Zoom gives weak Q1 outlook but sets sights on bigger customers

Zoom on Monday published better-than-expected fourth quarter financial results, but its weak Q1 2023 outlook sent shares down in after-hours trading. The communications company's quarterly results pale in comparison to the astronomical growth it experienced at the outset of the Covid-19 pandemic, even as it matures and sets its sights on larger, enterprise customers.

Zoom's Q4 non-GAAP net income per share was $1.29. Fourth quarter total revenue was $1.071.4 billion, up 21% year-over-year.

Analysts were expecting earnings of $1.05 per share on revenue of $1.05 billion.

Zoom also said its board of directors has authorized a stock repurchase program of up to $1 billion of Zoom's outstanding Class A common stock.

For the full fiscal year, Zoom's non-GAAP net income per share was $5.07. Total revenue in FY 2022 was $4.099.9 billion, up 55% year-over-year.

"In fiscal year 2022, we delivered strong results with total revenue of more than $4 billion growing 55% year over year along with increased profitability and operating cash flow growth as our global customer base continued to grow and find new use cases for our broadening communications platform," CEO Eric S. Yuan said in a statement. "Looking forward, we are addressing a large opportunity as we expect customers will continue to transform how they work and engage with their customers. It is apparent that businesses want a full communications platform that is integrated, secure, and easy to use. We are proud to lead the charge of the digital transformation for communications. To sustain and enhance our leadership position, in fiscal year 2023 we plan to build out our platform to further enrich the customer experience with new cloud-based technologies and expand our go-to-market motions, which we believe will enable us to drive future growth."

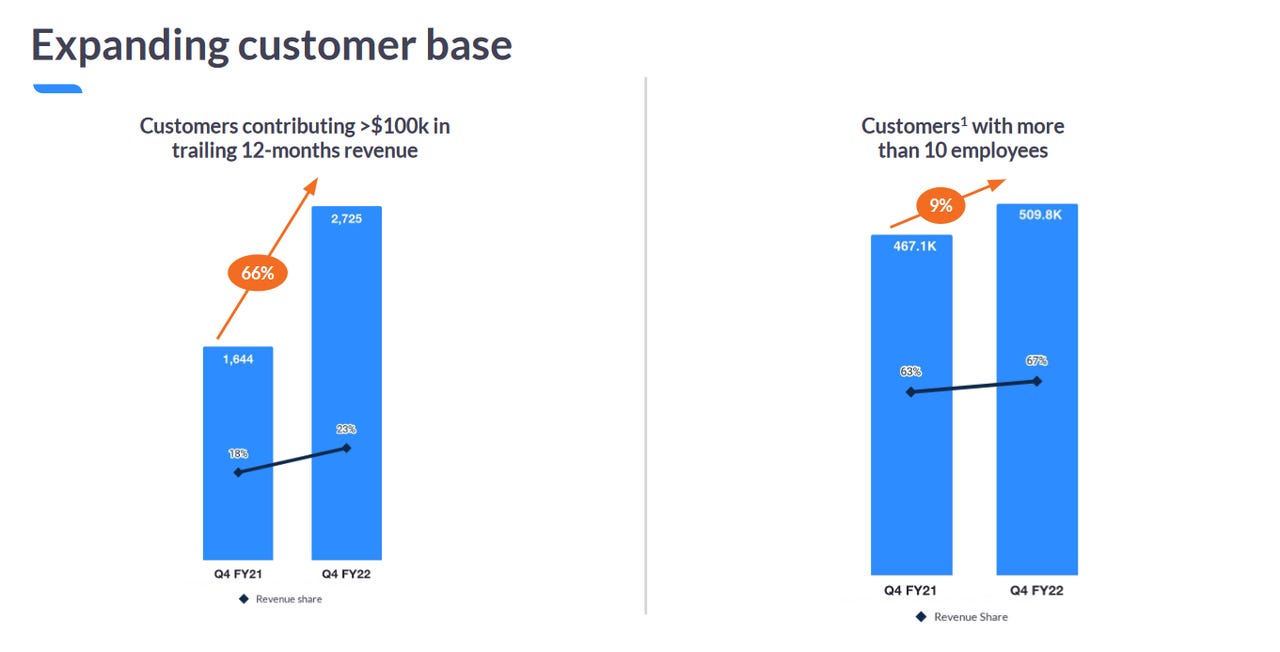

In Q4, Zoom's sales grew thanks to both new customers and expanding business with existing customers. At the end of the quarter, it had 2,725 customers contributing more than $100,000 in trailing 12 months revenue, up approximately 66% from the same quarter last fiscal year.

Going forward, Zoom also plans to report on its progress with enterprise customers. Zoom defines Enterprise customers as distinct business units who have been engaged by either Zoom's direct sales team, channel partners or independent software vendor partners. At the end of Q4, Zoom had approximately 191,000 Enterprise customers, up 35% year-over-year. The company had a trailing 12-month net dollar expansion rate for Enterprise customers of 130%

For Q1 2023, Zoom expects total revenue between $1.07 billion and $1.075 billion. First quarter non-GAAP diluted EPS is expected to be between 86 cents and 88 cents.

Analysts are expecting an EPS of $1.05 on revenue of $1.1 billion.

Zoom also announced Monday that it has appointed ServiceNow CEO Bill McDermott as an independent director on Zoom's Board of Directors effective March 1. McDermott will replace Bart Swanson, an early investor in Zoom who is stepping down from the Zoom board.