ANZ marks unveiling of the 'new ANZ' with ANZ Plus launch

ANZ boss Shayne Elliot has admitted that only now, after six years of digital transformation, is the bank in a "materially better position than just a few years ago".

The company has been on a multi-year digital transformation journey since 2016, which has resulted in dozens of changes to the company's operations, including the sale of 30 non-core businesses, teaming up with dozens of vendor partners including Salesforce, Atlassian, and Google, and taking out about AU$1 billion in run-the-bank costs while introducing "agile ways of working".

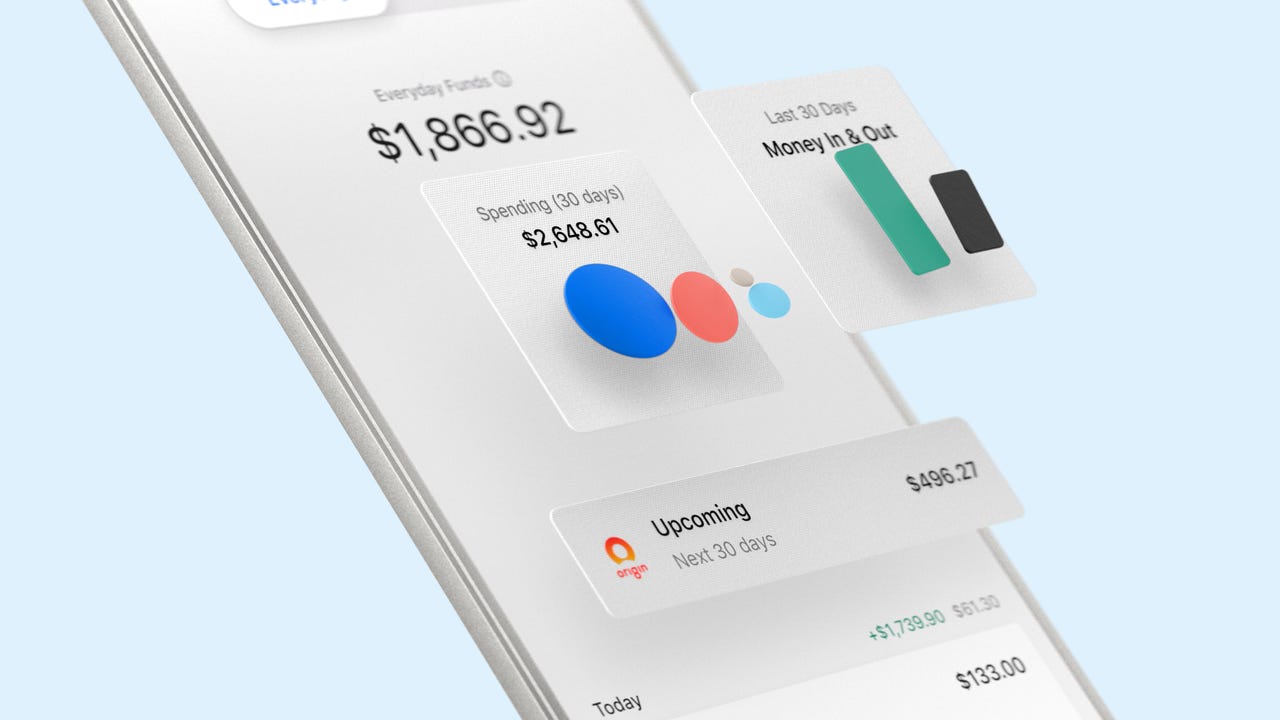

To mark what is considered only day one of the "new ANZ", the blue bank officially launched its ANZ Plus app, the bank's first digital, customer-facing banking product built under its digital division, ANZx. ANZ Plus is centred around signing customers up quickly and providing features and functions that help improve their spending habits and savings. The bank boasted it has seen 3,000 customers already sign up.

Users of ANZ Plus are not able to view pre-existing ANZ accounts on the new app, however. At launch, it's only available to customers who are iOS users, but an Android version is in development, the bank said.

"We've gone from this technology stack that was frankly inflexible, slow, and extremely costly to maintain to our new Plus platform that is nimble, adaptable, and cheaper to run. We've improved the quality of the data and we've simplified our products," Elliot said at the launch.

"To paint the picture, the simpler Plus service has already eliminated 58 service activities currently performed manually by our people already. It means we're going to be 30% more efficient in the back office and lead to a 45% reduction of complaints.

"We've also reduced the time it takes to onboard a new customer from three to five business days to three minutes."

Maile Carnegie, the former Google Australia chief who was recruited to spearhead the company's digital push and more recently appointed to head up bank's retail division that oversees ANZ Plus, added building ANZ Plus on Google Cloud also meant standing up 20 different technology kits, including an online customer experience platform and the ability to see and manage the controls the bank has built.

She explained the bank kicked off with savings and transactions to help bolster the bank's data capabilities, which would then underpin future product launches.

"We started with savings and transactions because it enabled us to get the data architecture right, and that's going to be just massively differentiating," she said.

During the launch, Elliott also took the opportunity to justify the decision to overhaul the company's technology stack, saying it was not the bank's "catchup strategy", but rather a "step ahead".

"What we've done instead is design a new retail bank without the constraints of existing technology, a retail bank focused on improving the financial wellbeing of our customers," he said.

"We did it, not just because it's the right thing to do, but also because we know for ANZ to be successful, we're going to get better, lifetime value per customer than our competitors.

"What does that mean? It means Australians will join and choose ANZ because we're competitive, we're engaging, we're convenient, and they'll stay with us longer and do more with us because we continue to innovate."

Even though the bank is focused on building the "financial wellbeing" of its customers, there are no plans to include cryptocurrency investment in ANZ Plus, even though the bank has invested in blockchain and was involved in minting the first Australian dollar stablcoin.

"If we're saying people don't understand the fundamental concept of spending less than you earn and saving for a rainy day, I find it hard to say our first proposition was going to let them go wild with crypto," he told ZDNet.

Products that are in the pipeline, however, include the introduction of digital home loans, scheduled to be launched next year. This will be followed by credit cards and banking services for small businesses.

There also plans to deliver more than 100 features in ANZ Plus across the next few months, such as the ability to join the bank with a foreign passport, enabling customers to see real-time expense predictions, and check which merchants has their card on file.

"[Plus platform] allows the release of new features quickly, safely, and cheaply … previously, we would struggle to launch on new feature per month," Elliot said.

The bank also envisions that eventually it will migrate existing customers onto ANZ Plus to avoid complexity.

"We are not building a different brand," Carnegie said.

"Now, we're calling it Plus because we just want to differentiate it versus our current product for the time being. But later this year, we're also going to be starting to migrate our existing customers onto these products on this platform, and over time will deprecate the Plus and we'll be back to being ANZ."

Work is also ongoing in transitioning off the bank's existing Hogan core banking system from CSC and simplifying the products within the environment.

"We have got a fair amount of legacy in the bank. There's still elements of green screens that exist today when we're doing things in our core systems. Now, we would really like to modernise our stack ... and we really want to bring it into a modern cloud environment," ANZx domain lead general manager Wayne Spiteri said.

RELATED COVERAGE

- Commonwealth Bank acquires 20% stake in Paypa Plane

- Eftpos added security features go-live as digital upgrades continue

- Australian banks begin publishing quarterly retail payment service reliability reports

- Singapore, Australia amongst four central banks to test cross-border digital payments platform

- NAB profit soars above $6b for FY21 as investment in digital continues to pay off