Apple eclipses Q3 estimates with double-digit growth in products and services

Apple posted a record June quarter on Thursday, eclipsing market estimates thanks to double-digit growth in both products and services. The company also saw growth in each of its geographic segments.

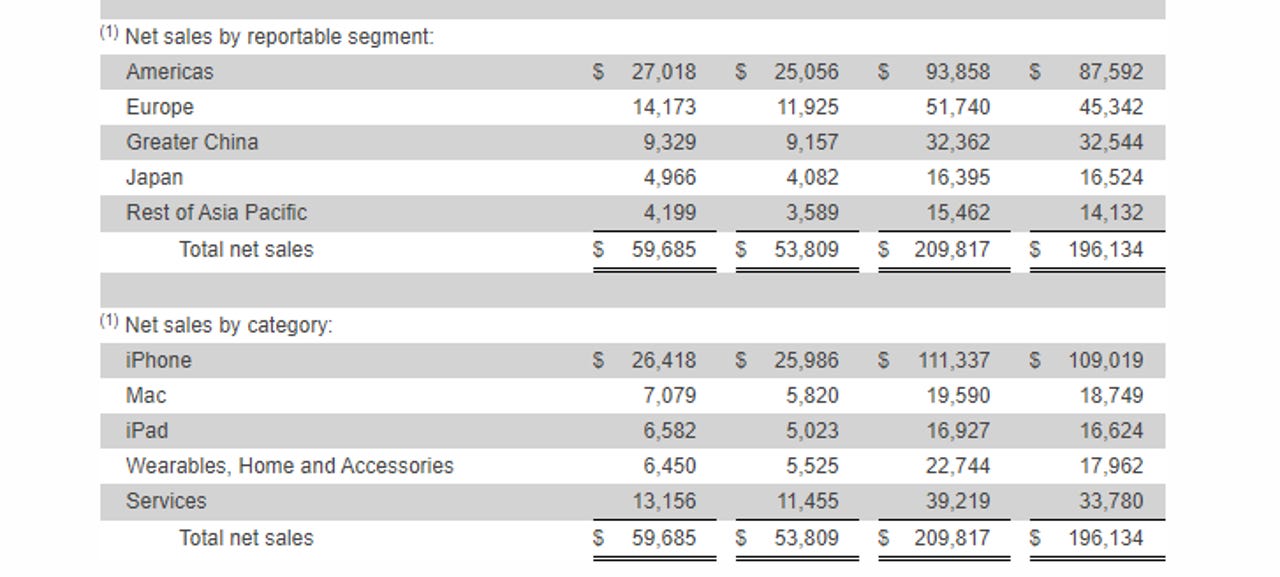

The Cupertino tech giant reported Q3 earnings of $2.58 a share, up 18 percent year-over-year, on revenues of $59.7 billion, an increase of 11 percent over the year prior.

Wall Street was expecting earnings of $2.04 per share on revenue of $52.25 billion.

"In uncertain times, this performance is a testament to the important role our products play in our customers' lives and to Apple's relentless innovation," CEO Tim Cook said in a statement. "This is a challenging moment for our communities, and, from Apple's new $100 million Racial Equity and Justice Initiative to a new commitment to be carbon neutral by 2030, we're living the principle that what we make and do should create opportunity and leave the world better than we found it."

Apple also announced its board of directors declared a cash dividend of 82 cents per share of the company's common stock. Additionally, the board of directors approved a four-for-one stock split to make the stock more accessible to a broader base of investors. Each Apple shareholder at the close of business on August 24 will receive three additional shares for every share held on the record date, and trading will begin on a split-adjusted basis on August 31.

Apple's active installed base of devices reached an all-time high in Q3, in all of its geographic segments and major product categories.

Revenue from iPhone sales totaled $26.4 billion, up 2 percent from $25.98 billion in Q3 2019. Apple saw better-than-expected demand in May and June, Cook said on a Thursday conference call. The results were due to a number of causes, he said, including a strong iPhone SE launch, continued economic stimulus, as well as potentially some benefit from shelter-in-place restrictions lifting around the world.

Mac sales totaled $7.08 billion, up 22 percent from $5.82 billion a year prior. Third quarter iPad sales came to $6.58 billion, up 31 percent from $5.02 billion a year prior. Revenue from Mac and iPad sales grew in spite of supply constraints on both products, underscoring "how integral they have become to working and learning from home," Cook said.

The Wearables, Home and Accessories segment brought in $6.45 billion, up 17 percent from $5.53 billion a year prior. The Wearables business now the size of Fortune 140 company, Apple noted. Apple Watch continued to extend its reach with new customers -- over 75 percent of customers purchasing watch in Q3 were new to the product.

Services revenue in Q3 came to $13.16 billion, up 15 percent from $11.46 billion a year prior. The company achieved its goal of doubling its fiscal 2016 services revenue six months ahead of schedule.

The category results reflected all-time record performance and strong double-digit growth for some services, including the App Store, Apple Music, Video and cloud services. New services like Apple TV Plus, Apple Arcade, Apple News Plus and Apple Card also contributed to overall Services growth.

"Customer engagement in our ecosystem continues to grow at a fast pace," Apple CFO Luca Maestri said on Thursday's conference call.

Apple now has more than 550 million paid subscriptions across the services on its platform, up 130 million from a year ago. The company remains confident it can reach its increased target of 600 million paid subscriptions before the end of 2020.