AWS brings in nearly $10b in sales for Amazon in Q4, hits $40b annual run rate

Amazon Web Services brought in $9.95 billion in net sales for Amazon in the fourth quarter of fiscal 2019, giving the massive cloud computing business an annual revenue run rate of $40 billion. Once again, AWS accounted for most of Amazon's operating income, though its growth rate continued to decelerate slightly.

AWS faces increased competition, particularly from Microsoft Azure. However, Amazon CFO Brian Olsavsky said Thursday, "We think we start with a very big lead in this space because of our many years of investment, not only in capacity but in services and features."

While the growth rate has slowed, AWS's annual run rate grew from $30 billion at the end of 2018, he noted. "We continue to be happy with our top line growth," he said.

Overall, Amazon posted strong Q4 and full-year results, in spite of major investments in shifting its Prime subscription program to a one-day shipping offer.

Fourth quarter net income increased to $3.3 billion, or $6.47 per diluted share. Amazon's net sales increased 21 percent to $87.4 billion in the fourth quarter, compared with $72.4 billion in Q4 2018.

Wall Street was looking for earnings of $4.03 on revenue of $86.02 billion.

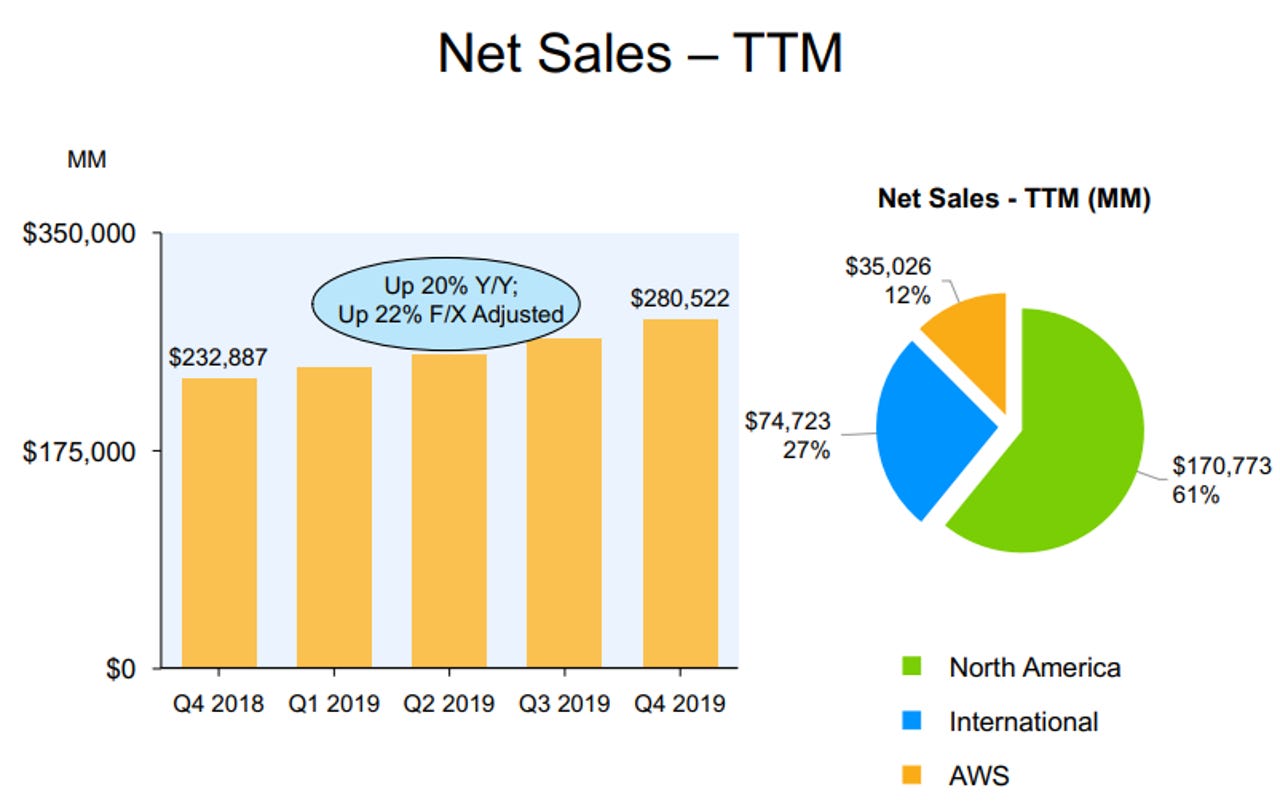

For the full fiscal year, net income increased to $11.6 billion, or $23.01 per diluted share. Net sales increased 20 percent to $280.5 billion, compared with $232.9 billion in 2018.

The company took less of a hit in Q4 than expected from its major investments in Amazon Prime. The transition to one-day shipping took its toll on Q3 earnings, but in a statement Thursday, Amazon CEO Jeff Bezos suggested in a statement that the investment is already paying off in higher customer engagement.

"More people joined Prime this quarter than ever before, and we now have over 150 million paid Prime members around the world," Bezos said. "We've made Prime delivery faster — the number of items delivered to U.S. customers with Prime's free one-day and same-day delivery more than quadrupled this quarter compared to last year. Members now have free two-hour grocery delivery from Amazon Fresh and Whole Foods Market in more than 2,000 U.S. cities and towns. Prime members watched double the hours of original movies and TV shows on Prime Video this quarter compared to last year, and Amazon Originals received a record 88 nominations and 26 wins at major awards shows."

For the fourth quarter, Amazon's North America segment brought in net sales of $53.67 billion. International net sales accounted for $23.81 billion. At $9.9 billion, AWS accounted for just 12 percent of Amazon's total net sales.

