4G LTE subscriptions reach 1b: Ovum

Analyst firm Ovum has revealed research showing that 4G long-term evolution (LTE) subscriptions reached 1.05 billion during Q4 of financial year 2015.

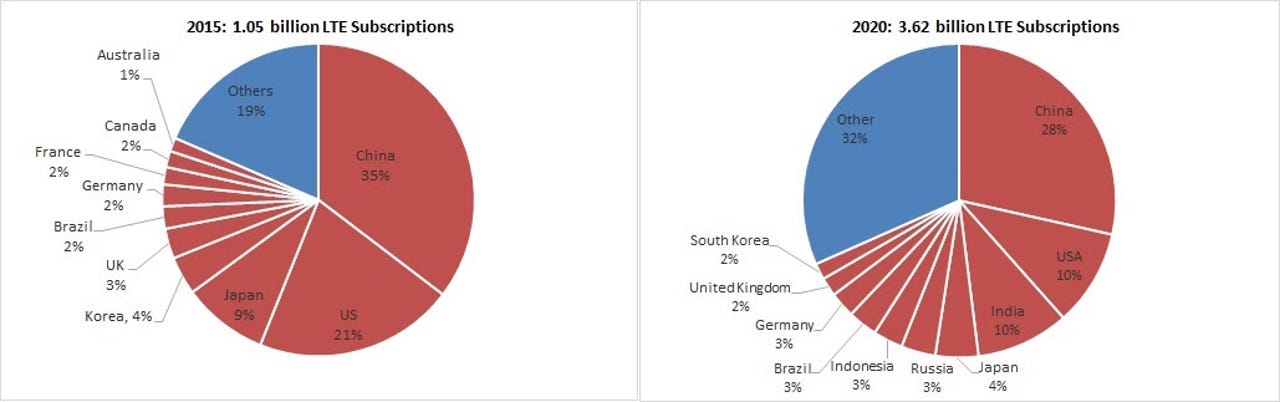

According to Ovum's report, three quarters of all LTE subscriptions come from just five countries: China, at 35 percent of all LTE subscribers; the United States, at 21 percent; Japan, with 9 percent; South Korea, at 4 percent; and the United Kingdom, at 3 percent.

Brazil, Germany, France, and Canada follow, at 2 percent each of LTE subscriptions worldwide, with Australia accounting for 1 percent.

Ovum also forecast LTE subscriptions to continue growing by the double digits to reach 3.62 billion by 2020. By this time, Ovum predicted China to account for 28 percent; the US and India for 10 percent; Japan for 4 percent; Russia, Indonesia, Brazil, and Germany for 3 percent each; and the UK and South Korea for 2 percent. Australia disappears into the "Other" section on the 2020 chart.

Ovum pointed out that LTE adoption has occurred twice as fast as W-CDMA adoption, with wireless data speeds being "critical" for users.

"Reaching 1 billion LTE subscriptions has taken less than six years compared with more than 10 years required for W-CDMA," said Ovum chief research officer Mark Newman.

"This highlights just how critical wireless data speeds have become, as operators aggressively roll out 4G networks to meet consumer demand for capacity, which continues unabated."

Latest Australian news

Newman added that LTE users will double by 2017 and triple by 2019 off the back of cheaper smartphones and less expensive mobile broadband services. By the end of 2020, smartphones using 3G and 4G services will make up 85 percent of all subscriptions, Ovum said.

Last year, Ovum revealed that China Mobile is the world's number one mobile provider, with 633 million devices subscribed. The telco is followed by Vodafone, with 408 million, and India's Bharti Airtel, with 314 million.

Locally, Vodafone remained the third-biggest provider, beaten out by Telstra and Optus.

In November, Ovum also predicted streaming subscriptions within Australia to increase by a factor of 17 between 2014 and 2019, to reach 4.707 million subscribers, according to a report into subscription video-on-demand (SVOD) services commissioned by the company rolling out the National Broadband Network (NBN).

Pay TV subscriptions, meanwhile will grow by 18.4 percent during the same period, said the Ovum report.

The continuing rise of SVOD services will put pressure on the networks and capacity in Australia, Ovum added, which could be eased by the NBN's rollout of ubiquitous, high-speed broadband.

"The recent boom in subscription video-on-demand services, driven by the launch of Netflix, Stan, and Presto in Australia, was accompanied by a sharp rise in network data traffic," the report said.

"Average monthly download usage on the NBN network was 73GB in March 2015, but was 110GB by September, a rise of 51 percent in just six months. Some capacity problems arose [as a result of] this sudden increase in demand."

However, Ovum refuted that despite the Telstra TV launch and Optus' English Premier League rights victory, telecommunications carriers will never be the major providers of media content.

"There are a lot of ambitions stated about telcos becoming content companies," David Kennedy, Ovum research director for APAC Telecoms, said in November.

"I think all of the telcos will be picking their partners, in order to bundle their telco services. They need to, because they need to defend their real revenue source, which is broadband access.

"But I just don't believe that the telcos as such are ever going to become major or dominant players in the media industry."