PayPal reports solid Q4, claims 305 million active users

PayPal beat estimates for its fiscal fourth quarter but its shares were down after hours on light guidance.

The San Jose, Calif.-based payments company reported net income of $507 million, or 43 cents per share. Non-GAAP earnings were 86 cents per share on revenue of $4.96 billion.

Featured

Wall Street was looking for earnings of 83 cents per share on revenue of $4.94 billion.

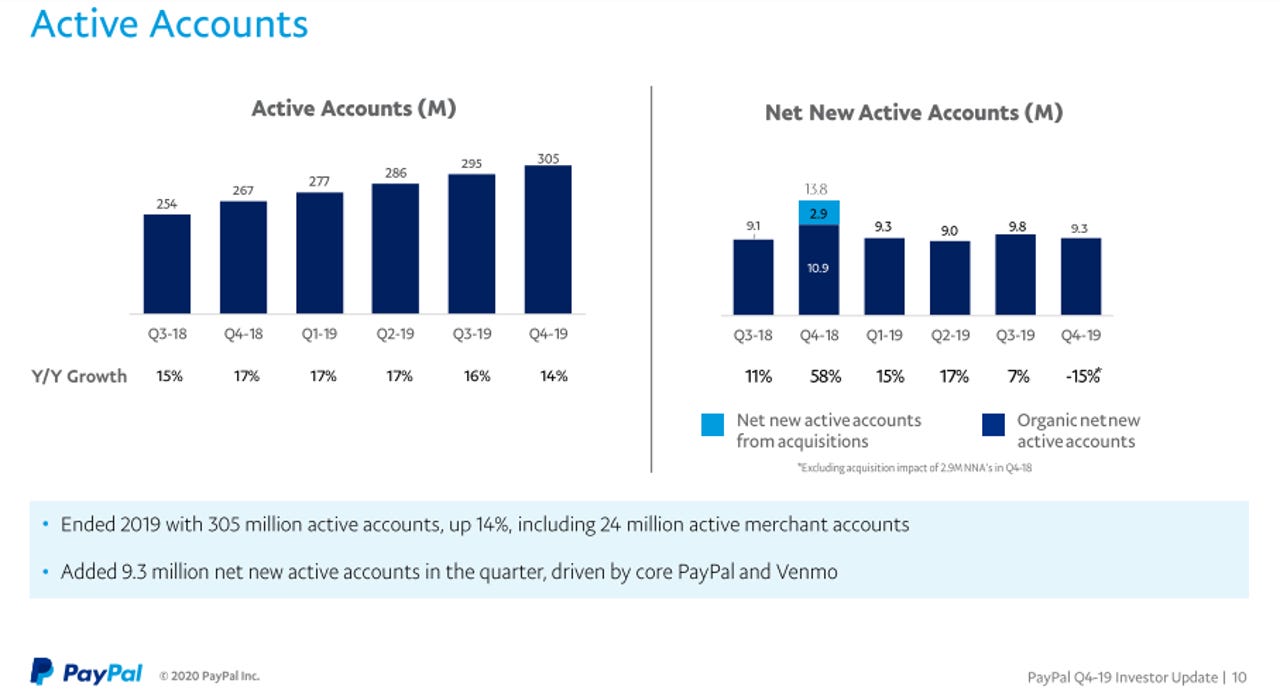

For the year PayPal reported revenue of $17.77 billion and non-GAAP EPS of $3.10. Elsewhere on the balance sheet, the company ended the quarter with an active account base of 305 million, after adding 9.3 million users in Q4.

PayPal says it processed $199 billion in total payment volume during the quarter. Breaking the numbers down further, PayPal says it processed a total of roughly 3.5 billion payment transactions. Overall, the quarter was strong, but there are concerns about the economy to start the year.

PayPal's social payments platform Venmo processed more than $29 billion of TPV, up 56% over the same period last year. The company also announced that Venmo's active user base sits at 52 million as of the fourth quarter, up from the 40 million that PayPal last disclosed in April.

"In Q4 alone, we processed nearly $200 billion of TPV and engagement grew 10% to 40.6 transactions per active account,"said PayPal CEO Dan Schulman. "We strengthened our value proposition for consumers and merchants, expanded our international scope and scale, and announced transformative strategic acquisitions, investments and commercial partnerships."

On a conference call with analysts, Schulman outlined the following:

We added 9.3 million net new actives in the quarter, ending the year with 305 million active accounts on our platform, up 14% year-over-year, including 24 million merchants. In 2020, we expect to add approximately 35 million net new active accounts, inclusive of our acquisitions not including Honey.

And.

Venmo processed $29 billion in volume for the quarter, growing 56%. And for the year, volume increased to $102 billion. We ended the year with Venmo's customer base exceeding 52 million active accounts, driving its current revenue run rate of more than $450 million.

Schulman added that PayPal is broadening its relationships with financial institutions and integrating with e-commerce players. The wild card is the economy.

In terms of outlook, analysts are expecting Q1 revenue of $4.85 billion with earnings of 82 cents a share. PayPal responded with first quarter revenue guidance in the range of $4.78 billion to $4.84 billion, with earnings between 76 cents and 78 cents a share.

CFO John Rainey said there are some economic concerns to warrant caution, but the secular trends are strong:

There's always a certain amount of trepidation that exists about the macro economy. But I think the macro economy was maybe a little wobblier last year. And we certainly enjoyed, I think, a better holiday season this period as we looked at the month of December, even going into January, and so we're starting off on the right start.

For the year, PayPal said it expects revenue in the range of $20.8 billion to $21 billion with non-GAAP EPS between $3.39 and $3.46. Wall Street is expecting $20.79 billion in revenue and EPS of $3.49.