AMD Q2 strong amid EPYC, Ryzen demand

AMD reported better-than-expected second quarter results as it saw strong demand across its product lines. The chipmaker also upped its outlook for 2021.

The results land after strong results from Intel, which is expanding its foundry business. AMD is benefiting from gaining share in the data center as well as PCs.

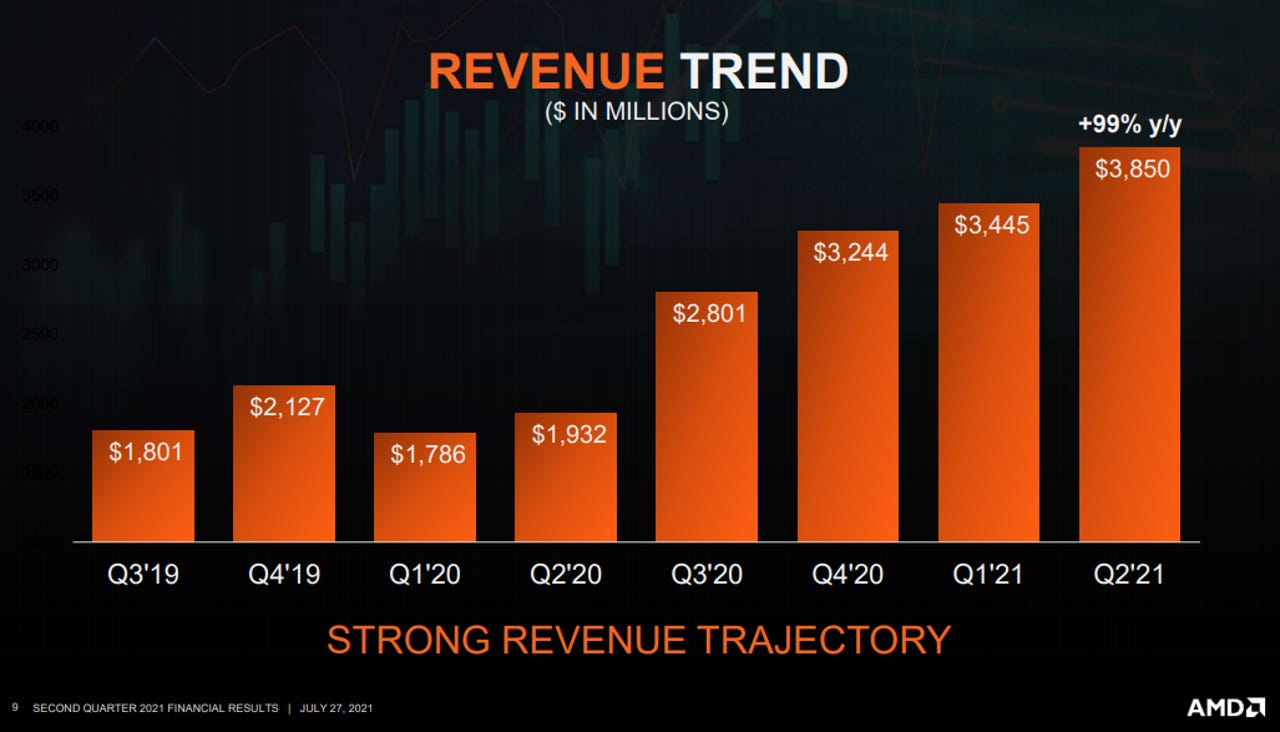

The company reported second quarter earnings of 58 cents a share on revenue of $3.85 billion, up 99% from a year ago. Non-GAAP earnings were 63 cents a share.

Wall Street was expecting AMD to report second quarter revenue of $3.62 billion with non-GAAP earnings of 54 cents a share.

As for the outlook, AMD said it expects revenue for the third quarter will be about $4.1 billion give or take $100 million. That revenue growth, driven by AMD's gaming and data center business, would be up 46% from a year ago.

Wall Street was modeling third quarter revenue of $3.82 billion.

More:

- Steam Deck is an AMD-powered handheld PC from Valve that runs KDE on Arch Linux

- HP's Pavilion Aero 13 starts at $749, all AMD powered

- Google Cloud partners with AMD for 'Tau' virtual machines for scale-out workloads

- The global chip shortage will be a long-lasting problem. Here's what it means for you, and for the world

For 2021, AMD is projecting revenue growth of about 60%, up from the 50% previously outlined. Gross margins for the year will be about 48%.

AMD CEO Lisa Su said on an earnings conference call:

Both desktop and notebook revenue increased by a strong double-digit percentage year-over-year, and we believe we gained revenue share for the fifth straight quarter. In desktop, robust demand for our highest-end Ryzen processors drove a richer mix in the quarter as Ryzen 9 processor unit shipments more than doubled In the enterprise, Ryzen Pro mobile processor unit shipments nearly doubled year-over-year as we won multiple high-volume deployments in the quarter with Fortune 500 financial services, automotive and pharmaceutical companies. In graphics, revenue doubled year-over-year, led by demand for Radeon 6000 series desktop graphics cards in the channel and adoption of our data center GPUs. RDNA 2 GPU shipments grew by a double-digit percentage sequentially as the first notebooks powered by our Radeon RX6000 M-Series GPUs launched, including the first AMD Advantage notebooks that combine high-performance Ryzen CPUs, Radeon GPUs and AMD software with premium design features to deliver best-in-class gaming experiences.

Su added that AMD Advantage laptops from ASUS, HP, MSI and Lenovo will hit the market in coming months.

In addition, AMD is seeing momentum in the data center. Su said:

We delivered our fifth straight quarter of record server processor revenue. Sales grew by a significant double-digit percentage sequentially, driven by higher unit shipments and ASP. We are seeing very strong demand across our full server portfolio with second gen EPYC processor revenue growing sequentially and third gen EPYC processor sales more than doubling quarter-over-quarter. Third gen EPYC processor revenue is ramping faster than the prior generation.

Cloud demand further accelerated in the quarter, led by growing internal workload adoption and nearly 50 new AMD-powered instances by AWS, Microsoft Azure, Google, Tencent and Alibaba. Google announced it chose AMD EPYC processors to exclusively power the first offering in its new Tau VM family. In enterprise, we see demand accelerating as more than 100 third gen EPYC processor platforms are now in production from HP, Lenovo, Supermicro, Cisco and others.

Other items:

- Computing and graphics revenue was $2.25 billion, up 65% from a year ago. PC processor average selling price was up due to Ryzen desktop and notebook chips. GPU average selling prices also grew.

- Enterprise, embedded and semi-custom unit revenue was $1.6 billion, up 183% from a year ago. EPYC processor demand drove sales.

- AMD ended the third quarter with cash, cash equivalents and short-term investments of $3.79 billion.