updated user count since last October, when it claimed to have 12 million daily active users. Instead, the company's second quarter financial report continues to put the focus on paid and enterprise customers. Slack said that it ended the quarter with over 130,000 paid customers, up 30% year-over-year, with 985 of those paid customers bringing Slack annual recurring revenue greater than $100,000. The company added 8,000 new paid customers in the second quarter.

On Slack Connect, the company said it ended the quarter with over 52,000 paid customers and more than 380,000 connected endpoints, which are described as a unique workspace in a connected externally shared channel.

"In a volatile macro environment, we remain focused on investing for long-term growth and driving innovation in this category," said Slack CFO Allen Shim. "Our largest customers are standardizing their work on Slack, and we ended the quarter with 87 Paid Customers spending over $1 million annually, up 78% year-over-year."

In terms of guidance, Slack expects third-quarter revenue in the range of $222 million to $225 million, with a net loss per share between 6 cents and 5 cents. Analysts expect Slack to deliver revenue of $223.7 million with a non-GAAP EPS loss of 5 cents.

For the year, Slack is expecting a loss from 14 cents to 13 cents with revenue between $870 million to $876 million. Analysts were expecting a full-year loss of 16 cents on revenue of $872.3 million.