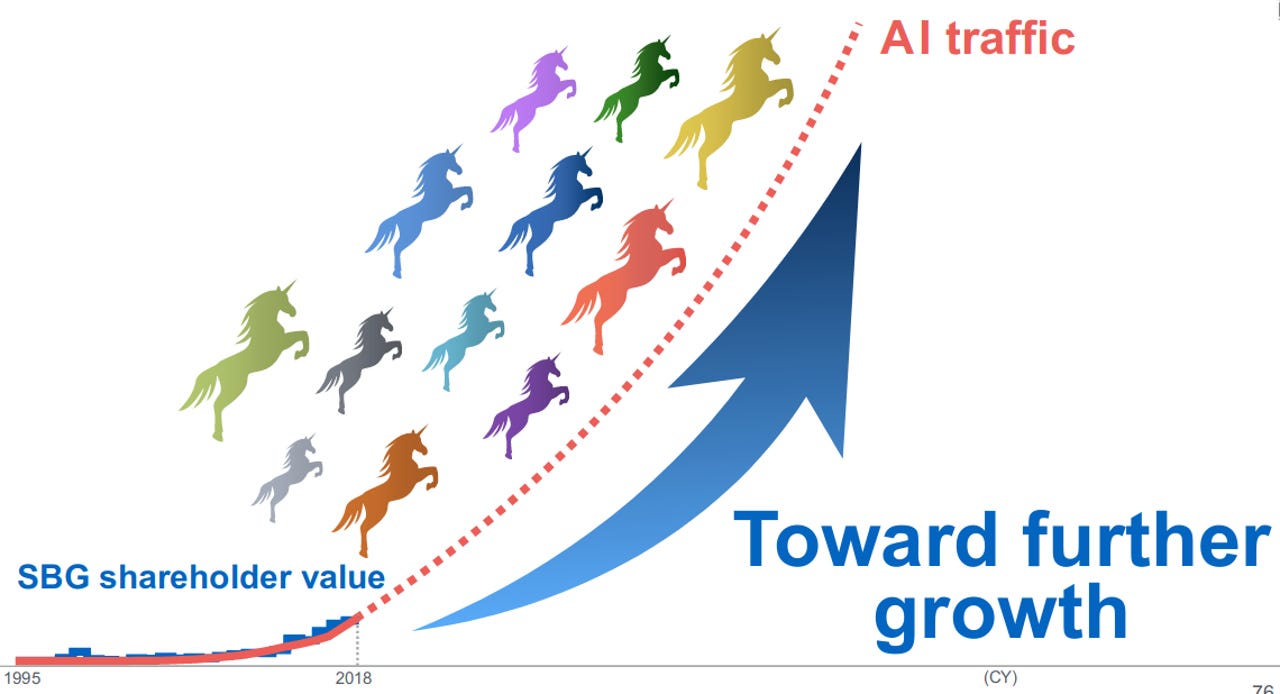

SoftBank Group looking to ride AI unicorns into the future

SoftBank Group saw its operating income increase by 81% over the year to March 31, 2019, driven by its SoftBank Vision and Delta Funds more than tripling their operating income.

Overall, the SoftBank conglomerate took in ¥9.6 trillion in sales, an increase of 5%, from which it made ¥2.35 trillion in earnings before interest and taxes, up 81%, and ¥1.4 trillion of net income.

Broken down, both of its telcos in the form of Sprint and SoftBank Corporation contributed around ¥3.7 trillion in sales, with Yahoo Japan making ¥947 billion in sales, and others making up the remaining ¥1.2 trillion.

For operating income, the SoftBank Vision Fund hit ¥1.26 trillion, SoftBank made ¥725 billion, Sprint contributed ¥280 billion, and Yahoo Japan made ¥135 billion.

The SoftBank Vision Fund now holds $97 billion in committed capital, of which one third is from SoftBank Group and the rest is from third party investors, while the Delta Fund holds $6 billion in capital of which SoftBank Group has committed $4.4 billion towards.

For its Fund segment, SoftBank reported ¥297 billion in realised gain from selling investments, and ¥1 trillion from increases in investment valuations. Its realised gains were from Walmart's May purchase of Flipkart for $16 billion, of which SoftBank had a 20%, and the selling of Nvidia shares in January.

SoftBank said the fair value of its investment in Uber increased by ¥418 million over the year, ¥203 million in Guardant Health, and ¥154 million in Oyo.

As of March 31, the SoftBank Vision Fund portfolio had parted with $60 billion in investments for a fair value of $72.3 billion.

Following the sale of its investment of DiDi to the SoftBank Vision Fund, the Delta Fund now has no investments.

In its presentation to investors, SoftBank said the Vision Fund would specialise in artificial intelligence, invest in unicorns, and "synergy creation".

For its Japanese telco arm, SoftBank reported sales increasing by 4% and adjusted earnings before interest, tax, depreciation, and amortisation (EBITDA) rising by 1% to ¥1.2 trillion. The telco now has 22 million mobile subscribers across its SoftBank, Y!mobile, and Line Mobile brands, and 5.9 million fibre subscribers.

On December 19, SoftBank Corporation was listed on the Tokyo Stock Exchange, which saw SoftBank Group's indirect ownership fall from 99.99% to 66.5%

Its US carrier Sprint, which is currently trying to merge with T-mobile, saw sales grow by 3.5% and EBITDA jumped 15% to ¥1.4 trillion.

Over the course of the year to March 31, Sprint lost 138,000 mobile customers, with postpaid plans without a phone being the only area to see an increase. Sprint's total subscriber base now sits at 54.5 million, and overall monthly postpaid average revenue per user dropped by $1.15 to $43.25.

Softbank cited "deterioration of global business conditions in the semiconductor industry" for an 11.5% drop in Arm's licensing revenue. For the full year, Arm sales were steady at ¥202 billion, while sales increased by 11.3% in the fourth quarter. In EBITDA terms, Arm declined by 21% to ¥24.4 billion.

In US dollar terms, technology licensing brought in $71 million less than a year prior, recording $547 million in sales; technology royalties brought in $11 million more, recording $1.1 billion in sales; and software and services jumped by $65 million to make $191 million in sales.

"Technology royalty revenue's growth rate has slowed down due to a deceleration in semiconductor demand globally including a weakening in global smartphone demand, especially in China, combined with a general slowdown in global chip sales," the company said.

"Going forwards, royalty revenue growth will continued to be impacted by the slowdown in smartphone demand, but the overall growth of royalty revenue is still expected to increase in the medium-to long-term as Arm gains share in other secular growth markets such as networking, automotive, and IoT."

During the fiscal year, Arm purchased a pair of Internet of Things companies in the form of Treasure Data and Stream Technologies.

The entire conglomerate now holds around ¥27 trillion in equity holdings, and ¥4.4 trillion in net debt.

Related Coverage

- GM's Cruise raises another $1.15b from group headed by SoftBank and Honda

- SoftBank sells off Nvidia and Flipkart stakes to bank $5.6 billion in exits for 2018

- Cleaning machine: SoftBank brings AI to a dirty job

- Japanese mobile operators will spend $14.4 billion on 5G networks by 2024 (TechRepublic)

- SoftBank invested 'almost nothing' in Pepper robot security, creating huge business risk (TechRepublic)

- Docker, Arm partner to streamline development for cloud, edge and IoT

- What Linus Torvalds really thinks about ARM processors