However, AWS once again accounted for the bulk of operating income, bringing in $2.596 billion in Q4. By comparison, Q4 North America operating income was $1.9 billion, while the International segment posted an operating loss of $617 million.

For the full year, North American net sales came to $170.77 billion. AWS net sales were $35 billion, and International net sales $74.723 billion.

AWS operating income for FY 2019 was $9.201 billion. By comparison, FY 2019 North America operating income was $7.033 billion, while International posted a loss of $1.69 billion.

AWS's growth rate for the full fiscal year was 37 percent, higher than the company's overall growth rate of 20 percent. By comparison, for FY 2018, AWS grew at a robust 47 percent.

For the fourth quarter, AWS posted a 34 percent growth rate, slightly lower than Q3's 35 percent growth rate and slower than the 45 percent growth rate posted in Q4 2018.

AWS continues to grow at a strong clip, Olsavsky said Thursday, because of increased sales and support teams, "more and better" products and its geographic expansion. There are currently 69 AWS availability zones across 22 geographic regions.

Tech analyst Patrick Moorhead noted that AWS sales grew over $2.5 billion for the quarter, which is larger than the overall annual size of most cloud company's revenue.

"To put this into perspective, if we annualize AWS's Q4 numbers, it would be a $40B business compares to Google Cloud of $8B," he said in a statement emailed to ZDNet. "Google's Cloud business includes a lot of GSuite SaaS, not IaaS or PaaS. As AWS gets larger, the percentage growth will decline due to the law of large numbers, so I urge everybody to focus on dollar growth and compare it to its competitors like Google Cloud, IBM Cloud, and Azure."

Thursday's results also demonstrated the growing heft of Amazon's advertising business. Advertising services is the primary driver of sales in Amazon's "Other" category, which is not an official business segment. Amazon said the category grew 41 percent in the fourth quarter to bring in $4.78 billion in net sales.

For the first quarter of fiscal 2020, Amazon said it expects operating income between $3 billion and $4.2 billion. It expects net sales between $69 billion and $73 billion.

Amazon expects to reach this level of operating income thanks in part to its ability to increase the life expectancy of its servers from three years to four years, Olsavsky said. The company expects to save $800 million in Q1 in depreciation expenses due to an increase in the estimated useful life of its servers.