Synnex, Tech Data combine in $7.2 billion merger, eye expansion markets

Technology distributors Synnex and Tech Data are merging in deal valued at about $7.2 billion including net debt to create a company with $57 billion in annual revenue with 22,000 employees.

The combination of two companies will expand the geographic and product reach into cybersecurity, cloud, data and Internet of things. Synnex is publicly traded on the New York Stock Exchange and Tech Data is privately held and owned by Apollo Global Management.

Once the deal is complete, the combined company will offer more than 200,000 products in more than 100 countries. The scale will improve efficiency and partnerships with vendors.

According to Synnex and Tech Data, the combination will also be better able to tackle growth markets such as IoT, 5G, cloud and edge computing as well as everything-as-a-service extensions.

Here are the financial details:

- Apollo Funds will get an aggregate of 44 million Synnex share and refinancing of Tech Data's net debt and preferred shares of $2.7 billion.

- Synnex shareholders will own 55% of the combined company with 45% going to Apollo Funds.

- Tech Data CEO Rich Hume will lead the combined company and Synnex CEO Dennis Polk will be executive chair.

- The combined company will see non-GAAP earnings per share accretion of more than 25% in the first year after the close.

- The company sees savings of $100 million in the first year of closing with at least $200 million by the end of the second year.

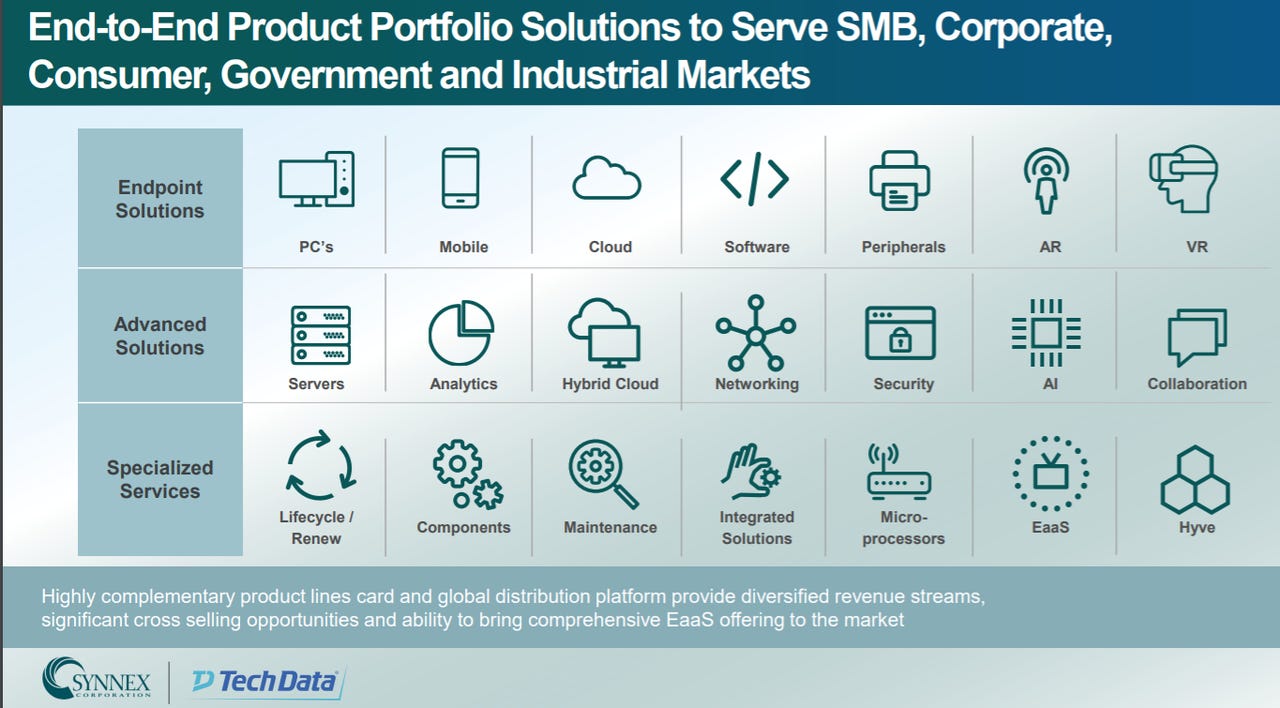

Here's a look at the end markets and technology stacks Synnex and Tech Data will target.

Of those markets, Synnex and Tech Data see the most opportunity in analytics and artificial intelligence, next-gen data centers, cloud, security, IoT, 5G and third-party platform services.

Separately, Synnex reported fiscal first quarter earnings of $1.69 a share ($1.89 a share non-GAAP) on revenue of $4.94 billion, up 21% from a year ago. Polk said that Synnex is "encouraged by the IT spending environment so far in 2021" due to digital transformation projects and remote work investments.