Telstra drops FY19 guidance by AU$300m due to NBN Corporate Plan

Telstra has provided what it called "modest" reductions in its FY19 guidance following the release of the National Broadband Network (NBN) Corporate Plan last week, with expected income dropping by AU$300 million.

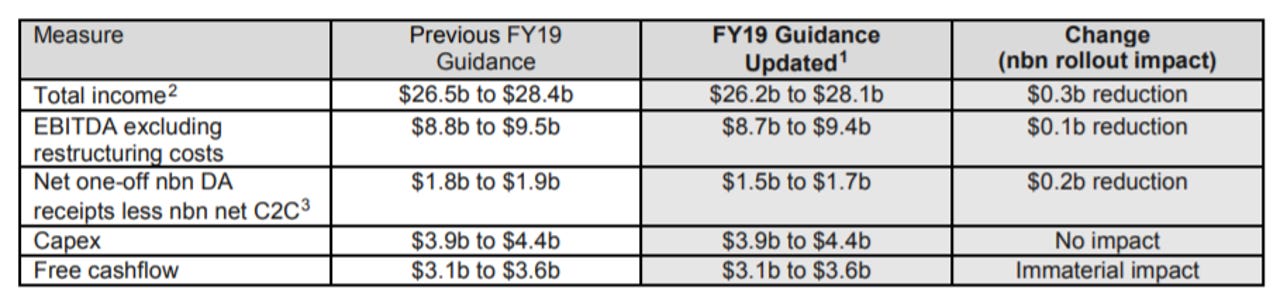

According to Telstra's revised guidance, instead of income being between AU$26.5 billion and AU$28.4 billion, it is expected to be between AU$26.2 billion and AU$28.1 billion. Earnings before interest, tax, depreciation, and amortisation (EBITDA) has shifted down by AU$100 million, from between AU$8.8 billion and AU$9.5 billion to between AU$8.7 billion and AU$9.4 billion.

Net one-off NBN definitive agreement (DA) receipts less NBN net costs to connect will provide AU$200 million less to Telstra, down from between AU$1.8 billion and AU$1.9 billion to AU$1.5 billion and AU$1.7 billion.

Capex and free cashflow will see no material impact, Telstra said.

However, Telstra added that the changes in NBN's Corporate Plan are "expected to be financially positive to Telstra over the full NBN rollout".

"The NBN Corporate Plan 2019 includes lower than previously estimated premises declared ready for service (RFS) and premises activated for FY19," Telstra said on Thursday morning.

"This has the effect of deferring per subscriber address amount (PSAA) receipts from NBN in FY19 into future periods. This will be partly offset in FY19 by the natural hedge including benefits from lower NBN costs to connect (C2C), lower network payments to NBN, and retained wholesale EBITDA."

Telstra's FY18 financial results, published last month, reported a net profit of AU$3.5 billion for the 2018 financial year, down by 9 percent due to the "enormous impact" of the NBN as well as a rise in mobile competition ahead of TPG's entrance.

During FY18, Telstra's revenue remained stagnant, at AU$26 billion, while EBITDA was down by 5.2 percent to AU$10.1 billion. Operating expenses rose by 7.6 percent to AU$18.9 billion, while capex rose by 2.4 percent to AU$4.7 billion in total for the year.

Despite this, Telstra reported customer base growth across both fixed and mobile. The telco made AU$14.7 billion in consumer and small business income, down 0.3 percent; AU$8.2 billion in enterprise, up 1.7 percent; AU$2.7 billion in wholesale, down 3.5 percent; and AU$1.2 billion in operations, up 5.7 percent.

The mobile business brought in AU$10.1 billion in revenue, up 0.4 percent thanks to the addition of 342,000 retail customers during the year for a total base of 17.7 million, with 7.9 million of these in post-paid.

The telco lost 37,000 customers in mobile broadband during FY18.

Must read: Telstra2022: Key takeaways from Telstra's new strategy

NBN unveiled its Corporate Plan 2019-22 last week, revealing that it is expecting a base case funding of AU$51 billion following decisions made last financial year to "consciously prioritise customer experience" including the cease-sale on hybrid fibre-coaxial (HFC).

After last year estimating peak funding in the range of AU$47 billion to AU$51 billion with a base case of AU$49 billion, the new Corporate Plan predicted that it will hit AU$42.9 billion in peak funding by the end of FY2019, AU$48.7 billion by FY20, and AU$50.9 billion by FY21 and FY22. New NBN CEO Stephen Rue said the rise in funding would be funded through short-term private debt.

"The decision to pause HFC orders and optimise the network is expected to impact revenue over the life of the build by AU$0.7 billion, and incur additional optimisation capex spend of AU$0.2 billion," NBN's Corporate Plan said.

"The wholesale pricing change, while successful in helping shift end users to higher-speed plans and helping reduce congestion, is forecast to result in a AU$0.7 billion deferral in revenue in the plan.

"The fixed-wireless capacity upgrade program is designed to help address congestion in order to improve end-user experience, and is expected to result in additional capex of AU$0.8 billion."

According to the Corporate Plan, NBN expects to generate AU$2.6 billion in revenue and negative AU$1.7 billion in EBITDA in FY19; AU$3.9 billion of revenue and minus AU$1.4 billion of EBITDA in FY20; AU$5.2 billion in revenue and AU$1.3 billion of EBITDA in FY21; and AU$5.6 billion in revenue and AU$2.5 billion of EBITDA in FY22.

The build is still set to be complete by June 2020, NBN said.

The company plans to have 9.9 million premises RFS, 9.7 million ready to connect (RTC), and 5.5 million activated by FY19; 11.6 million RFS and RTC and 7.5 million activated by FY20; 11.7 million RFS and RTC and 8.4 million activated by FY21; and 11.9 million RFS and RTC and 8.7 million activated by FY22.

Related Coverage

- NBN base case funding jumps to AU$51b following HFC pause

- NBN doubles revenue for AU$2b in FY18, readies G.fast for FttC

- Telstra FY18 profit down by AU$345m ahead of nationwide 5G launch

- NBN to subsidise medical alarm upgrades

- NBN to take FttC to MDUs

- ACCC reconsiders Telstra copper regulation

- NBN 'absolutely' still planning 5G fixed-wireless

- NBN launches business customer experience centre

- ACMA begins enforcing NBN migration rules backed by AU$10m penalties

- NBN appoints CFO Stephen Rue as new CEO

- Nokia deploys software-defined solutions across NBN FttC network

- NBN announces new fixed-wireless pricing

- Labor pushes amendments to 'highly regrettable' NBN subsidy scheme

- ACMA goes to tender to test NBN modems

- NBN finally launches DOCSIS 3.1 across HFC network

- Streaming media policy (Tech Pro Research)