AMD's Q3 outlook lighter than expected as Q2 earnings on target

AMD's second quarter results were on target, but the company's outlook was light.

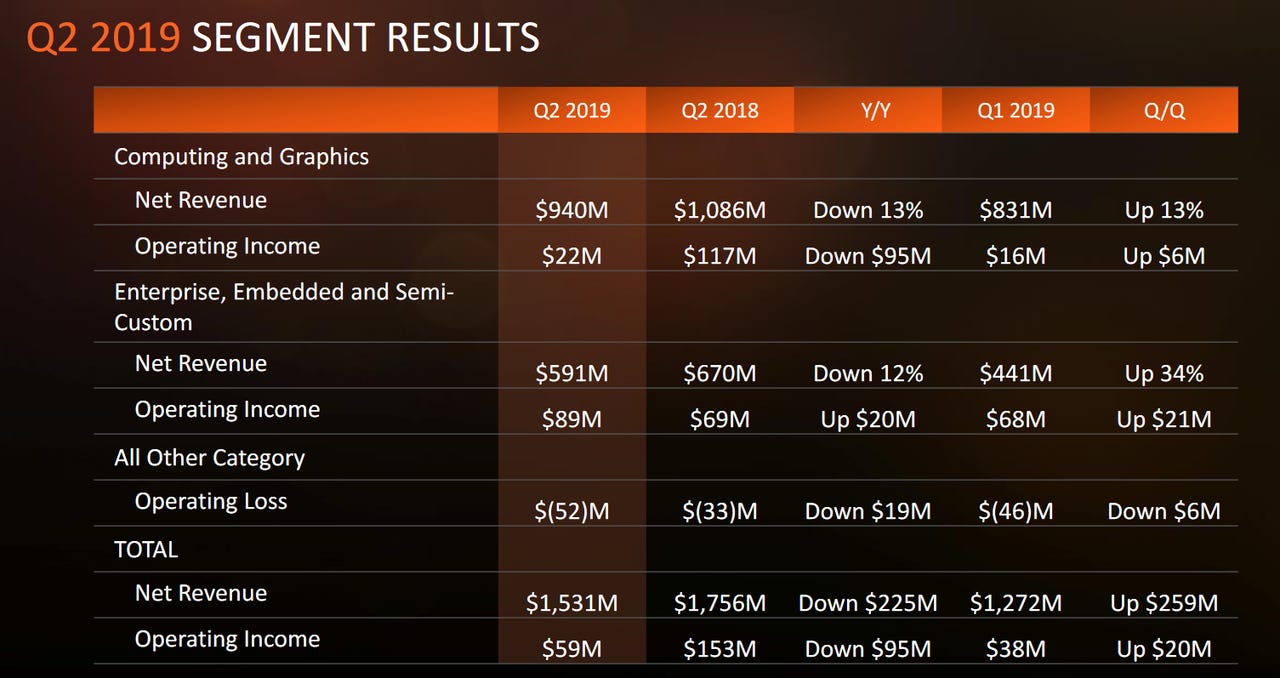

The chipmaker, which has garnered interest as it competes better against larger rivals such as Intel and Nvidia, reported second quarter net income of $35 million, or 3 cents a share, on revenue of $1.53 billion, down 13% from a year ago. Adjusted earnings for AMD in the second quarter came in at 8 cents a share.

Wall Street was expecting AMD to report second quarter revenue of $1.52 billion with adjusted earnings of 8 cents a share. In the first quarter, AMD's sales were down from a year ago, but better than expected.

But the outlook for AMD fell short given that shares have run up into the earnings report. AMD projected third quarter revenue of about $1.8 billion, give or take $50 million. Those sales would be up 9% from a year ago with strong demand for Ryzen, EPYC and Radeon demand.

For the third quarter, analysts were expecting AMD to report revenue of $1.95 billion with adjusted earnings of 23 cents a share.

AMD said it expects 2019 revenue to increase at a mid-single digit percent rate.

During the quarter, AMD launched its client and graphics processors and introduced its new gaming infrastructure.

By unit, AMD said that its computing and graphics group delivered second quarter sales of $940 million, down 13% from a year ago. Graphics chips saw lower channel sales with stronger demand for PCs and data center. Enterprise, embedded and semi-custom unit revenue was $591 million, down 12% from a year ago.

On a conference call with analysts, CEO Lisa Su said:

I am extremely pleased with our execution in the quarter as we ramped production on Ryzen 3000 CPUs, Radeon 5700 GPUs, and early volumes of our 2nd generation EPYC processors in advance of their third quarter launch.

Su also highlighted AMD's server traction.

In server, CPU revenue grew significantly year-over-year and sequentially driven by initial shipments of our next-generation "Rome" processors to lead cloud and OEM customers.

First-generation EPYC processor-based cloud deployments continued to increase in the quarter. Amazon expanded availability of its EPYC processor-powered instances to more than 15 regions and dozens of configurations. And, Microsoft launched general availability of its Azure HB supercomputing virtual machines that, for the first time ever, enable customers to run demanding HPC workloads in the cloud.

Turning to our next-generation "Rome" server processor.

"Rome" is on-time and exceeding expectations, delivering leadership performance and TCO across a significantly expanded number of cloud and enterprise workloads.

Customer excitement continues to grow. Compared to our first generation EPYC processors, we have more than twice the number of platforms in development with a larger set of partners. We also have four times more enterprise and cloud customers actively engaged on deployments prior to launch.

More on AMD: