Sprint Q1 meets expectations, but subscriber loss still an issue

Sprint on Wednesday reported in line first quarter results, but is still losing subscribers.

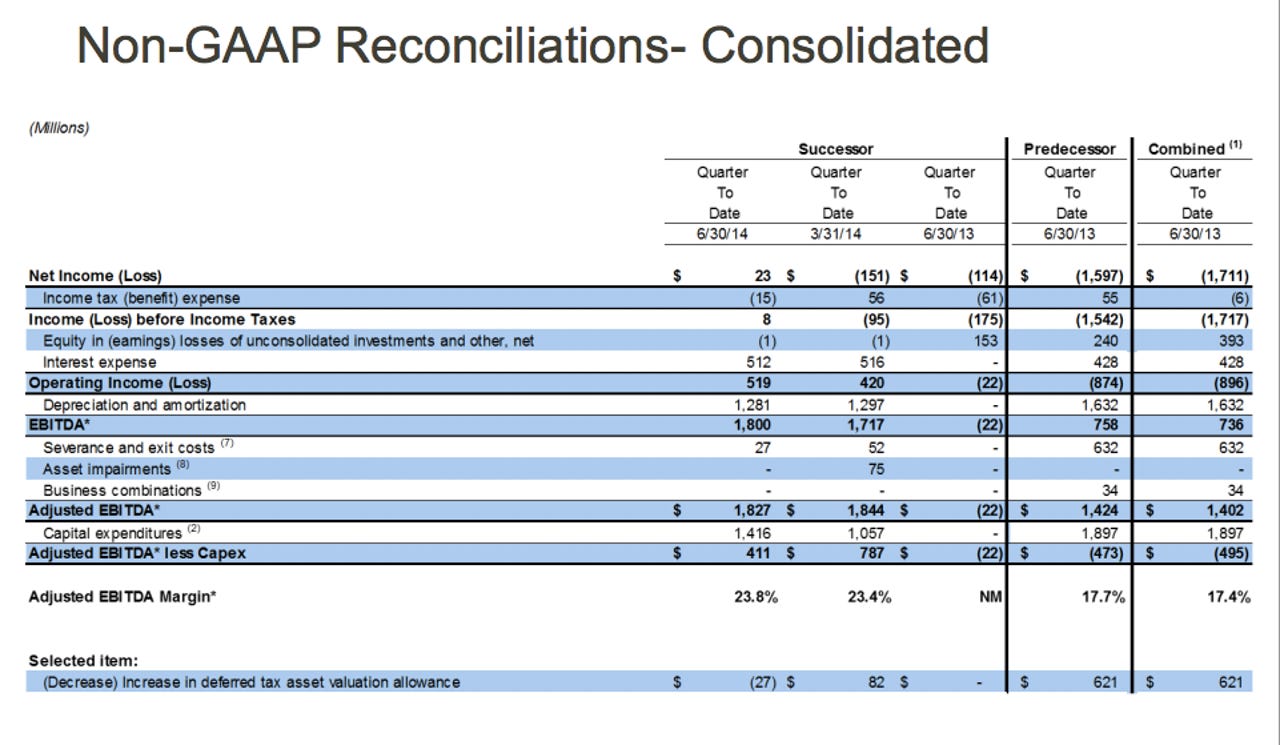

The mobile network carrier posted a quarterly profit of $23 million, or one cent per share, on revenue of $8.79 billion (statement). That's compared to a loss of $114 million a year earlier.

Wall Street was expecting a loss of one cent per share on revenue of $8.78 billion.

Last quarter Sprint lost 383,000 net contract subscribers, a highly profitable segment of its customer base. The bleeding slightly lessened during the quarter ending June 30, with an estimated 245,000 subscribers jumping ship.

Tech Earnings

Sprint CEO Daniel Hesse was bullish on the carrier's ability to quell the subscriber exodus. Hesse said that even though Sprint's complete network replacement impacted the network experience (the overhaul led to more dropped calls in construction areas), the company now expects to achieve postpaid net subscriber growth in the fourth quarter of the year.

The big takeaway, however, is that Sprint spent less on building out its network and that move may indicate it's about to bid for T-Mobile officially, according to analysts.

Kevin Manning of BMO Capital Markets Corp. noted:

Sprint results were largely in line to slightly better than consensus, but not good enough to hurt its case that it should be allowed to combine with T-Mobile to compete with AT&T and Verizon. We see the soft capex spend as another sign Sprint intends to attempt to acquire T-Mobile. We expect a combined Sprint/T-Mobile to use the T-Mobile network as the go-forward network.

As for its network spend, Sprint said it improved its wireless cost of service by $243 million year-over-year primarily due to the elimination of network expenses related to the aging Nextel platform.

Joe Euteneuer, the carrier's chief financial officer, said during the earnings call:

The improvements were driven by continued reduction in care expenses through operational efficiencies, lower selling expenses and lower marketing spend partially offset by higher bad debt expense. The lower selling expenses are a result of continued streamlining of the sales organization as well as improved table mix and lower average commission rates due to device mix.

Sprint said it continues to expect calendar 2014 Adjusted EBITDA to be between $6.7 billion and $6.9 billion.